Imagine a world where you can potentially profit from the daily fluctuations of global currencies. This is the exciting realm of forex trading, where you can buy and sell currencies against each other, hoping to capitalize on market movements. But how do you even begin this journey? The answer lies in opening your own forex account, a gateway to a world of possibilities.

Image: blog.fxcc.com

This comprehensive guide will equip you with all the necessary knowledge to navigate the process of opening a forex account, from understanding the basics to choosing the perfect broker for your needs. We’ll delve into the crucial factors to consider, the steps involved, and the vital tips that can set you on the path to success in this exciting and dynamic market.

Step 1: Understanding the Forex Market

Before diving into the specifics of opening an account, it’s crucial to understand the fundamental workings of the forex market. Forex, short for foreign exchange, is the largest and most liquid financial market globally, transcending geographical boundaries and operating 24/5. It’s a marketplace where currencies are exchanged, influenced by a myriad of factors such as economic data, political events, and investor sentiment.

The forex market is a complex ecosystem where participants, including individuals, banks, institutions, and brokers, interact to determine the value of one currency against another. This constant interplay of market forces creates opportunities for traders to profit from price movements.

Step 2: Choosing the Right Forex Broker

Choosing a reputable and reliable forex broker is the cornerstone of your trading journey. The broker acts as an intermediary, providing you with the platform and tools to execute trades in the forex market. The key is to find a broker that aligns with your trading style, risk tolerance, and financial goals.

Factors to Consider When Choosing a Forex Broker:

- Regulation and Licensing: Look for brokers with licenses from reputable financial regulatory bodies such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Commodity Futures Trading Commission (CFTC) in the United States. These licenses indicate that the broker operates under strict regulatory oversight, safeguarding your funds and ensuring fair trading practices.

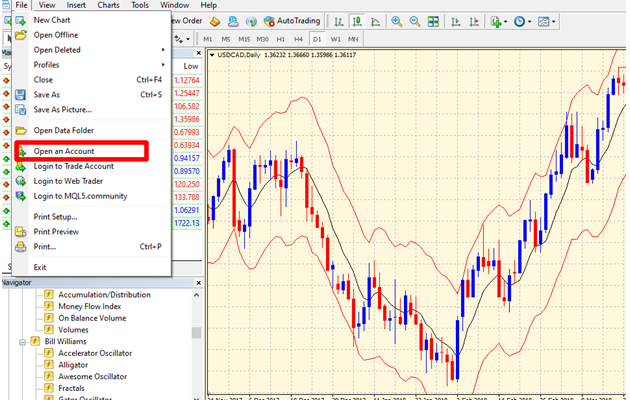

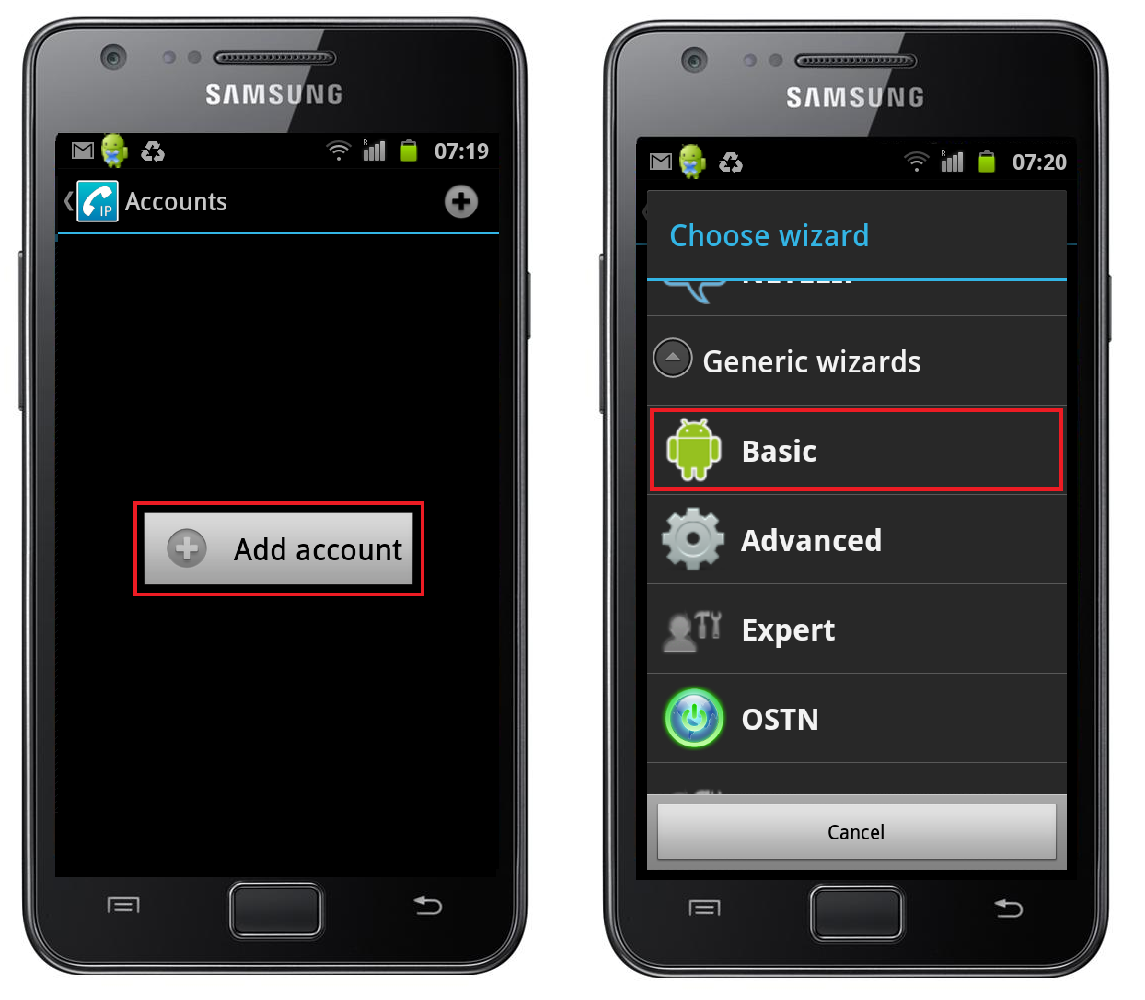

- Trading Platform: The trading platform is your window into the forex market. Choose a platform with user-friendly interfaces, advanced charting capabilities, and a range of technical analysis tools.

- Spreads and Commissions: Brokers charge varying fees in the form of spreads and commissions. Spreads are the difference between the buy and sell prices of a currency pair, while commissions are additional fees charged for each transaction. Compare these charges across different brokers to find those with competitive pricing.

- Deposits and Withdrawals: Ensure the broker offers convenient and secure deposit and withdrawal methods. Consider the minimum deposit requirement and withdrawal fees associated with different payment options.

- Account Types: Most brokers offer different account types, each tailored to specific trading needs and experience levels. Research the different account types and their features to find one that aligns with your trading goals.

- Educational Resources: A reputable broker should provide comprehensive educational resources, including tutorials, webinars, and market analysis reports. These resources can help you develop your trading skills and gain a deeper understanding of the forex market.

Image: faqogumypoze.web.fc2.com

Step 3: Navigating the Account Opening Process

The account opening process typically involves the following steps:

-

Complete an Application: Begin by filling out an online application form, providing personal details such as your name, address, contact information, and financial information.

-

Verification and KYC: Your application will be subject to verification and Know Your Customer (KYC) checks to ensure compliance with anti-money laundering regulations. You may be asked to provide supporting documentation, such as a copy of your passport or driver’s license, proof of address, and financial statements.

-

Deposit Funds: Once your account is verified, you will need to deposit funds into your trading account. The minimum deposit requirement varies between brokers.

-

Choose Trading Instruments: Select the currency pairs you want to trade. The choices can range from major currency pairs like EUR/USD and GBP/USD to exotic currency pairs like USD/ZAR and EUR/TRY.

-

Start Trading: Once your account is funded, you can begin exploring the trading platform and placing your first trades.

Step 4: Understanding Forex Trading Terminology

Before delving into the world of forex trading, it’s imperative to grasp the fundamental terminology:

- Currency Pairs: Forex trading involves buying one currency and selling another. A currency pair is a combination of two currencies, such as EUR/USD (Euro against US Dollar) or GBP/JPY (British Pound against Japanese Yen).

- Bid and Ask Prices: The bid price is the price at which a broker is willing to buy a currency pair, while the ask price is the price at which they are willing to sell. The difference between these two prices is called the spread.

- Pips (Points in Percentage): The smallest unit of change in the exchange rate of a currency pair is called a pip.

- Lots: Lots refer to the unit size of a forex trade. Standard lots are 100,000 units of the base currency.

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. It amplifies both profits and losses.

- Margin: Margin is the amount of money required to hold a forex position open. It is a percentage of the total position value.

- Stop-Loss Orders: Stop-loss orders are used to limit losses on a trade by automatically closing the position when the price reaches a predetermined level.

- Take-Profit Orders: Take-profit orders are used to secure profits by automatically closing a trade when the price reaches a predetermined level.

Step 5: Essential Forex Trading Tips

- Start Small: Don’t jump in with large sums of money. Start with a small account balance to minimize potential losses and gain experience before scaling up.

- Learn the Fundamentals: Before placing trades, invest time in understanding the basics of forex trading, including technical analysis, fundamental analysis, and risk management.

- Practice with a Demo Account: Most brokers offer demo accounts, which allow you to practice trading in a simulated environment without risking real money.

- Manage Your Risk: Always use stop-loss orders to limit potential losses and never trade with money you can’t afford to lose.

- Keep Learning: The forex market is constantly evolving. Stay informed about market news and events, and continue learning to improve your trading skills.

- Develop a Trading Plan: Define your trading goals, risk tolerance, and exit strategies before you start trading.

Open Forex Account

https://youtube.com/watch?v=McsNpt105M4

Conclusion:

Opening a forex account can be a powerful step towards harnessing the potential of the global currency market. Remember, trading Forex carries inherent risks, but with thorough research, careful planning, and continuous learning, you can potentially navigate this dynamic market to achieve your financial goals. This guide has equipped you with the essential information and tips to embark on your forex trading journey. Now, take the leap, embrace the world of currency exchange, and open your account to a world of financial possibilities.