Empower Your International Transactions with SBI Forex Card

Navigating foreign exchange markets can be daunting, especially when traveling or conducting international business. To simplify your financial transactions abroad, SBI offers an exceptional solution: the SBI Forex Card. This card provides a secure, convenient, and cost-effective way to manage your finances while traveling internationally.

Image: www.forex.academy

Forex Card: Delving into the Concept

A forex card, short for foreign exchange card, is a prepaid travel card that allows you to load multiple currencies onto a single card. It eliminates the need to carry large amounts of cash, reducing the risk of theft or loss. Forex cards offer competitive exchange rates, allowing you to save money compared to traditional currency exchange methods.

Advantages of Using SBI Forex Card

- Convenience: Access your funds anytime, anywhere with a global network of ATMs and point-of-sale terminals.

- Competitive Exchange Rates: Get real-time, interbank exchange rates, ensuring you get the best possible value for your money.

- Security: Enjoy the peace of mind that comes with chip and PIN technology, ensuring your transactions are secure and protected.

- Ease of Use: Reload your card online or through SBI’s mobile app, making it quick and easy to manage your finances on the go.

- Wide Acceptance: SBI Forex Cards are widely accepted at millions of locations around the world, ensuring seamless transactions.

Latest Trends and Innovations in Forex Services

The forex industry is constantly evolving, with the introduction of new technologies and services designed to enhance user convenience. One such innovation is the integration of digital wallets with forex cards. This allows users to link their forex card to their digital wallet, enabling them to make mobile payments and manage their finances conveniently.

Another emerging trend is the rise of mobile-first forex services. These services provide users with a seamless experience, allowing them to manage their forex accounts and make transactions via smartphone applications. This ease of access makes it easier than ever for travelers to manage their finances while abroad.

Image: management.ind.in

Tips and Expert Advice: Maximizing Your Forex Card Usage

- Lock-in Exchange Rates: Take advantage of favorable exchange rates by locking them in when you load your forex card, ensuring a guaranteed exchange rate for your transactions.

- Avoid ATM Withdrawal Fees: Withdraw cash strategically from ATMs that offer low or no fees to minimize transaction costs.

- Monitor Your Transactions: Regularly track your spending through online or mobile banking to stay aware of your balance and card usage.

- Use Currency Conversion Services: Utilize forex card providers that offer currency conversion services to get the most competitive rates when making purchases or withdrawing cash in foreign currencies.

- Be Diligent with Security: Always protect your PIN and never provide it to anyone. Report any lost or stolen cards immediately to prevent unauthorized usage.

Frequently Asked Questions on SBI Forex Card

-

Where can I use my SBI Forex Card?

You can use your SBI Forex Card anywhere that accepts Visa or Mastercard, including ATMs, point-of-sale terminals, and online purchases. -

Is it safe to use my SBI Forex Card abroad?

Yes, SBI Forex Cards are secure with chip and PIN technology. Additionally, SBI provides 24/7 customer support to assist with any issues or concerns. -

How do I load my SBI Forex Card?

You can load your SBI Forex Card online through SBI’s website or mobile app, or at select SBI Bank branches. -

What are the fees associated with SBI Forex Card?

SBI charges a nominal fee for loading and using your forex card. The fees vary depending on the transaction type and currency.

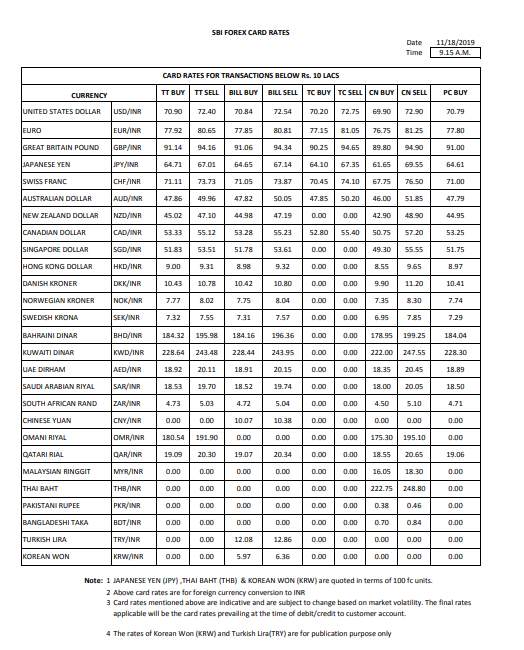

Sbi Forex Card Rate For Today

Conclusion: Embracing Global Convenience and Savings

SBI Forex Card offers a convenient, secure, and cost-effective way to manage your finances while traveling abroad. By providing competitive exchange rates, global accessibility, and advanced security features, SBI Forex Card empowers you to navigate international transactions with confidence and ease. Whether you’re exploring new destinations or conducting cross-border business, let SBI Forex Card be your trusted financial companion, unlocking a world of financial freedom and savings.

Are you ready to enhance your international banking experience? Discover the benefits of SBI Forex Card today!