In the ever-changing landscape of the foreign exchange market, where currency values fluctuate constantly, volatility is an essential force that savvy traders harness to maximize their profits. 2018 witnessed some of the most dramatic currency swings in recent memory, and by understanding the most volatile forex pairs, traders can identify potential opportunities and navigate market uncertainty.

Image: www.forex24hr.com

Volatility, measured by the standard deviation of a currency pair’s price over a given period, indicates the extent to which its value can fluctuate. Highly volatile pairs offer higher potential returns but also come with greater risks, while less volatile pairs provide relative stability and consistency.

Identifying the Most Volatile Forex Pairs

To identify the most volatile forex pairs, traders can analyze historical price data, news events, and economic indicators that impact currency values. The following pairs consistently exhibited high volatility in 2018:

EUR/USD

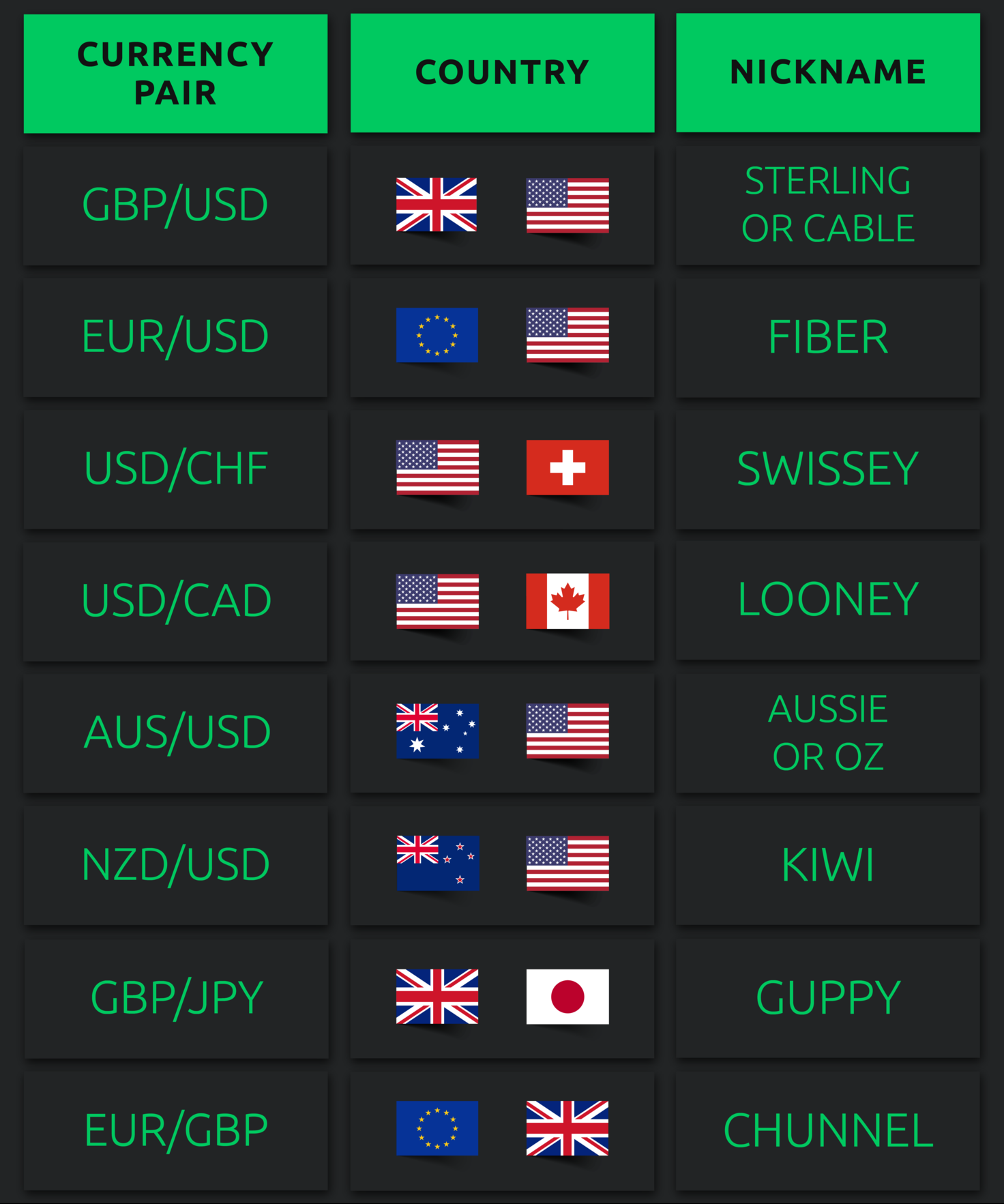

The euro-US dollar pair, commonly known as the “euro,” is the most traded currency pair globally. Its volatility in 2018 was driven by political and economic developments in the Eurozone and the US, including Brexit negotiations, interest rate changes, and trade disputes.

USD/JPY

The US dollar-Japanese yen pair, or “dollar-yen,” is another highly volatile pair. The yen’s safe-haven status during periods of market turmoil makes it sensitive to geopolitical events and economic uncertainty. In 2018, trade tensions and geopolitical risks contributed to the pair’s volatility.

Image: dzengi.com

AUD/USD

The Australian dollar-US dollar pair, sometimes called the “Aussie,” is heavily influenced by commodity prices and economic growth in Australia and the US. Australia’s resource-dependent economy makes the Aussie vulnerable to fluctuations in global demand for raw materials.

NZD/USD

The New Zealand dollar-US dollar pair, or “kiwi,” shares many characteristics with the Aussie, as New Zealand’s economy is also export-oriented and vulnerable to global economic conditions. However, the NZD/USD pair exhibited even higher volatility in 2018 amid concerns over the country’s housing bubble.

GBP/USD

The British pound-US dollar pair, known as “cable,” has historical significance and is often volatile due to political developments in the UK, including the ongoing Brexit negotiations. The pound’s value also fluctuates in response to economic data and interest rate decisions by the Bank of England.

Tips for Trading Volatile Forex Pairs

While volatile forex pairs carry greater risks, they also provide opportunities for profit. Traders can mitigate risks and improve their chances of success by utilizing the following tips:

FAQs on Trading Volatile Forex Pairs

- Q: Which factors influence forex volatility?

A: Economic data, political events, interest rate changes, and global economic conditions all impact forex volatility. - Q: Is it possible to predict market volatility?

A: Predicting market volatility accurately is impossible, but traders can analyze historical data and monitor economic indicators to make educated guesses. - Q: How can I mitigate risks when trading volatile pairs?

A: Implement sound risk management practices, such as setting stop-loss orders and managing position size. - Q: What is the best trading strategy for volatile pairs?

A: Trend trading is often effective, as volatility can create strong momentum. However, traders should not overstay their positions and must respect the market’s direction. - Q: How can I stay informed about the forex market?

A: Monitor economic news, read market analysis, and follow financial news sources to stay abreast of the latest developments.

Most Volatile Forex Pairs 2018

Conclusion

In 2018, the forex market experienced significant volatility, presenting opportunities and risks for traders. By understanding the most volatile forex pairs and applying effective trading strategies, traders can navigate market uncertainty and increase their potential for successful trades. Volatility is an inherent feature of the forex market, and traders who embrace it and learn to manage its risks can unlock its potential rewards.

If you’re interested in the exciting world of volatile forex pairs and want to explore their trading possibilities further, don’t hesitate to embark on your research journey. Your knowledge and skills will evolve as you continue to follow market trends, stay informed, and apply sound trading principles.