Introduction

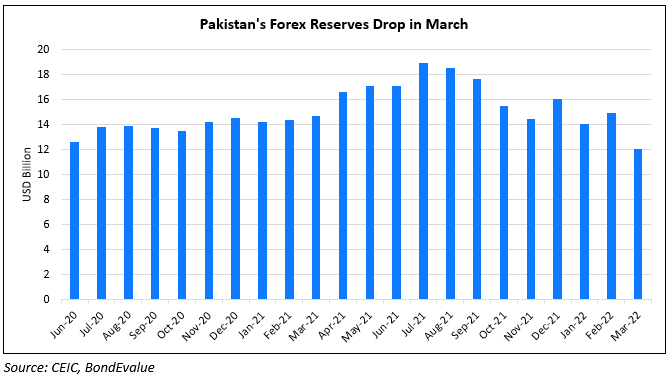

Image: bondevalue.com

Pakistan’s foreign exchange reserves serve as a critical lifeline for the economy, ensuring stability in the face of global economic fluctuations. September 2019 marked a significant juncture in the country’s financial history, witnessing a substantial increase in forex reserves. This article delves into the reasons behind this remarkable surge, its implications for the Pakistani economy, and the future outlook for the country’s financial health.

Forex Reserves Overview

Foreign exchange reserves are essentially the assets held by a country’s central bank in foreign currencies, primarily composed of U.S. dollars, euros, and other major currencies. These reserves play a crucial role in maintaining economic stability by providing a buffer against external shocks and ensuring the smooth flow of international trade.

Surge in Forex Reserves in September 2019

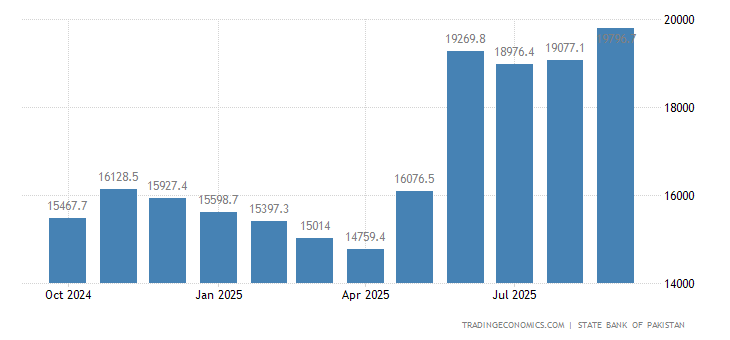

In September 2019, Pakistan’s forex reserves witnessed a notable surge of $550 million, bringing the total reserves to a healthy $8.2 billion. This significant increase was attributed to a combination of factors:

-

Increased Exports and Remittances: Pakistan’s exports and remittances from overseas Pakistanis experienced a notable boost during the month. This influx of foreign currency contributed significantly to the increase in forex reserves.

-

Foreign Currency Deposits: The State Bank of Pakistan (SBP) offered attractive incentives to banks for attracting foreign currency deposits. This initiative encouraged banks to secure more foreign currency, which subsequently contributed to the overall increase in reserves.

-

World Bank Loan Disbursement: The World Bank disbursed a portion of a $500 million loan to Pakistan in September 2019. This loan played a pivotal role in bolstering the country’s forex reserves.

Implications for the Pakistani Economy

The surge in forex reserves in September 2019 carried a wealth of positive implications for the Pakistani economy:

-

Improved Economic Stability: Increased forex reserves provide the central bank with a greater capacity to intervene in the foreign exchange market, stabilizing the rupee exchange rate and mitigating external economic shocks.

-

Enhanced Import Capacity: With ample forex reserves, Pakistan can import essential commodities without facing constraints, ensuring consistent supplies and curbing inflation.

-

Confidence Boost for Foreign Investors: A strong foreign exchange reserve position instils confidence in foreign investors, encouraging them to invest in the Pakistani economy and contributing to economic growth.

Trend Analysis and Future Outlook

In the coming months, the trajectory of Pakistan’s forex reserves will be influenced by various factors:

- Exports and Remittances: Sustained growth in exports and remittances will continue to bolster forex reserves.

- Foreign Direct Investment (FDI): Increased FDI is expected to further contribute to forex inflows.

- World Bank Loan Disbursements: The disbursement of the remaining portion of the World Bank loan will have a positive impact on reserves.

Based on these factors, analysts project that Pakistan’s forex reserves are likely to remain stable or increase modestly in the short-term. However, the country’s economic outlook remains contingent upon prudent macroeconomic policies, prudent fiscal management, and sustained improvements in exports and foreign investment.

Image: tradingeconomics.com

Pakistan Forex Reserves September 2019