Unveiling the SEBI-Registered Forex Brokers

In India, the Securities and Exchange Board of India (SEBI) is the governing body responsible for regulating financial markets, including the foreign exchange (forex) market. SEBI registration is an essential factor for ensuring the legitimacy and credibility of forex brokers operating within the country. Choosing a SEBI-registered broker offers peace of mind and adheres to strict regulations designed to safeguard investor interests.

Image: pantip.com

Benefits of Trading with SEBI-Registered Forex Brokers

SEBI-registered forex brokers provide numerous benefits, including:

- Compliance and Regulation: Adherence to SEBI’s guidelines ensures transparency, fair practices, and minimizes the risk of fraud.

- Reliable Data and Reporting: Brokers are required to provide accurate and timely market data, enabling traders to make informed decisions.

- Investor Protection: SEBI offers redressal mechanisms in case of any disputes, providing a layer of protection for traders.

li>Transparent Fee Structure: Brokers must clearly disclose their fees and charges, ensuring transparency and eliminating hidden costs.

Understanding Forex Trading

Foreign exchange trading, also known as forex trading, involves the exchange of currencies for profit. The forex market is the largest and most liquid financial market globally, with 24-hour trading availability. Forex trading requires knowledge of currency pairs, market analysis, and trading strategies.

Choosing the Right Forex Pair

Selecting the right currency pair is crucial for successful forex trading. Some popular and frequently traded currency pairs include:

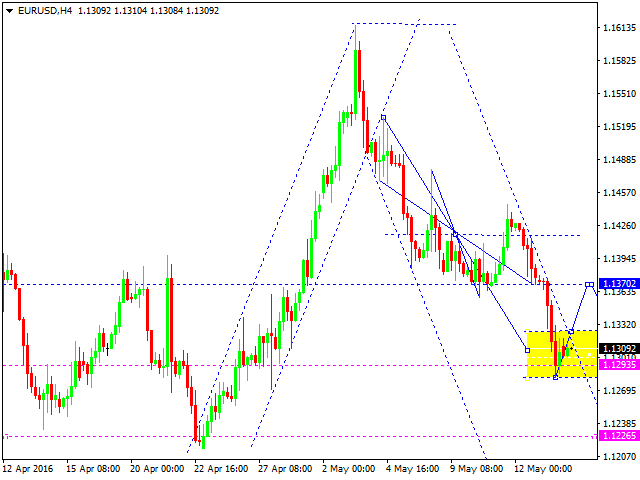

Image: www.mql5.com

EUR/USD (Euro/US Dollar)

- Most liquid traded pair

- Relatively stable and has low volatility

- Suitable for beginners and experienced traders

GBP/USD (British Pound/US Dollar)

- Second most traded pair

- Higher volatility compared to EUR/USD

- Impacted by political and economic news

USD/JPY (US Dollar/Japanese Yen)

- Third most traded pair

- Often considered a safe-haven currency

- High volatility influenced by geopolitical events

Trading Tips for Forex Beginners

Embarking on forex trading requires preparation and a sound approach. Here are some tips for beginners:

1. Educate Yourself

Thoroughly understand forex fundamentals, trading strategies, and risk management techniques.

2. Start with a Demo Account

Practice trading in a risk-free environment with a demo account before venturing into real trading.

3. Set Realistic Expectations

Do not expect to earn quick riches. Set modest profit goals and understand that forex trading involves risks.

4. Manage Your Risk

Implement effective risk management strategies, such as setting stop-loss orders and determining your risk tolerance.

Frequently Asked Questions about Forex Trading

Q: How much capital do I need to start forex trading?

A: The amount of capital required varies depending on your trading strategy and risk tolerance. Start with a small amount of capital you can afford to lose.

Q: What are the risks involved in forex trading?

A: Forex trading carries the risk of losing your investment due to market fluctuations, leverage, and trading errors.

Q: How do I choose a reputable forex broker?

A: Look for SEBI-registered brokers with a good track record, transparency, and competitive fees.

Q: Can I trade forex on weekends?

A: The forex market is closed on weekends, typically from Friday evening to Sunday evening.

Sebi Registered Eur Usd Gbp Usd Usd Jpy Forex Broker

https://youtube.com/watch?v=qJjZxZCm9zg

Conclusion

Navigating the world of forex trading requires a well-informed approach. Opting for SEBI-registered brokers for trading currency pairs like EUR/USD, GBP/USD, and USD/JPY ensures a secure and regulated trading environment. By understanding forex trading, choosing the right currency pairs, and adhering to sound trading practices, you can explore the possibilities of forex trading while mitigating potential risks.

Are you ready to delve into the realm of forex trading with SEBI-registered brokers?