Navigating the complexities of the foreign exchange market (forex) requires a thorough understanding of fundamental concepts, including ask and bid rates. These rates play a crucial role in currency conversion and serve as the foundation for all forex transactions.

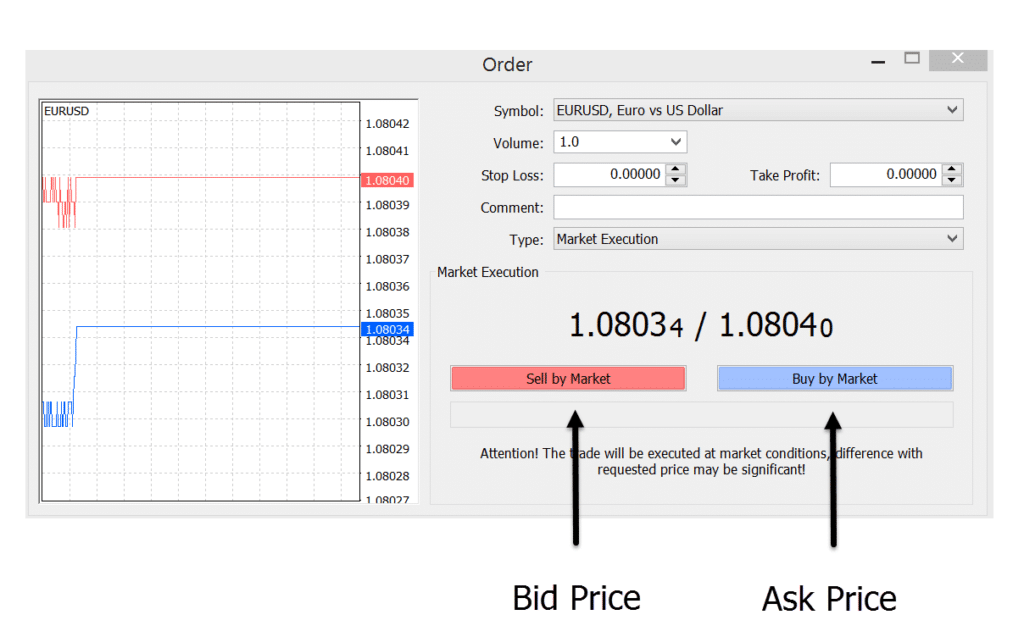

Image: learnpriceaction.com

Understanding Ask and Bid Rates

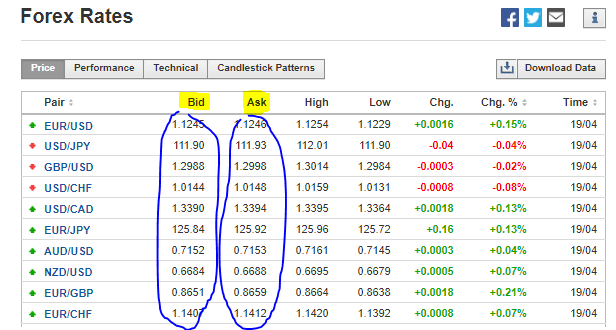

The ask rate, also known as the offer rate, represents the price at which a currency dealer is willing to sell a specified currency pair. On the other hand, the bid rate, or request rate, indicates the price the dealer is willing to pay for the same currency pair. The difference between these rates, known as the spread, represents the dealer’s profit margin.

Importance of Rate Conversion

Rate conversion is the process of converting one currency into another. It’s frequently used by individuals, businesses, and financial institutions involved in international transactions. Travelers, for example, need to convert their home currency into the currency of the country they’re visiting. Traders and investors also engage in rate conversion to purchase financial instruments denominated in different currencies.

Mechanics of Rate Conversion

To convert a specific amount of currency, multiply it by the prevailing ask rate for a buy transaction and the bid rate for a sell transaction. For instance, if you’re buying 1,000 euros (EUR) and the ask rate is 1.1340 USD/EUR, you would pay $1,134.00. If you’re selling 1,000 euros, and the bid rate is 1.1260 USD/EUR, you would receive $1,126.00. The bid-ask spread would be 0.008 USD/EUR in this case, generating a profit for the dealer on each trade.

Image: www.investing.com

Influencing Factors for Ask and Bid Rates

Several factors influence the fluctuations in ask and bid rates. These factors include:

- Economic data: Macroeconomic indicators like GDP, inflation, and employment rates provide insights into the relative strength of different economies.

- Political and regulatory changes: Political instability, government policies, and regulatory announcements can impact investor sentiment and lead to currency fluctuations.

- Supply and demand: The availability and demand for a given currency pair determine the ask and bid rates. Speculative trading can also contribute to supply and demand imbalances.

Real-World Applications

Rate conversion has practical implications in various sectors:

- International trade: Importers and exporters adjust their prices based on exchange rates to ensure competitive pricing in the global market.

- Tourism: Travelers exchange their home currencies into local currencies to facilitate purchases and activities during their trips.

- Investments: Investors can diversify their portfolios by investing in assets denominated in different currencies, requiring currency conversion.

Rate Conversion In Forex Ask And Bid

Conclusion

Understanding ask and bid rates is essential for anyone involved in currency conversions. These rates serve as the basis for all forex transactions and impact international business, travel, and investments. By staying informed about exchange rates and geopolitical factors that influence them, individuals and businesses can navigate the forex market effectively and optimize their currency conversions.