In the world of finance and trading, acronyms abound. While some are readily recognizable, others may leave us scratching our heads, wondering what they signify. One such acronym that often sparks curiosity is “NFA.” I remember when I first encountered this abbreviation, I was confused. I was trying to understand the intricacies of forex trading, and this phrase kept popping up. After some research, I realized that NFA holds substantial weight in the financial world.

Image: ythi.net

Understanding the meaning of NFA is crucial for anyone who engages in financial markets, especially those involved in forex trading. It provides insights into the regulatory landscape, ensuring transparency and trustworthiness in the industry. In this article, we’ll delve into the world of NFA, exploring its definition, significance, and implications for both traders and regulators.

Unveiling the Meaning of NFA

NFA stands for the **National Futures Association**. It is a non-profit, self-regulatory organization (SRO) that regulates the futures, options, and swaps markets in the United States. Think of it as a watchdog that ensures fair and ethical operations within these markets. The NFA plays a critical role in safeguarding market integrity, protecting investors, and promoting a stable financial environment.

The NFA’s regulatory framework is comprehensive, encompassing a wide range of activities, including:

- Registration and Oversight: The NFA oversees the registration and licensing of brokerage firms, futures commission merchants, and other entities operating within the futures market. This ensures that only those meeting specific requirements can participate in these markets

- Compliance Monitoring: The NFA monitors the activities of registered entities through regular audits and inspections to ensure compliance with regulations, reducing the risk of fraudulent or unethical practices.

- Dispute Resolution: The NFA also provides a platform for resolving disputes between members and customers, promoting a fair and transparent process for settling disagreements.

- Education and Training: The NFA invests in educational initiatives to enhance public awareness about the futures market, helping investors make informed decisions.

The Importance of NFA in Forex Trading

While the NFA primarily regulates the futures market, its influence extends to the forex market due to the significant overlap in trading practices. Forex brokers operating in the U.S. are often subject to NFA regulations, especially if they offer futures or options products. This oversight plays a vital role in assuring traders that they’re engaging with reputable, regulated brokers.

Here’s how the NFA directly impacts forex traders:

- Protection Against Fraud: NFA regulation helps to reduce the risk of fraudulent activities by forex brokers, which can protect traders from losing their funds to scams.

- Account Security: NFA rules often require brokers to maintain sufficient capital reserves and segregate client funds, reducing the likelihood of broker insolvency or misuse of client accounts.

- Transparent Practices: The NFA mandates transparency in broker operations, requiring them to disclose their trading practices, risks associated with forex trading, and relevant financial information.

Key Considerations for Forex Traders

In choosing a forex broker, it’s essential to understand the regulatory landscape. An NFA-registered broker should be a significant factor in your decision. Here are some essential questions to ask:

- NFA Registration Number: Is the broker registered with the NFA? Can you verify the registration number on the NFA’s website?

- Regulatory Compliance: Does the broker demonstrate adherence to NFA rules and regulations?

- Client Protection: What measures does the broker have in place to protect client funds? Are they segregating client funds?

- Financial Stability: Does the broker have a strong financial track record? Does it adhere to capital adequacy requirements?

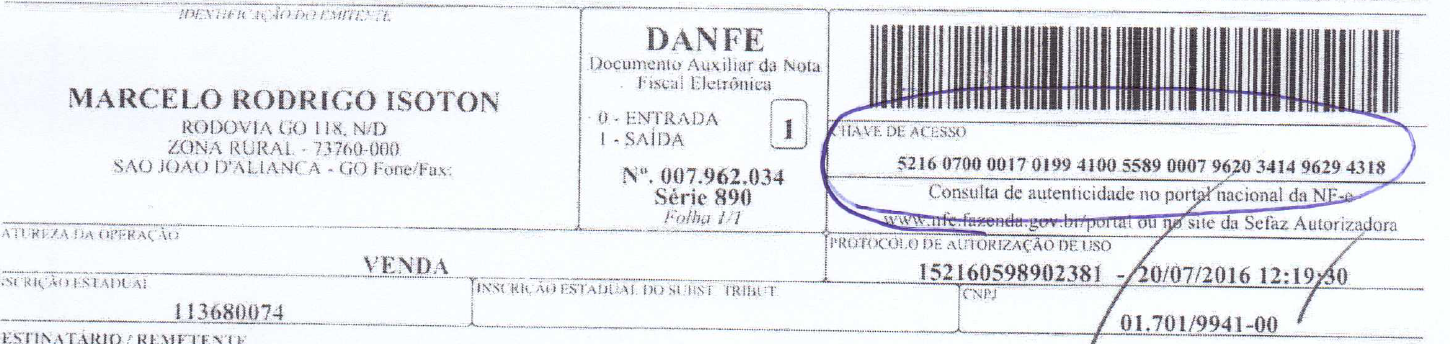

Image: www.projetoacbr.com.br

Latest Trends and Developments

The NFA is constantly evolving to adapt to the changing landscape of financial markets. Recent developments involve enhancing regulatory frameworks to address the emergence of new technologies, such as cryptocurrencies and decentralized finance (DeFi). The NFA is actively monitoring these evolving areas, seeking to ensure an appropriate regulatory framework that balances innovation with investor protection.

Expert Tips for Forex Traders

As a forex trader, understanding the NFA’s role is critical for navigating the often complex world of currency trading. Here are some practical tips based on my experience:

- Prioritize NFA-Registered Brokers: When choosing a broker, give preference to those registered with the NFA. This ensures adherence to strong regulatory standards and a trusted trading environment.

- Understand Risk Disclosure: NFA rules require brokers to disclose relevant risks associated with forex trading. Carefully review these disclosures before trading to make informed decisions.

- Stay Informed about NFA Developments: The NFA website is a valuable resource for updates, announcements, and regulatory developments that affect traders.

- Report Suspicious Activities: If you encounter a broker engaging in suspicious or fraudulent activities, report it to the NFA. They are responsible for investigating such complaints and holding brokers accountable for misconduct.

Importance of Due Diligence

While the NFA plays a significant role in promoting transparency and safeguarding investors, remember that it’s ultimately your responsibility to conduct thorough due diligence before engaging in forex trading. Don’t just rely on NFA registration; research the broker’s reputation, financial history, and client feedback.

FAQ

Q: What is the difference between the NFA and the CFTC?

A: The CFTC (Commodity Futures Trading Commission) is the primary regulator of the futures industry in the U.S. The NFA is an SRO that operates under the CFTC’s oversight. While the CFTC sets broad regulations, the NFA implements and enforces these regulations through its own rules and procedures. Think of the NFA as the enforcement arm of the CFTC for the futures industry.

Q: How can I find out if a forex broker is registered with the NFA?

A: The NFA has a searchable database on its website where you can verify the registration status of brokers. You can search by broker name, registration number, or other criteria.

Q: What are the penalties for violating NFA regulations?

A: The NFA has the authority to impose various penalties for violations, including monetary fines, suspension of registration, and revocation of licenses. The severity of the penalty often depends on the nature and severity of the violation.

What Does Nfa Stand For

Conclusion

Understanding the acronym “NFA” is crucial for anyone involved in the futures and forex markets. The NFA plays a critical role in ensuring fair trading practices, protecting investors, and maintaining stability within these markets. Remember, due diligence is paramount. Always research a broker’s reputation and regulatory status before committing your funds.

Are you interested in learning more about the NFA and its impact on forex trading? Share your questions or insights in the comments section below.