Introduction: Navigating the Evolving Terrain of Forex Trading

The global foreign exchange (forex) market, a trillion-dollar arena where currencies are exchanged, is an ever-shifting landscape. Currency values fluctuate incessantly, influenced by a myriad of economic, political, and social factors. Understanding these dynamics is crucial for traders, investors, and businesses alike. In this comprehensive article, we embark on a journey to unravel the recent market trends in forex markets globally, providing actionable insights to empower you in the fast-paced world of currency trading.

Image: udilisavu.web.fc2.com

Unveiling the Major Players: Understanding Currency Pairs and Market Structure

The forex market is primarily driven by the trading of currency pairs, with each pair representing the relative value of two different currencies. The most commonly traded currency pairs, known as majors, include the EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These currencies account for a significant portion of global trading volume and are highly liquid, making them ideal for trading. Other currencies, referred to as minors or exotics, are less traded and have lower liquidity.

Analyzing Economic Indicators: Key Drivers of Market Sentiment

Economic indicators, released regularly by central banks and government agencies, provide valuable insights into the health of a country’s economy and can significantly impact currency values. Some of the most closely monitored indicators include:

- Gross domestic product (GDP): A measure of the total value of goods and services produced within a country, reflecting overall economic growth.

- Inflation: The rate at which prices for goods and services are rising, providing insights into the stability of a country’s economy and the direction of interest rate decisions.

- Unemployment rate: An indicator of the availability of labor, affecting consumer spending and economic sentiment.

- Interest rates: The rates set by central banks, influencing the cost of borrowing and lending and impacting currency values.

Central Bank Policies: Orchestrating the Market Symphony

Central banks play a crucial role in shaping market trends through monetary policies, primarily interest rate decisions and quantitative easing or tightening. Interest rate changes directly affect the cost of borrowing and can lead to significant currency fluctuations. For example, increasing interest rates often strengthens a currency, while lowering them can weaken it. Central banks also engage in quantitative easing or tightening, purchasing or selling bonds to influence money supply and liquidity, thus impacting currency values.

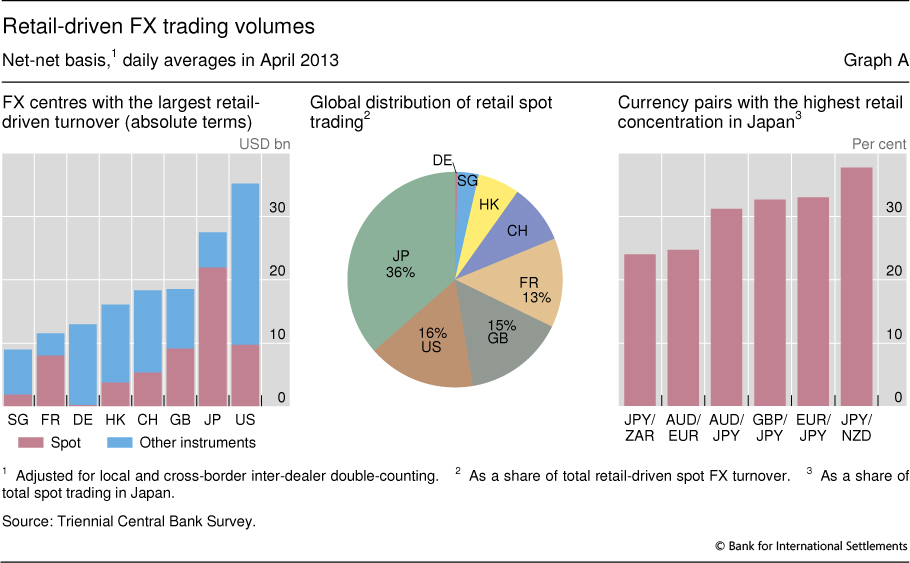

Image: www.bis.org

Geopolitical Events and Natural Disasters: Unpredictable Market Disruptors

While economic factors dominate market sentiment, geopolitical events and natural disasters can also have a profound impact on forex markets. Political instability, trade disputes, and international conflicts can trigger market volatility and sharp currency movements. Natural disasters, such as earthquakes, floods, or pandemics, can disrupt supply chains, damage infrastructure, and impact economic growth, leading to currency fluctuations.

Technological Advancements: Shaping the Future of Forex Trading

The rise of fintech and technological advancements has revolutionized forex trading. Automated trading platforms, mobile applications, and artificial intelligence are transforming the industry, enhancing efficiency, accessibility, and opportunities for traders. As technology continues to evolve, we can expect further innovations and a more dynamic and data-driven forex market landscape.

The Impact of Market Trends on Global Business and Investment

Fluctuations in forex markets impact global businesses and investments in numerous ways:

- Currency risk: Businesses and investors face currency risk when conducting international transactions, as fluctuations in currency values can affect the value of their assets and revenue.

- Investment returns: Forex market trends can influence the returns on foreign investments, as changes in currency values can either enhance or diminish the value of returns.

- Commodities prices: Forex rates impact the pricing of commodities, such as oil, gold, and wheat, as they are often traded in U.S. dollars.

- Consumer confidence: Currency strength can affect consumer confidence, influencing spending patterns and economic growth.

Recent Market Trends In Forex Markets Globally

Conclusion: Embracing Market Trends for Informed Decision-Making

The global forex market is a complex and ever-evolving landscape. By understanding recent market trends, economic indicators, central bank policies, geopolitical events, and technological advancements, traders, investors, and businesses can gain a competitive edge in navigating this dynamic trading arena. Embrace the constant flux of the forex market, adapt to changing conditions, and harness the power of market intelligence to make informed decisions that drive success.