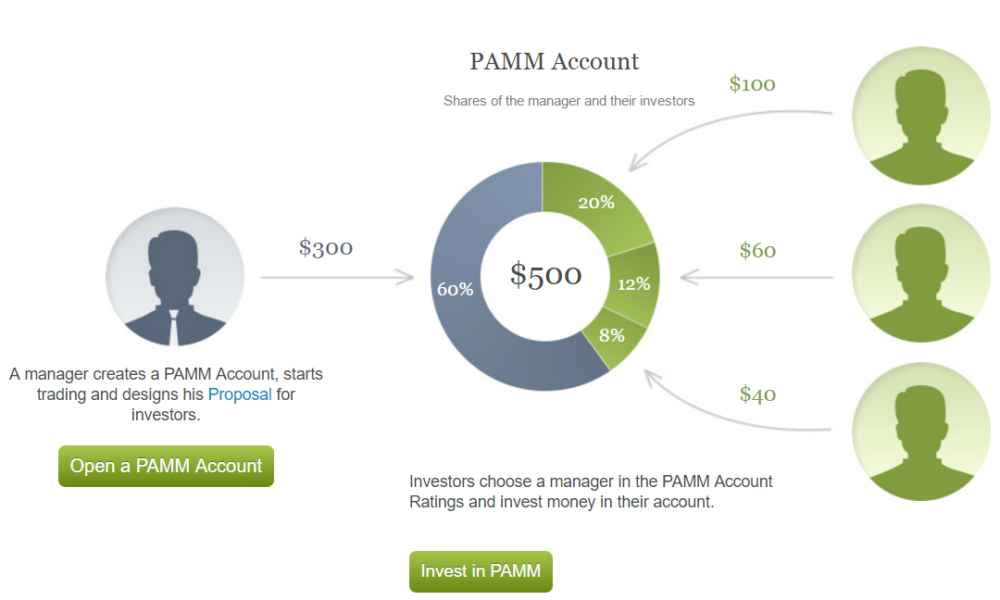

The world of finance presents lucrative opportunities for skilled individuals, and becoming a registered Forex PAMM manager offers one such avenue. A PAMM (Percentage Allocation Management Module) account enables traders to pool funds and allocate them to experienced managers who make investment decisions on their behalf, benefiting from potential profits while mitigating risk.

Image: www.profitf.com

Understanding the Role of a Forex PAMM Manager

Forex PAMM managers serve as investment custodians, utilizing their expertise and market analysis to make profitable trades in the volatile foreign exchange market. They play a crucial role in managing risk, selecting appropriate investment strategies, and optimizing returns for the investors under their wing.

Qualifications for Registration

Becoming a registered Forex PAMM manager entails meeting specific criteria set by regulatory authorities. Typically, these requirements include:

- Relevant educational background in finance or a related field

- Proven trading experience and a track record of successful investments

- Comprehensive understanding of Forex market dynamics and trading strategies

- Excellent risk management and money management skills

- Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations

Registration Process

The registration process for becoming a Forex PAMM manager involves the following steps:

- Choose a reputable Forex broker that offers PAMM accounts.

- Meet the broker’s eligibility requirements.

- Submit a formal application and undergo a thorough vetting process.

- Once approved, complete the necessary training and certification programs.

- Fulfill ongoing legal and regulatory requirements.

Image: www.bunbunonline.com

Tips and Expert Advice

To excel as a Forex PAMM manager, consider the following tips:

- Develop a robust trading strategy that aligns with your investment objectives.

- Conduct thorough market research and stay up-to-date with economic indicators.

- Manage risk effectively by setting appropriate stop-loss levels and diversifying your portfolio.

- Communicate regularly with investors, providing transparent updates on trading performance.

- Continuously educate yourself and seek professional development opportunities.

Beyond technical expertise, effective communication and interpersonal skills are essential for successful PAMM managers. Establishing clear expectations and building trust with investors fosters long-term relationships.

FAQs

Q: What are the benefits of becoming a registered Forex PAMM manager?

A: Registered managers gain access to a pool of funds, potential performance-based earnings, and the opportunity to establish a reputable brand.

Q: Is prior experience as a trader mandatory?

A: Yes, most brokers require applicants to demonstrate a consistent trading history before registering as a PAMM manager.

Q: How are PAMM managers compensated?

A: Typically through a performance-based fee structure, where a percentage of profits generated from successful trades is shared with the manager.

How To Be A Registered Forex Pamm Manager

Conclusion

Becoming a registered Forex PAMM manager opens doors to a rewarding career in the financial industry. By meeting rigorous eligibility criteria, adhering to regulatory guidelines, and constantly honing your skills, you can establish yourself as a trusted and successful wealth manager. If you possess a passion for finance, a commitment to excellence, and a desire to positively impact the financial well-being of others, consider exploring this path.

Are you interested in embarking on a journey to become a registered Forex PAMM manager?