The world of forex trading has welcomed a transformative concept: micro accounts. These specialized accounts cater to aspiring traders, allowing them to embark on their trading journey with modest capital. In this comprehensive guide, we delve into the intricate world of micro account brokers, empowering you with the knowledge to make informed decisions and harness the potential of these accounts.

Image: www.brokerxplorer.com

What is a Micro Account in Forex Trading?

A micro account is a type of forex trading account designed specifically for individuals with limited capital or those seeking to minimize risk. Its primary distinction lies in its reduced trading unit, typically set at 1,000 units of the base currency. This smaller unit size enables traders to enter and exit positions with greater flexibility, facilitating position management with lower capital requirements.

Benefits of Micro Accounts

Micro accounts offer numerous advantages for both novice and experienced traders alike:

- Lower Capital Requirements: As mentioned earlier, micro accounts require significantly less capital to open than standard accounts. This reduced threshold makes forex trading more accessible to those with limited financial resources, allowing them to participate in the market with more manageable investments.

- Minimal Risk Exposure: Due to the smaller trading unit, each position traded through a micro account carries a lower risk exposure. This feature shields traders from substantial losses, providing a buffer against potential market fluctuations.

- Efficient Risk Management: The reduced position size enables traders to implement more precise risk management strategies. Smaller positions allow for tighter stop-loss orders, protecting traders from excessive drawdowns.

- Testing Platform: Micro accounts provide an ideal platform for traders to test strategies and hone their trading skills without risking significant capital. They offer a realistic trading environment, allowing traders to experiment with different approaches before committing larger sums of money.

Choosing a Micro Account Broker

Selecting the right micro account broker is crucial for a successful trading experience. Here are key factors to consider:

- Regulation and Licensing: Choose brokers that are regulated by reputable authorities to ensure the security of your funds and compliance with industry standards.

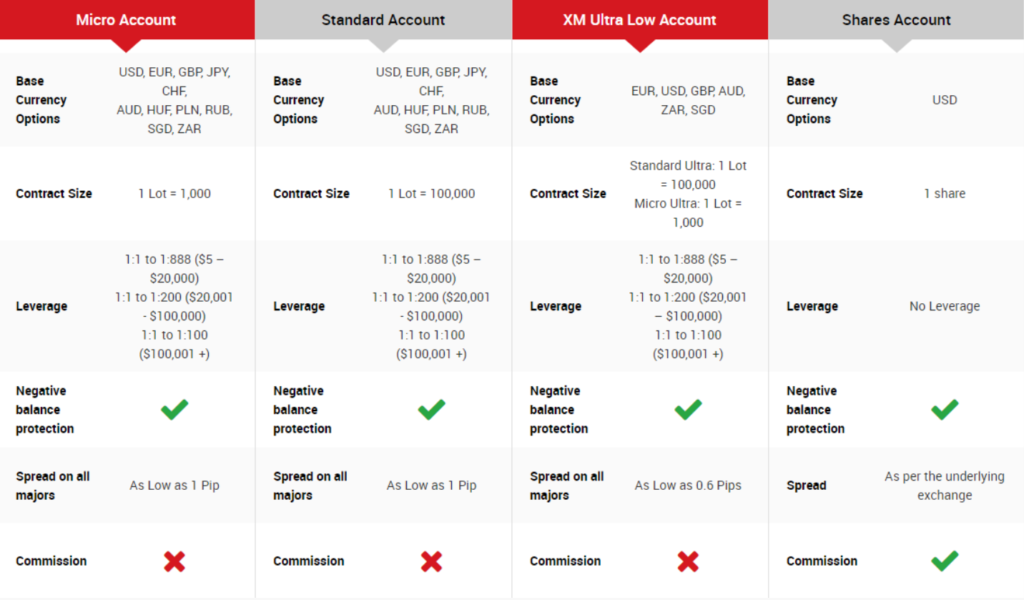

- Account Types: Look for brokers that offer not only micro accounts but also a range of account options to suit your evolving trading needs.

- Trading Conditions: Pay attention to the spread (difference between the bid and ask price), commissions, and other trading costs.

- Minimum Deposit: Consider the minimum deposit required to open a micro account, ensuring it aligns with your financial capabilities.

- Customer Support: Responsive and knowledgeable customer support is essential for a smooth trading experience.

Image: topforexbrokers.net

Capitalizing on the Power of Micro Accounts

To leverage the benefits of micro accounts effectively, consider these strategies:

- Start Small: Begin with a modest investment and gradually increase your capital as you gain experience and confidence.

- Practice Risk Management: Implement sound risk management principles, including setting appropriate stop-loss orders and position sizing strategies.

- Manage Expectations: Remember that micro accounts have limitations. Set realistic profit targets and avoid overtrading to minimize potential losses.

- Seek Education: Continuously expand your knowledge of forex trading concepts, strategies, and risk management techniques.

Micro Account Broker In Forex

Conclusion

Micro account brokers have revolutionized forex trading by making it accessible to individuals with modest capital or those seeking to mitigate risk. By understanding the benefits and choosing the right broker, traders can harness the power of micro accounts to embark on their trading journey with confidence. Combining responsible trading practices with a commitment to education will empower traders to navigate the forex market successfully and potentially reap the rewards it offers.