Unveiling the Secrets: Unveiling the Secrets of Institutional Forex Traders’ Moving Averages

Image: www.youtube.com

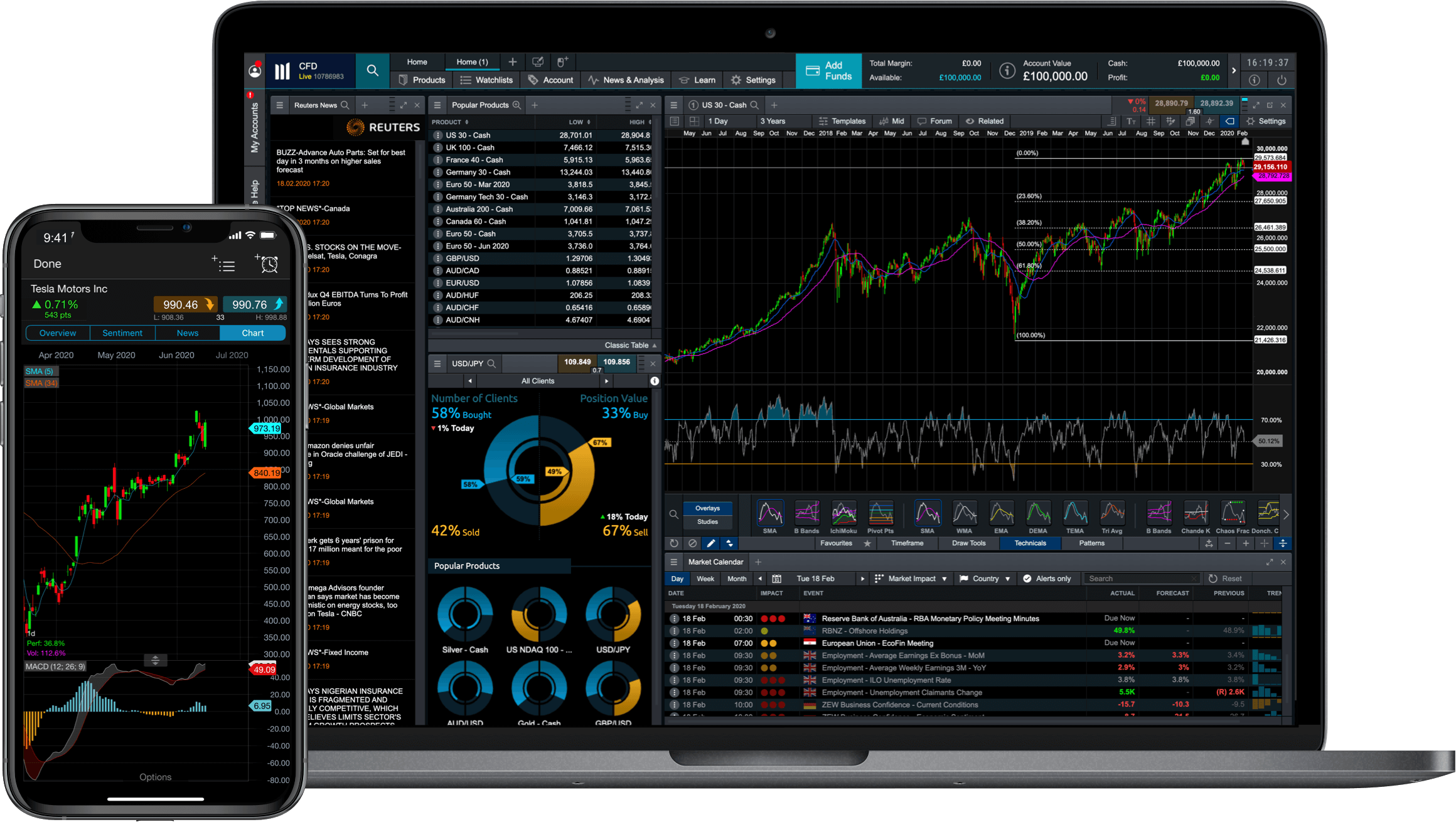

In the fast-paced world of foreign exchange (Forex) trading, institutional traders wield a formidable arsenal of tools and techniques to navigate the volatile markets. Among their most trusted allies are moving averages (MAs), powerful indicators that reveal trends and provide invaluable insights into price dynamics. By understanding how institutional traders utilize MAs, you too can elevate your trading strategies and gain a competitive edge.

MAs: Cutting Through Market Noise

Moving averages are a technical indicator that smooths out price data over a specified period, allowing traders to discern the underlying direction of a currency pair. By filtering out short-term fluctuations, MAs help traders identify long-term trends and potential reversals. Institutional traders commonly employ a variety of MAs with different periods to capture various price action nuances.

A Spectrum of MAs: A Spectrum of MAs

Commonly used MAs include:

- Simple Moving Average (SMA): A straightforward calculation that computes the average price over a specified period.

- Exponential Moving Average (EMA): An advanced variant that gives more weight to recent prices, providing quicker reactions to market shifts.

- Weighted Moving Average (WMA): Similar to the EMA, but assigns higher weights to prices within the specified period.

- Linear Weighted Moving Average (LWMA): A smoother version of the WMA, distributing weights linearly over the period.

Utilizing MAs: Unveiling Market Insights

Institutional traders leverage MAs to:

- Identify Trends: By observing the slope and direction of an MA, traders can determine whether a currency pair is moving in an uptrend, downtrend, or trading sideways.

- Confirm Support and Resistance: MAs can act as dynamic support and resistance levels, providing clues about potential reversal zones.

- Evaluate Momentum: The direction and strength of the MA slope indicate the momentum of the market, helping traders gauge the speed and volatility of a trend.

- Forecast Market Reversals: When the price consistently breaks and closes below a significant MA level, it can signal a potential trend reversal.

Expert Perspectives: Insights from the Masters

“Moving averages are an integral part of my trading strategy,” says John Carter, a renowned technical analyst. “They provide me with a framework to understand the market’s long-term direction and identify potential opportunities.”

“I rely on the EMA to quickly react to changing market conditions,” adds Jane Kenney, a seasoned forex trader. “Its sensitivity to recent price action allows me to capitalize on emerging trends and market reversals.”

Harnessing the Power of MAs

To effectively incorporate MAs into your trading strategy, consider the following tips:

- Combine Multiple MAs: Use different time frames to get a broader perspective of the market.

- Customize Parameters: Adjust the MA period to suit your trading style and market conditions.

- Look for Divergences: Compare MAs with price action to identify potential overbought or oversold conditions.

- Use MAs as a Filter: Integrate MAs with other trading tools to confirm signals and improve decision-making.

Conclusion

Mastering the art of moving averages is a cornerstone of successful institutional Forex trading. By embracing the insights of experts, experimenting with different MA types, and adapting to changing market conditions, you can harness the power of this versatile indicator to elevate your trading strategies and achieve greater success in the ever-evolving Forex landscape.

Image: www.mymoneyonline.org

What Are The Ma Used By Institutional Forex Traders