Introduction

Image: management.ind.in

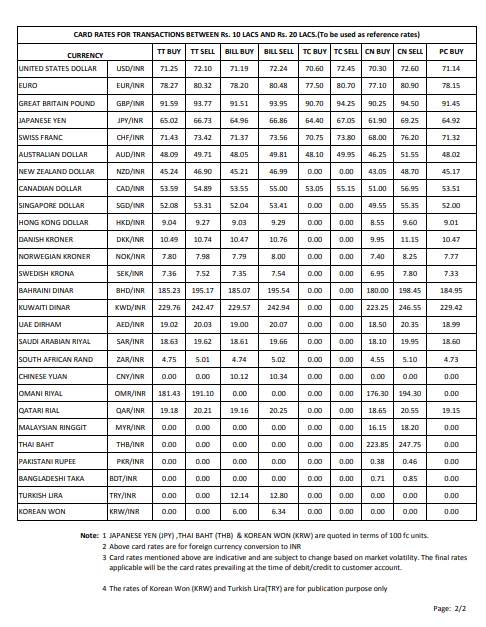

State Bank of India (SBI), India’s largest public sector bank, offers a comprehensive range of foreign exchange (forex) services to cater to the diverse needs of its customers. As of December 31, 2018, SBI played a significant role in India’s forex market, with a strong track record and competitive offerings. This article aims to provide an in-depth analysis of SBI forex as of 31.12.2018, exploring its services, market position, and key trends.

SBI Forex Services

- Currency Trading: SBI offers a broad range of currency pairs for trading, including major currencies like USD/INR, EUR/USD, and GBP/USD, as well as emerging market currencies.

- Remittances: SBI facilitates international money transfers for personal and business purposes, with various options for sending and receiving funds across borders.

- Travel Currency: The bank provides foreign exchange services for travelers, including cash exchange, traveler’s checks, and prepaid travel cards.

- Hedging Products: SBI offers hedging instruments such as forward contracts and options to help customers manage currency risks in international transactions.

- Currency Advisory: The bank provides expert insights and market analysis to guide clients on forex market dynamics and investment strategies.

Market Position and Performance

SBI is a key player in India’s forex market, with a substantial share of the retail and corporate forex business. The bank’s forex trading volume as of December 2018 was significant, and it consistently maintained a competitive position in terms of pricing and execution. SBI’s forex operations contributed significantly to the bank’s overall revenue and profitability.

Key Trends and Developments

- Digitalization: SBI has invested heavily in digitalization initiatives, making its forex services more accessible and convenient for customers. Online platforms and mobile applications allow for seamless currency trading and remittance transactions.

- Growing Demand for Hedging Products: With increased international trade and investment, demand for hedging products such as forward contracts and options has witnessed a steady growth. SBI offers tailored solutions to meet the specific risk management needs of its clients.

- Cross-Border Remittances: The bank has expanded its remittance services to tap into the growing demand for cross-border payments. SBI offers competitive exchange rates and various remittance options to cater to diverse customer requirements.

Conclusion

SBI forex as of December 31, 2018, presented a robust and dynamic picture. The bank’s comprehensive forex services, strong market position, and embrace of digitalization position it as a prominent player in the Indian forex market. By staying abreast of evolving industry trends and customer needs, SBI continues to deliver innovative and efficient forex solutions, empowering its clients to navigate the complexities of international currency transactions.

Image: github.com

Sbi Forex As On 31.12.2018