In the labyrinthine world of finance, the Reserve Bank of India (RBI) stands tall as the guardian of monetary policy, shaping the economic landscape of the nation. Amidst its esteemed ranks, the Foreign Exchange (Forex) Officer plays a pivotal role in managing the country’s foreign currency reserves and ensuring exchange rate stability. With their expertise in international finance, these officers command substantial financial compensation.

Image: www.youtube.com

Forex Officer: A Gateway to Financial Prestige

Forex Officers are entrusted with the responsibility of executing foreign exchange transactions, monitoring exchange rates, and formulating policies that navigate the volatile currents of the global currency market. Their knowledge of financial markets, macroeconomic dynamics, and risk management allows them to steer the ship of India’s foreign exchange reserves through choppy waters.

As a result of their specialized skillset and significant responsibilities, RBI Forex Officers enjoy a lucrative and highly coveted career path. Their financial rewards reflect the critical role they play in safeguarding the nation’s economic interests.

Unveiling the Salary Structure

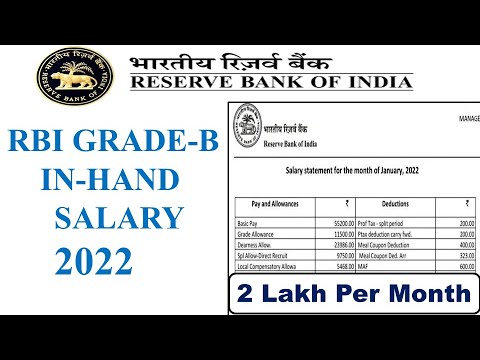

The RBI Forex Officer salary structure is designed to attract and retain exceptional talent in the field of international finance. The exact salary range varies depending on experience, seniority, and performance, but it typically falls within the following bands:

- Grade A Officer: ₹75,000 – ₹1,40,000 per month

- Grade B Officer: ₹65,000 – ₹1,20,000 per month

- Grade C Officer: ₹55,000 – ₹1,00,000 per month

In addition to their base salary, Forex Officers may be eligible for various allowances and benefits, such as housing allowances, travel allowances, medical insurance, and car loans. These perks further enhance the financial appeal of this prestigious role.

Career Advancement and Growth Potential

The RBI Forex Officer career path provides ample opportunities for professional growth and development. High-performing officers can progress through the ranks, assuming positions of greater responsibility and influence within the Reserve Bank of India.

In the upper echelons of the hierarchy, Forex Officers may be entrusted with managing the bank’s foreign exchange reserves, formulating monetary policy, and representing India in international financial fora. The rewards for excellence in this field are substantial, both in terms of financial compensation and professional recognition.

Image: www.jagranjosh.com

Empowering Expertise: Tips and Expert Advice

1. Pursue Higher Education: A master’s degree in international finance, economics, or a related field can significantly enhance your employability as an RBI Forex Officer.

2. Cultivate Analytical Skills: The ability to analyze financial data, understand economic trends, and assess market risks is essential for success in this role.

3. Stay Abreast of Global Finance: Maintain a keen interest in international financial markets, monetary policies, and geopolitical developments. This knowledge will sharpen your decision-making abilities.

Frequently Asked Questions (FAQs)

Q: What is the eligibility criteria for becoming an RBI Forex Officer?

A: Candidates must hold a Bachelor’s degree with a minimum of 60% marks in Economics, Econometrics, Mathematics, or Statistics, and must satisfy the RBI’s age and other eligibility criteria.

Q: How do I apply for an RBI Forex Officer position?

A: The RBI typically notifies job openings on its official website. Eligible candidates can apply online through the prescribed process.

Rbi Forex Officer Salary Salary

Conclusion

The Reserve Bank of India Forex Officer salary structure reflects the importance attached to the role in the realm of international finance. With their expertise, responsibilities, and ample growth opportunities, Forex Officers enjoy a secure and lucrative career. Are you ready to embark on the path to financial success and make a meaningful contribution to the economic fabric of India?