Introduction

As a seasoned forex trader, I’ve witnessed firsthand the power of Murray Math Lines. These time-tested tools provide unparalleled insights into price action, enabling traders to make informed trading decisions. Join me on a journey as we unravel the intricacies of Murray Math Lines and unlock their potential in your trading endeavors.

Understanding Murray Math Lines

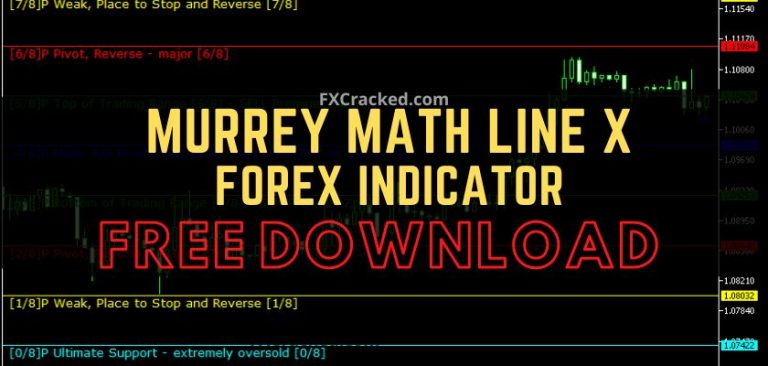

The foundation of Murray Math Lines lies in the principle of retracement levels, where price movements tend to pause at specific numerical ratios. Developed by T.H. Murray, this technique divides the range between a day’s high and low into eight equal segments, each representing a potential support or resistance level.

Relevance of Murray Math Lines in Forex

Murray Math Lines are particularly valuable in forex trading due to the currency market’s tendency to respect these retracement levels. By identifying these lines, traders can anticipate potential reversal zones and adjust their trading strategies accordingly. This advanced tool enhances market analysis and risk management, providing a framework for informed decision-making.

Key Concepts of Murray Math Lines

– **[0/8]** represents the opening price for a given period.

– **[1/8]** and **[7/8]** denote the day’s high and low prices, respectively.

– **[2/8, 3/8, 4/8, 5/8, 6/8]** are the intermediate retracement levels.

Trading Applications of Murray Math Lines

– **Support and Resistance Identification:** Murray Math Lines act as dynamic support and resistance levels, assisting traders in identifying potential trading opportunities.

– **Entry and Exit Points:** Traders can use Murray Math Lines to pinpoint optimal entry and exit points by recognizing potential reversal zones or breakouts.

– **Risk Management:** By setting stop-loss and take-profit levels at Murray Math Lines, traders can mitigate risk and optimize their trading strategies.

Expert Advice for Using Murray Math Lines

– **Use Multiple Time Frames:** Employ Murray Math Lines on different time frames to gain a comprehensive understanding of the market’s behavior.

– **Combine with Other Technical Indicators:** Enhance your trading analysis by incorporating Murray Math Lines with other technical indicators, such as moving averages or chart patterns.

– **Avoid Overtrading:** While Murray Math Lines are valuable tools, refrain from excessive trading or relying solely on them for decision-making.

FAQ About Murray Math Lines

**Q:** What is the significance of the [4/8] line?

**A:** The [4/8] line is a critical retracement level, representing the psychological midpoint between the [1/8] and [7/8] lines, often acting as a strong support or resistance level.

Q: Can Murray Math Lines predict future price movements?

A: While Murray Math Lines provide valuable insights, they do not guarantee future price movements. However, by incorporating them into your trading strategy, you can enhance your understanding of market dynamics and make more informed decisions.

Image: forex-station.com

Image: www.fxcracked.com

Murrey Math Lines In Forex

Conclusion

Murray Math Lines are indispensable tools for forex traders seeking to navigate the complexities of the financial markets. By understanding their concepts and implementing them effectively, you can unlock a new level of trading precision, make well-informed decisions, and potentially improve your trading outcomes.

Call to Action:

If you’re eager to delve deeper into the world of Murrey Math Lines, explore additional resources, engage in online forums, and seek guidance from experienced traders. By embracing this powerful technique, you can empower your trading journey and unlock new possibilities.