As I embarked on my recent business venture in South Africa, I found myself navigating the intricacies of the country’s foreign exchange market. The ever-fluctuating exchange rate, influenced by a myriad of factors, posed challenges and opportunities alike. This article aims to demystify the South African forex exchange rate, providing insights into its history, dynamics, and implications for travelers, businesses, and investors.

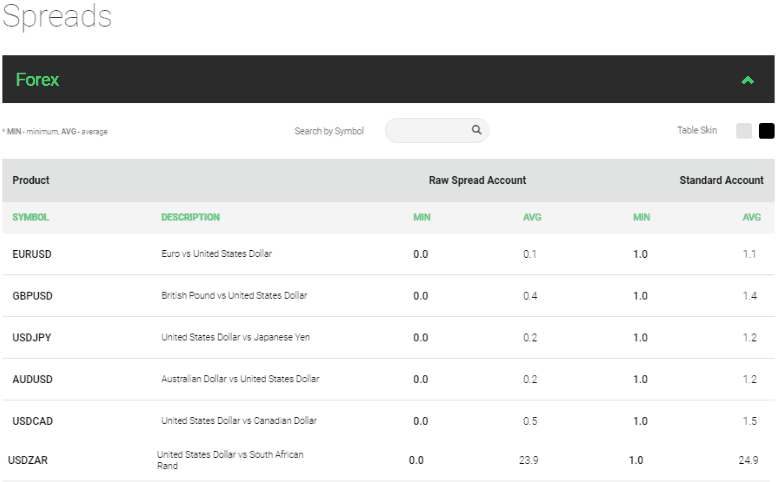

Image: www.compareforexbrokers.com

The South African forex market, like many others, operates on the fundamental principles of supply and demand. The exchange rate is the price of one currency in terms of another. In this case, it represents the value of the South African rand (ZAR) against other major currencies like the US dollar (USD), the euro, and the British pound. The exchange rate, therefore, indicates how much of the domestic currency is required to purchase foreign currencies.

Factors Influencing the Exchange Rate

Several factors influence the South African forex exchange rate, including:

- Economic Growth: A strong economy typically leads to a stronger currency, as investors flock to invest in a stable and growing market.

- Interest Rates: Higher interest rates make the domestic currency more attractive for investment, increasing its value.

- Inflation: Inflation erodes the purchasing power of a currency, leading to a depreciation in its exchange rate.

- Political and Economic Stability: Currency is a barometer of political and economic stability. Uncertainty can lead to currency depreciation.

- Global Market Conditions: Exchange rates are influenced by global economic and financial developments, such as fluctuations in commodity prices and changes in risk appetite.

Impact of the Exchange Rate

The exchange rate has profound implications for both domestic and international stakeholders:

- Travelers: A favorable exchange rate makes traveling abroad more affordable, while an unfavorable one increases the cost of international trips.

- Businesses: Companies that import goods see an impact on their input costs, determined by the rand’s value against the currencies of the countries they import from.

- Investors: Investors consider exchange rate fluctuations when making investment decisions, with the prospect of currency appreciation or depreciation influencing investment returns.

- Central Bank Policies: Central banks intervene in the forex market to influence the exchange rate, aiming to maintain stability in line with economic targets.

Tips for Navigating the Forex Market

Here are a few tips for navigating the South African forex market:

- Stay Informed: Keep abreast of economic and financial news that can impact the exchange rate.

- Monitor the Market: Use online currency exchange platforms to track real-time exchange rates and identify trends.

- Consider Hedging Strategies: Businesses can use hedging instruments to mitigate exchange rate fluctuations and protect against potential losses.

- Seek Professional Advice: Consult with a financial advisor for guidance on managing foreign exchange risk.

- Exercise Patience: Forex markets are volatile, and it’s crucial to have patience and avoid making hasty or emotionally driven decisions.

Remember, staying informed, monitoring the market, and executing sound strategies can empower you to navigate the South African forex exchange rate effectively.

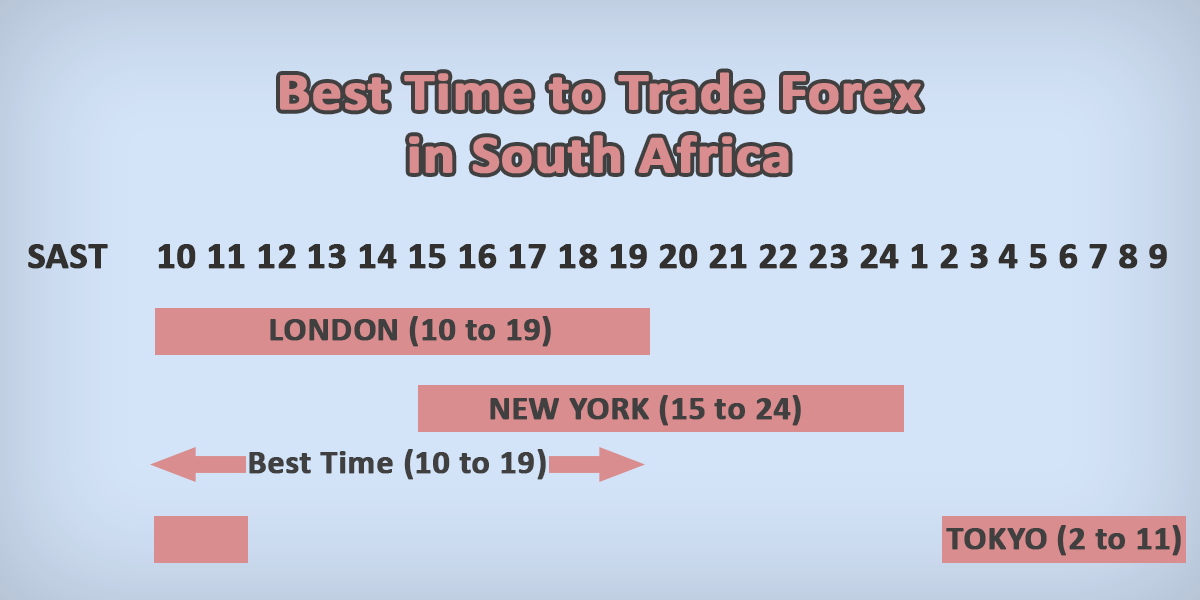

Image: www.forexbeginner.com

FAQ:

- Q: What factors drive the South African forex exchange rate?

A: Economic growth, interest rates, inflation, political stability, and global market conditions. - Q: How do I stay up-to-date on the exchange rate?

A: Monitor financial news outlets and use online currency exchange platforms. - Q: What are the implications of the exchange rate for travelers?

A: It impacts the cost of international travel and how far your money will go abroad. - Q: How can businesses mitigate the risks associated with exchange rate fluctuations?

A: By using hedging instruments to lock in exchange rates or diversifying revenue sources across multiple currencies. - Q: What are some tips for managing foreign exchange risk?

A: Stay informed, monitor the market, consider hedging strategies, seek professional advice, and exercise patience.

South Africa Forex Exchange Rate

Conclusion

Understanding the South African forex exchange rate is essential for informed decision-making. By considering economic fundamentals, monitoring market dynamics, and adhering to sound financial practices, you can navigate the forex market with confidence. Whether you’re a traveler, a business owner, or an investor, a deep understanding of the topic will empower you to mitigate risks and capitalize on opportunities in the global financial landscape.

Are you interested in delving deeper into the fascinating world of forex exchange rates? Let me know in the comments, and I’ll be happy to share more insights and engage in thought-provoking discussions.