Introduction

Forex arbitrage is a trading opportunity that involves buying and selling currency pairs on different exchanges to profit from slight price differences. While this may sound simple in theory, executing profitable arbitrage trades requires precision and fast execution, which is why many traders turn to expert advisors (EAs) to automate the process. In this article, we’ll dive into the world of simple arbitrage EA Forex MQL, exploring the concept, benefits, and practical implementation to enhance your trading endeavors.

Image: www.mql5.com

What is Simple Arbitrage EA Forex MQL?

A simple arbitrage EA Forex MQL is an automated trading software that identifies and executes arbitrage opportunities on the foreign exchange (Forex) market. It leverages the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform to monitor multiple currency pairs across different brokers or exchanges, detecting minute price variations that provide a positive profit margin.

Benefits of Using a Simple Arbitrage EA Forex MQL

There are several advantages to employing a simple arbitrage EA Forex MQL:

- Automation: EAs eliminate the need for manual trading, saving traders time and effort while ensuring consistent execution.

- Precision and Speed: EAs can execute trades with unmatched precision and speed, taking advantage of even fleeting price discrepancies.

- Reduced Risk: By leveraging predefined trading parameters, EAs can minimize the risks associated with arbitrage trading.

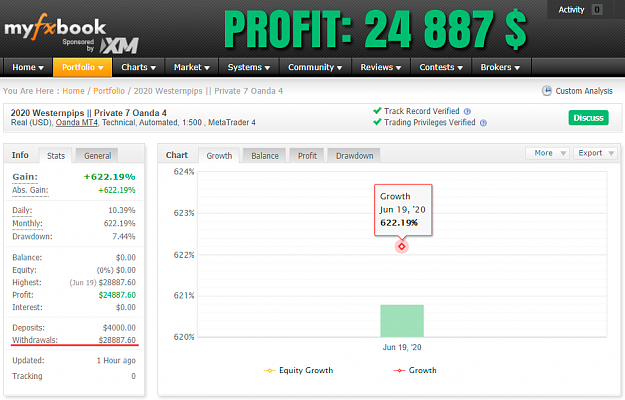

- Profitability: Properly configured EAs can generate consistent profits by exploiting price inefficiencies in the Forex market.

Understanding Simple Arbitrage EA Forex MQL

Before implementing a simple arbitrage EA Forex MQL, it’s crucial to understand the underlying concepts and mechanics:

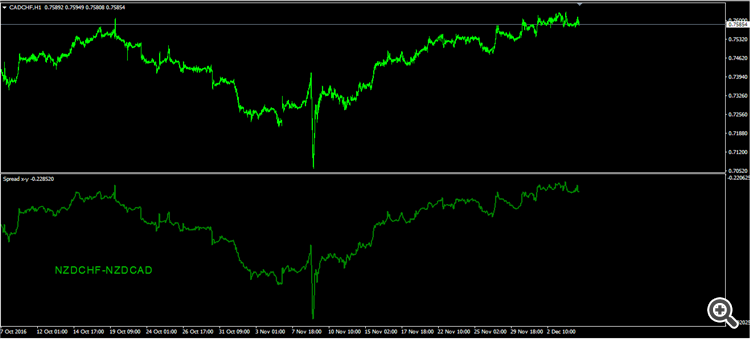

- Price Inefficiencies: Arbitrage opportunities arise when the same currency pair is priced slightly differently on different exchanges or brokers.

- Cross-Broker Spread: EAs monitor the spread (difference between bid and ask prices) across multiple brokers to identify profitable arbitrage opportunities.

- Multiple Instances: EAs allow traders to run multiple instances, trading different currency pairs or on different brokers simultaneously.

- Hedging Strategy: Simple arbitrage EAs typically use a hedging strategy, simultaneously opening opposing positions on different brokers to lock in the price spread.

Image: www.forexfactory.com

Simple Arbitrgae Ea Forex Mql

https://youtube.com/watch?v=l6i2c-NSeAE

Tips for Using a Simple Arbitrage EA Forex MQL Effectively

To maximize the potential of a simple arbitrage EA Forex MQL, consider the following tips:

- Test and Optimize: Conduct thorough testing and optimization on demo or simulated accounts to refine the EA’s parameters.

- Monitor Market Conditions: Regularly monitor market conditions, such as liquidity, volatility, and news events, to adjust the EA’s settings accordingly.

- Man