In the tumultuous world of forex trading, devising a robust and reliable strategy is paramount to achieving consistent profitability. Amidst the plethora of trading approaches, moving averages (MAs) stand out as an indispensable tool that has garnered widespread recognition among experienced traders. They offer a remarkably effective way to determine market trends, anticipate price movements, and optimize trade entries and exits. In this comprehensive guide, we will delve into the intricacies of MAs and unveil how you can harness their potential to unlock remarkable results in the realm of forex trading.

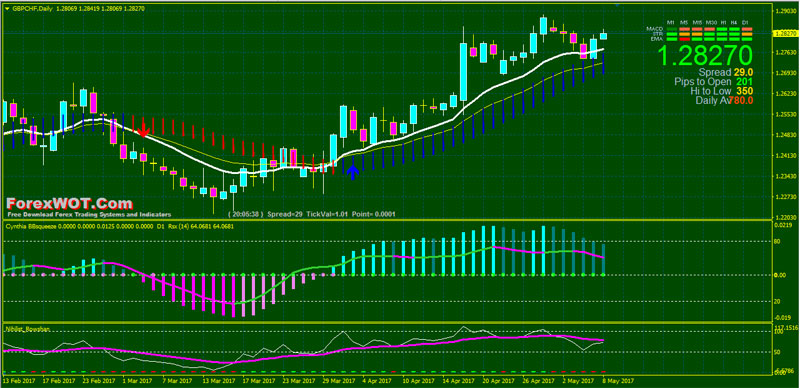

Image: forexwot.com

Laying the Foundation: Understanding Moving Averages

At their core, MAs represent a type of technical indicator that calculates the average price of a financial instrument over a predefined period of time. They are widely employed to smooth out price fluctuations and reveal the underlying trend or momentum in the market. By examining the position of the current price relative to the MA, traders can gain valuable insights into the prevailing market sentiment and make informed trading decisions.

Delving into the Different Types of Moving Averages

The forex market offers traders a vast array of MAs to choose from, each with its own distinct characteristics and suitability for various market conditions. The most commonly utilized types include:

Simple Moving Average (SMA): The Trading Workhorse

The SMA is calculated by averaging the closing prices over the selected period. It is widely employed due to its straightforwardness and intuitive interpretation. The SMA offers a baseline for identifying trends and provides clear signals for trend reversals.

Image: www.youtube.com

Exponential Moving Average (EMA): Smoothing Out the Noise

The EMA assigns exponentially higher weightage to more recent data. This results in a more responsive indicator that reacts swiftly to changing market conditions. The EMA is ideal for detecting shorter-term trends and identifying potential trading opportunities.

Weighted Moving Average (WMA): Unraveling the Market’s True Nature

The WMA places the most emphasis on the most recent data by assigning a greater weight to the latest closing prices. This characteristic makes the WMA highly responsive and suitable for identifying short-term market fluctuations and potential turning points.

Mastering the Art of Trend Identification

MAs are powerful tools in gauging the prevailing market trend. When the price consistently trades above a MA, it indicates an uptrend, while sustained trading below the MA signals a downtrend. Breakouts above or below the MA can be interpreted as potential trend reversals.

Trading with Moving Averages: Turning Trends into Profits

Once the trend is established, MAs can be utilized to identify profitable trading opportunities. By combining trend identification with technical analysis and risk management strategies, traders can optimize their entry and exit points, maximizing their potential for returns.

Crossovers: The Keystone of MA Trading

Crossovers occur when the price crosses above or below the MA. These crossovers often signify a change in market sentiment. For instance, a bullish crossover occurs when the price moves above the MA, indicating a potential uptrend. Conversely, when the price falls below the MA, it signals a bearish crossover and a possible downtrend.

Cautions and Considerations: Navigating the Forex Maze

While MAs offer immense trading value, it is crucial to be mindful of their limitations and consider additional factors to maximize their effectiveness. Lagging nature: MAs are inherently lagging indicators, meaning they reflect historical price data. This can lead to delayed signals and missed opportunities during fast-moving markets.

Noise and false signals: MAs can generate false signals, especially during choppy and range-bound conditions. Relying solely on MAs may result in premature entries and unnecessary losses.

Crossover failures: Occasionally, crossovers fail to materialize into significant trends, making it imperative to employ proper trade management techniques and risk mitigation strategies.

One Proven Strategy For Forex

Unlocking the Secrets of Forex Trading with Moving Averages

In the hands of a skilled trader, MAs serve as a powerful tool for deciphering market trends and identifying lucrative trading opportunities. By mastering the concepts of MAs and implementing them effectively, traders can gain a decisive edge in the competitive world of forex trading.

Remember, the journey to trading mastery is an ongoing process of learning, practice, and constant adaptation. Embrace the challenge, embrace the potential of MAs, and unlock the path to forex trading success.