Introduction

In the ever-evolving world of forex trading, meticulous analysis and precise decision-making are paramount. MetaTrader 4 (MT4) Forex signal indicators have emerged as a powerful tool that empowers traders to navigate the complexities of the market with confidence. These indicators provide insights into price movements, support and resistance levels, and potential trading opportunities, enhancing traders’ abilities to identify and exploit market trends.

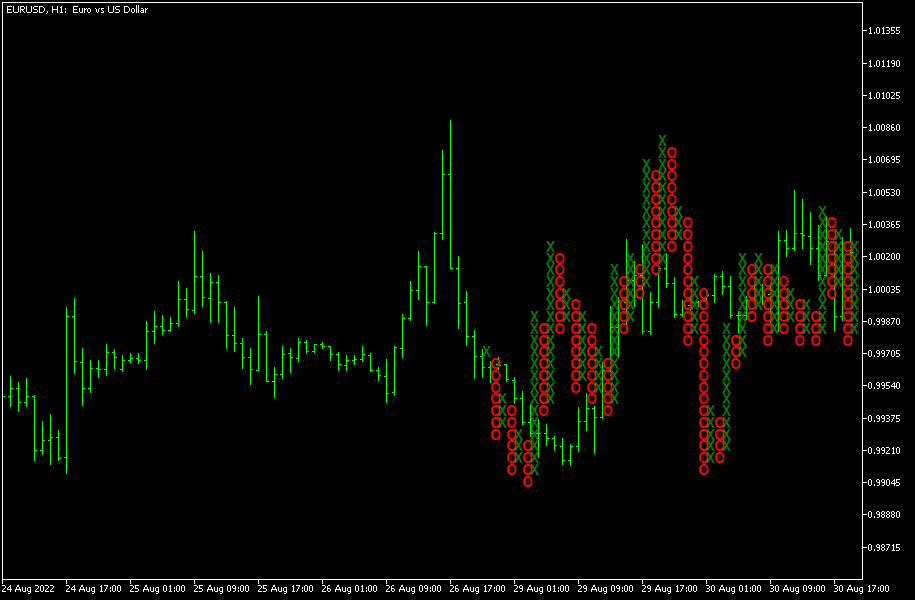

Image: www.earnforex.com

Understanding MetaTrader 4 Forex Signal Indicators

MetaTrader 4 signal indicators are technical analysis tools that utilize mathematical formulas to analyze price data and generate signals. These signals indicate potential buy or sell opportunities based on predefined parameters and algorithms. They are designed to assist traders in making informed decisions, reducing the risk of emotional or subjective biases.

Customizable parameters allow traders to tailor indicators to their individual trading strategies. The most popular signal indicators include Moving Averages, RSI (Relative Strength Index), Stochastic Oscillator, and Bollinger Bands.

Types of MetaTrader 4 Forex Signal Indicators

-

Trend-Following Indicators: These indicators identify the prevailing market trend and project its continuation. They include Moving Averages, Ichimoku Cloud, and Trend Lines.

-

Momentum Indicators: These indicators measure the strength and momentum of a trend. They include Relative Strength Index (RSI), Stochastic Oscillator, and MACD (Moving Average Convergence Divergence).

-

Oscillator Indicators: These indicators determine whether an asset is overbought or oversold. They include Williams %R, Bollinger Bands, and Parabolic SAR.

Leveraging MetaTrader 4 Forex Signal Indicators

Traders can maximize the effectiveness of signal indicators by understanding their limitations and combining them with other technical analysis tools. It’s crucial to remember that indicators are not foolproof and should be used in conjunction with a comprehensive trading strategy.

-

Confirmation of Market Trend: Signal indicators can identify the underlying market trend, but they should be used in conjunction with other indicators or chart patterns for confirmation.

-

Identifying Potential Entry and Exit Points: Indicators can provide short-term signals for potential entry and exit points, but traders should consider overall market conditions before making trades.

-

Trend Reversals and Breakouts: Indicators can help identify areas where trends might reverse or break out. However, it’s vital to exercise caution and consider other market factors before taking any action.

Image: www.youtube.com

Expert Insights and Actionable Tips

-

Divergence to Enhance Accuracy: Jayanthi Rangarajan, a renowned forex trader, emphasizes the importance of identifying divergence between price action and indicators for increased accuracy.

-

Combined Signal Approach: James Stanley, a leading forex strategist, advises traders to use multiple signal indicators to minimize false signals and maximize potential profits.

-

Understanding Indicator Parameters: Kieran McLaughlin, a respected forex educator, stresses the need for traders to fully understand the parameters and algorithms behind each indicator to optimize their usage.

Metatrader 4 Forex Signal Indicator

Conclusion

MetaTrader 4 Forex signal indicators are invaluable tools that empower traders to make informed decisions and navigate the complexities of forex trading. By combining indicators with technical analysis and a well-defined trading strategy, traders can increase their odds of success and achieve sustainable profitability in the ever-dynamic market.