The Lucrative World of PAMM Forex Trading

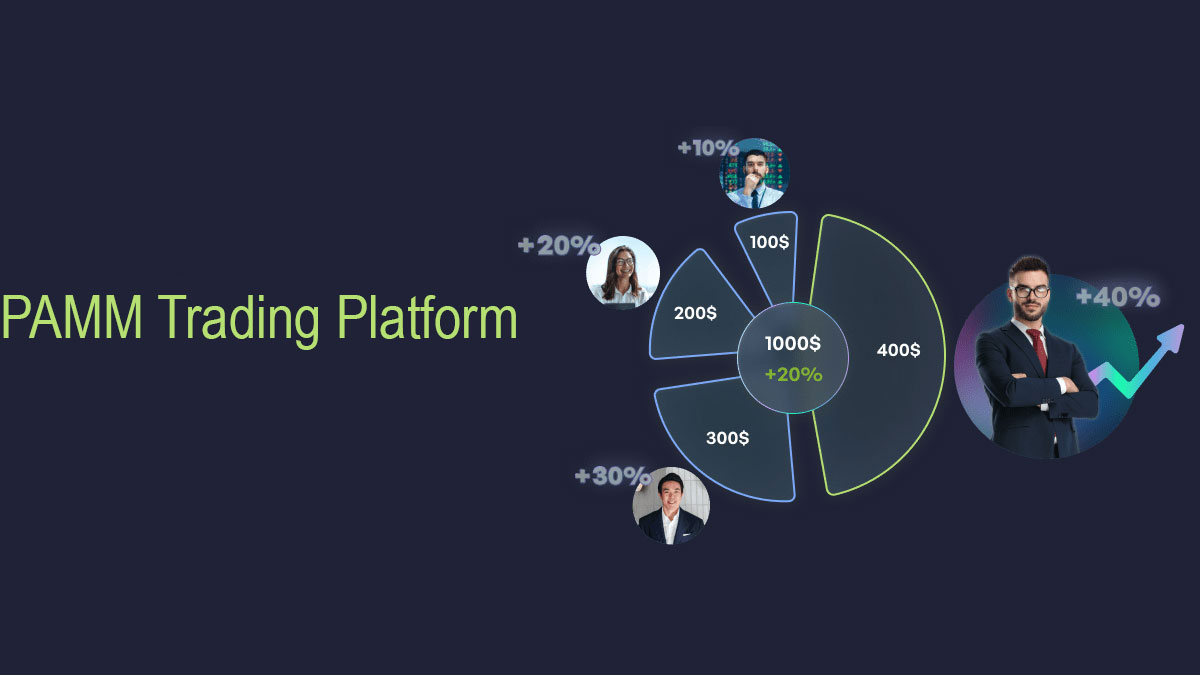

Delve into the captivating realm of Forex trading, amplified by the revolutionary concept of PAMM (Percentage Allocation Management Module) brokers. PAMM trading in India presents a unique opportunity to harness the expertise of seasoned traders and maximize your investment potential. Embark on a transformative journey as we unravel the intricacies of this dynamic financial landscape.

Image: www.ifcmarkets.com

Join the League of Successful Traders with Expertise

PAMM brokers serve as a bridge between aspiring traders and experienced portfolio managers, enabling seamless access to fund management. Traders with limited knowledge or time can allocate a portion of their funds to successful traders known as “Masters.” Masters are carefully evaluated and selected, ensuring their track record of consistent returns and adept risk management.

The beauty of PAMM trading lies in its inherent simplicity. Traders (Followers) invest in a Master’s account, benefiting from their expertise and market insights. The allocated funds are subsequently traded by the Master, who receives a performance fee based on the account’s overall profitability.

Navigating the PAMM Broker Landscape in India

Navigating the myriad of PAMM brokers in India can be a daunting task. It is imperative to meticulously evaluate their track record, fee structure, and regulatory compliance. Research various brokers, read reviews, and consult industry experts to identify a reliable and reputable firm that aligns with your investment objectives.

Consider factors such as account minimums, trading platforms, and supported currencies. Once you have identified a suitable broker, thoroughly review their PAMM contracts, ensuring a clear understanding of terms and conditions, performance fees, and withdrawal policies.

Tips for Success in PAMM Forex Trading

Success in PAMM Forex trading demands a multifaceted approach. Here are some indispensable tips:

- Diversify your investments: Allocate funds across multiple PAMM accounts to minimize risk and maximize returns.

- Monitor performance closely: Regularly review your account statements and performance metrics to ensure alignment with your expectations.

- Understand performance fees: Comprehend the fee structure and its implications on your overall profitability.

- Seek expert guidance: When in doubt, consult with experienced traders or professionals to gain valuable insights and refine your strategies.

Image: www.capitalfm.co.ke

Frequently Asked Questions (FAQs)

Q: What are the benefits of PAMM Forex trading?

A: Access to expertise, diversification opportunities, and potential for enhanced returns.

Q: How do I choose the right PAMM broker?

A: Evaluate track record, fee structure, regulatory compliance, and suitability to your investment goals.

Q: What is a performance fee?

A: A fee paid to the Master based on the account’s profitability.

Pamm Forex Broker In India

Conclusion: A World of Opportunity

Embracing PAMM Forex trading in India opens the door to a world of financial opportunity. By harnessing the expertise of seasoned traders and leveraging the power of diversification, you can unlock the potential for substantial returns. Remember to approach this endeavor with a well-researched strategy, a keen eye on performance, and a willingness to seek expert advice. Embrace the journey and experience the transformative power of PAMM Forex trading.

Are you ready to explore the exciting world of PAMM Forex trading and unlock your financial potential?