In the dynamic and ever-evolving world of Forex trading, traders are constantly seeking innovative strategies to maximize their profits while minimizing risks. Among the plethora of trading tools and indicators, the PDF Forex Heiken Ash (HMA) strategy stands out as a powerful and versatile approach that has captivated traders of all levels.

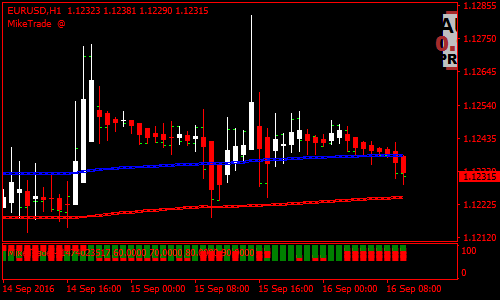

Image: www.dolphintrader.com

The Heiken Ash strategy, originally developed by Japanese trader Munehisa Homma, is a trend-following indicator that seeks to identify potential profit opportunities by filtering out market noise and revealing underlying trends. By combining the principles of Japanese candlestick charting with a unique calculation method, the HMA indicator creates a smoothed representation of price action that enhances trend identification.

Demystifying the Heiken Ash Strategy: A Step-by-Step Guide

Understanding HMA Candlesticks

Unlike traditional candlesticks that depict the open, close, high, and low prices, HMA candlesticks represent a modified version of these values. HMA candles have three main components:

- Open: (Previous Close + Current Open) / 2

- Close: (Previous Close + Current Close) / 2

- High/Low: The highest or lowest price of the current period, respectively

Interpreting HMA Candlesticks

HMA candlesticks provide valuable insights into trend direction and strength based on their color and shape:

- Bullish Candlesticks: Green candles indicate an uptrend and are characterized by a higher close than open.

- Bearish Candlesticks: Red candles indicate a downtrend and have a lower close than open.

Trend strength is assessed based on the candle’s body size and wicks. Larger bodies suggest stronger trends, while long wicks indicate potential reversals or consolidation.

Unveiling the PDF Forex Heiken Ash Strategy

The PDF Forex Heiken Ash (HMA) strategy combines the Heiken Ash indicator with price action analysis and other trading principles to identify high-probability trading opportunities. Here’s an overview of the strategy’s key components:

Entry Signals:

- Buy Signal: Two consecutive green Heiken Ash candles confirm an uptrend and trigger a buy entry.

- Sell Signal: Two consecutive red Heiken Ash candles indicate a downtrend and signal a sell entry.

Stop-Loss Placement:

- Long Trades: Stop-loss is placed below the previous swing low or a critical support level.

- Short Trades: Stop-loss is placed above the previous swing high or a key resistance level.

Target Profit Levels:

- Targets: Take-profit targets are based on chart patterns, trendlines, or Fibonacci levels.

- Trailing Stops: Traders can use trailing stops to lock in profits as the trend unfolds.

Combining with Price Action:

The PDF Forex HMA strategy integrates price action analysis to enhance trade identification and risk management. Traders may consider other indicators such as the Moving Average or Bollinger Bands to validate their trading decisions.

Benefits of Using PDF Forex Heiken Ash Strategy

- Trend Following: HMA candles effectively filter out market noise and highlight prevailing trends.

- Simplicity: The HMA strategy is easy to apply, requiring minimal technical analysis expertise.

- Low False Signals: Filtered candlesticks reduce false signals compared to traditional candlesticks.

- High Accuracy: The combination of HMA indicator with price action analysis enhances the accuracy of trading decisions.

Image: www.forexmt4indicators.com

Pdf Forex Heiken Ash Strategy

Conclusion

The PDF Forex Heiken Ash strategy offers a powerful and versatile approach to Forex trading, providing traders with a reliable framework for identifying high-probability trading opportunities. By understanding the unique features of Heiken Ash candles and incorporating price action analysis, traders can navigate market complexities and achieve consistent profits. However, it’s crucial to practice risk management techniques and continuously adapt the strategy to evolving market conditions.