Navigating the complexities of foreign exchange trading can be daunting, but with the right tools and strategies, it’s possible to maximize your potential returns. One invaluable tool in the arsenal of seasoned forex traders is the Relative Strength Index (RSI), a technical indicator that helps gauge the strength and momentum of currency pairs. RSI Multi Currency takes this indicator to the next level, enabling traders to track multiple currency pairs simultaneously, giving them a comprehensive overview of the market landscape.

Image: top-trading-indicators.com

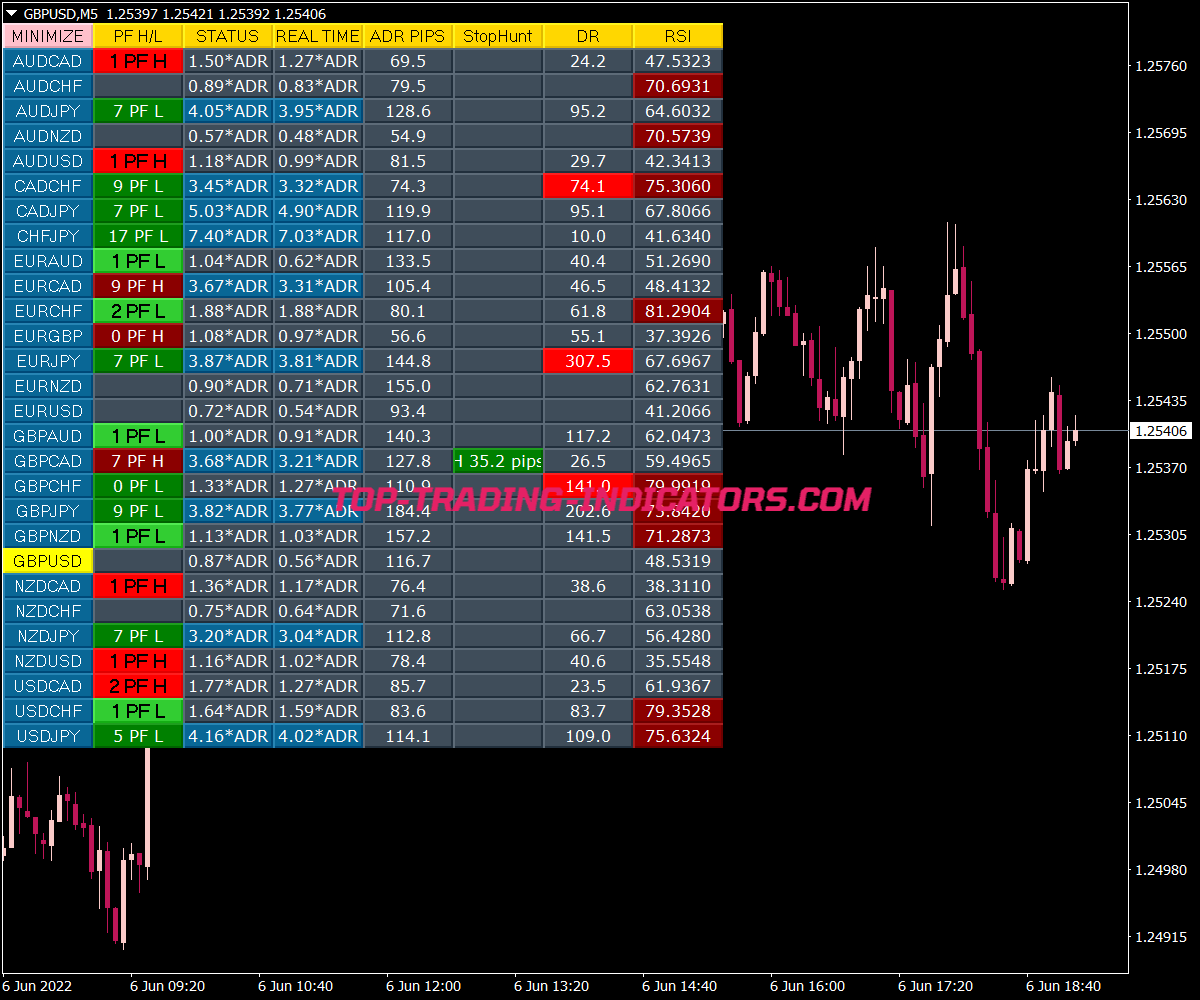

At a glance, RSI Multi Currency provides real-time updates on the RSI values of all major currency pairs, including EUR/USD, USD/JPY, GBP/USD, and more. This allows traders to quickly identify oversold or overbought conditions, enabling them to make informed trading decisions based on market trends.

Unveiling the Power of Multiple Currency Perspectives

RSI Multi Currency empowers traders by presenting a multidimensional view of the forex market. By monitoring multiple currency pairs simultaneously, traders can identify converging and diverging trends, thereby broadening their understanding of market dynamics. This holistic approach provides a comprehensive perspective, minimizing the risk of making decisions based solely on limited data.

Furthermore, RSI Multi Currency allows traders to track the correlation between different currency pairs, a crucial factor in developing effective trading strategies. By understanding how different currencies move in tandem or opposite directions, traders can make informed decisions about which currency pairs to trade and how to hedge their positions.

Technical Insights for Informed Trading

RSI Multi Currency is not merely a data visualization tool; it also provides valuable technical insights that empower traders to make informed trading decisions. By applying technical analysis techniques to the RSI values of multiple currency pairs, traders can identify potential trading opportunities, set appropriate stop-loss and take-profit levels, and manage their risk exposure.

The RSI indicator, upon which RSI Multi Currency is based, provides a clear visual representation of the relationship between gains and losses over a specified period. It oscillates between 0 and 100, with values above 70 typically indicating an overbought condition and values below 30 suggesting an oversold condition. By monitoring the RSI values of multiple currency pairs, traders can identify potential trend reversals and capitalize on short-term trading opportunities.

Staying Ahead of the Market: Embracing the Latest Trends

RSI Multi Currency is not limited to monitoring current market conditions; it also keeps traders informed about the latest trends and developments in the forex market. By integrating news and updates from reputable sources, RSI Multi Currency provides traders with a comprehensive view of market-moving events.

Traders can stay abreast of economic data releases, central bank announcements, and geopolitical events that can significantly impact currency prices. This real-time information, coupled with the historical RSI data, empowers traders to make nimble trading decisions and adapt their strategies to changing market conditions.

Image: www.ydeho.com

Expert Advice: Navigating the Forex Market

RSI Multi Currency is not simply a trading tool; it also provides access to invaluable expert advice and insights. Seasoned forex traders share their knowledge and experience through the platform, offering guidance on trading strategies, risk management techniques, and market analysis.

Traders can learn from the best in the industry, gain insights into successful trading practices, and stay informed about the latest trading techniques. This curated knowledge base ensures that traders are well-equipped to navigate the ever-evolving forex market.

FAQs: Demystifying RSI Multi Currency

- Q: What is RSI Multi Currency?

A: RSI Multi Currency is a comprehensive trading tool that provides real-time RSI values of multiple currency pairs, offering a holistic view of the forex market.

- Q: What are the benefits of using RSI Multi Currency?

A: RSI Multi Currency empowers traders with a multidimensional market perspective, enables them to identify trading opportunities, and provides access to expert advice.

- Q: How does RSI Multi Currency help traders make informed decisions?

A: By integrating technical analysis techniques with real-time market updates, RSI Multi Currency provides traders with insights into market trends, potential reversals, and risk management strategies.

- Q: Is RSI Multi Currency suitable for both beginners and experienced traders?

A: RSI Multi Currency is a valuable resource for traders of all levels. Beginners can leverage its easy-to-use interface and expert guidance, while experienced traders can enhance their trading strategies with the advanced technical analysis capabilities.

- Q: How do I get started with RSI Multi Currency?

A: Getting started with RSI Multi Currency is simple. Simply register for a free account and start tracking your desired currency pairs. No prior trading experience or technical knowledge is required.

Rsi Multi Currency In Forex

Conclusion: Empowering Forex Traders

RSI Multi Currency is an indispensable tool for forex traders seeking to elevate their trading performance. By providing a comprehensive view of the market, real-time updates, and expert insights, it empowers traders with knowledge and confidence to navigate the complexities of currency trading. Whether you are a seasoned professional or a novice trader, RSI Multi Currency can help you unlock the full potential of the forex market.

Are you ready to take your forex trading to the next level? Explore RSI Multi Currency today and discover the world of multidimensional insights and expert guidance that awaits you.