H1: Breaking Down Pakistan Forex Reserves vs India: A Comprehensive Analysis

Image: bondevalue.com

Introduction:

Foreign exchange reserves, a nation’s store of foreign currency and gold, play a pivotal role in economic stability. Two major South Asian economies, Pakistan and India, exhibit distinct trajectories in their forex reserves, highlighting contrasting economic strengths and challenges. This article delves into the intriguing world of foreign exchange reserves, comparing Pakistan and India, to uncover their significance and implications for their respective economies.

Understanding Foreign Exchange Reserves: A Lifeline for Economies

Foreign exchange reserves are the accumulated assets held by a central bank in the form of foreign currencies, gold, and other financial instruments. These reserves act as a buffer against external shocks such as currency fluctuations and economic crises. They also ensure import financing, maintain exchange rate stability, and enhance confidence among investors and lenders.

Pakistan’s Rollercoaster Forex Reserves: Challenges and Opportunities

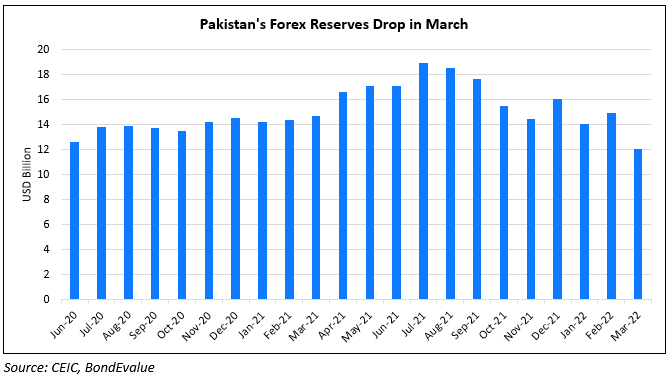

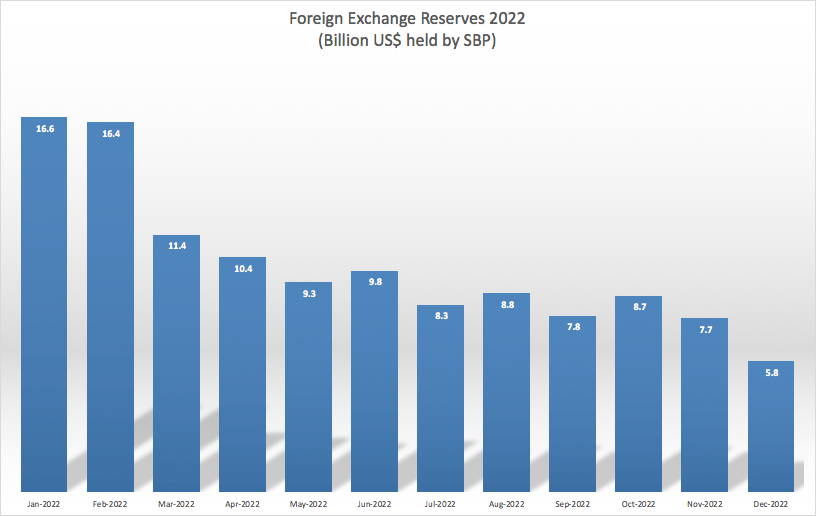

Pakistan’s foreign exchange reserves have experienced significant fluctuations in recent years. The country’s reserves dwindled in 2022 due to debt repayments, reduced foreign inflows, and rising import bills. However, in recent months, Pakistan has witnessed a steady increase in its reserves, bolstered by external financing and improved trade conditions.

Despite these gains, Pakistan’s forex reserves remain relatively low compared to its peer economies. This vulnerability underscores the need for economic diversification, export promotion, and prudent fiscal management to mitigate external imbalances and strengthen its reserve position.

India’s Growing Forex Might: A Tale of Economic Resilience

In contrast to Pakistan, India has maintained robust foreign exchange reserves, reaching record highs in 2023. This surge in reserves is attributed to India’s resilient economy, increased foreign direct investment, and the influx of remittances from its large diaspora population.

India’s ample forex reserves provide multiple advantages, including exchange rate stability, reduced external vulnerabilities, and enhanced flexibility in responding to unforeseen economic challenges. The government has used these reserves to support its growth initiatives, including infrastructure development and social welfare programs.

The Interplay of Economic Factors: A Balancing Act

The differences in forex reserves between Pakistan and India stem from a multitude of economic factors. India’s larger economy, diversified exports, and strong foreign remittances contribute to its robust reserve position. Pakistan, on the other hand, faces challenges in export competitiveness, a reliance on imported energy, and a relatively narrow economic base.

However, both countries recognize the critical importance of forex reserves for their economic health. They have implemented various policies and measures aimed at enhancing reserves, such as promoting foreign investment, encouraging exports, and managing external debt wisely.

Implications for Trade and Economic Growth

The contrasting reserve positions of Pakistan and India have significant implications for their trade and economic growth prospects. India’s larger reserves provide it with a competitive advantage in international trade, allowing it to weather external shocks and negotiate better terms of trade.

Pakistan, with its lower reserves, faces constraints in its ability to engage in competitive imports and may be more vulnerable to global economic downturns. The country needs to focus on export-led growth, import substitution, and foreign investment inflows to bolster its reserve position and support sustainable economic progress.

Conclusion: A Journey of Economic Resilience

Pakistan and India’s contrasting foreign exchange reserves reflect their distinct economic trajectories. India’s robust reserves provide it with greater resilience and growth opportunities, while Pakistan faces challenges in strengthening its reserve position. Both countries must prioritize prudent economic policies, export diversification, and foreign investment to enhance their forex reserves. By doing so, they can unlock their full economic potential and pave the way for sustainable and inclusive growth for their citizens.

Image: www.arabnews.pk

Pakistan Forex Reserves Vs India