In the dynamic world of forex, where currencies dance in a delicate tango, gaining an edge over unpredictable market movements can seem like a daunting task. Enter leading indicators, the beacons of market insight that illuminate the path to informed trading decisions. These harbingers of future price action empower you to navigate the turbulent waters of forex with confidence and precision.

Image: fxssi.com

What are Leading Indicators in Forex?

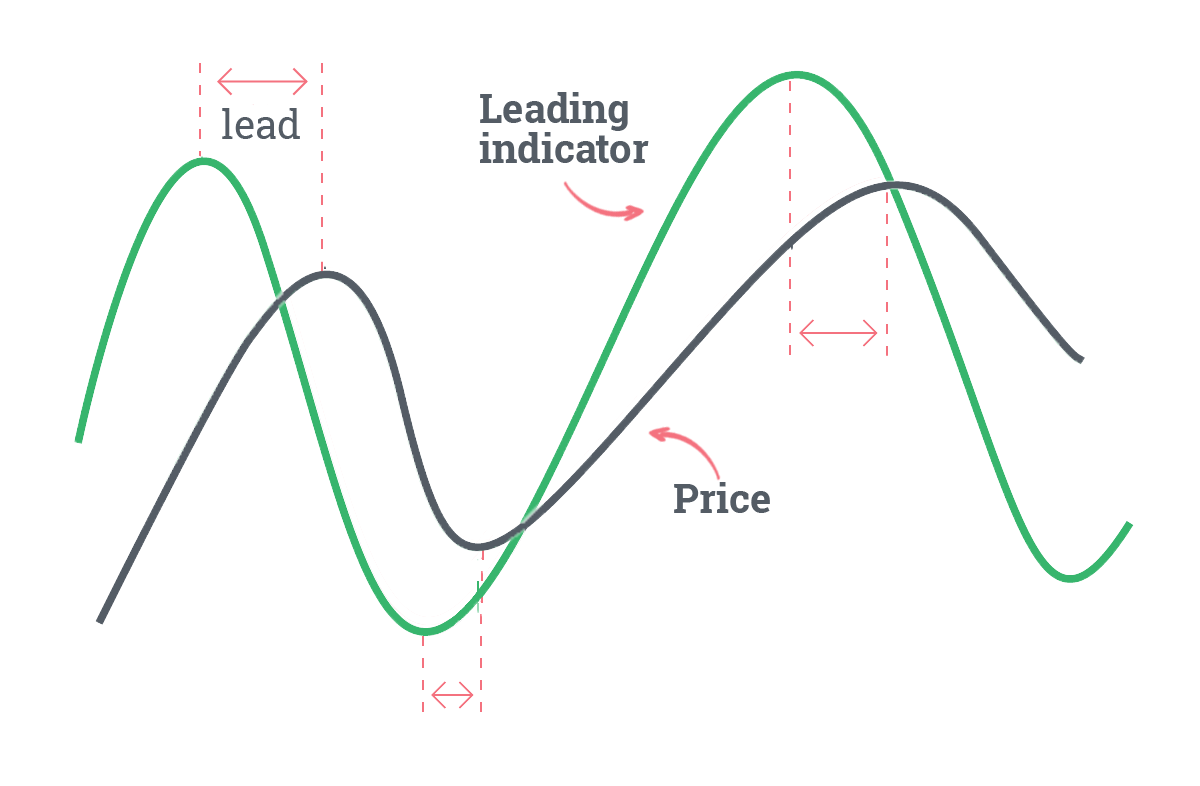

Leading indicators, as their name suggests, are technical analysis tools that attempt to anticipate future price movements based on current market conditions. Unlike lagging indicators, which simply react to past price action, leading indicators strive to predict future trends before they fully materialize. This forward-looking nature provides traders with a priceless advantage in identifying potential market opportunities and mitigating risks.

The Predictive Power of Leading Market Momentum

One of the most widely recognized leading indicators is market momentum. This concept gauges the pace and direction of price movement, giving traders insights into the market’s underlying strength or weakness. When momentum is strong and trending, it often signals that the trend is likely to continue, providing a basis for favorable trades.

Relative Strength Index (RSI) – Assessing Market Sentiment

The Relative Strength Index (RSI) is a momentum-based leading indicator that quantifies market sentiment by analyzing the magnitude of price changes over a specified period. An RSI value above 70 indicates overbought conditions, suggesting a potential for trend reversal, while a value below 30 signals oversold conditions and a possible trend resumption.

Image: www.dailyfx.com

Stochastic Oscillator – Pinpointing Extreme Market Conditions

The Stochastic Oscillator is another leading indicator that identifies overbought and oversold levels. It oscillates between 0 and 100, with values above 80 indicating overbought conditions and values below 20 signaling oversold areas. When the Stochastic Oscillator exhibits divergence from the underlying price movement, it often suggests an impending trend reversal.

Moving Averages – Forecasting Trend Strength and Direction

Moving averages are a fundamental leading indicator that smooths out price data to reveal the prevailing trend. Traders commonly employ two types of moving averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA). When the price action crosses above or below a moving average, it can indicate a potential trend reversal or continuation.

Fibonacci Retracement Levels – Uncovering Support and Resistance

Fibonacci retracement levels are derived from the Fibonacci sequence and are used to identify potential support and resistance levels after a significant price movement. These levels are often seen as magnets that attract price movement, making them valuable for identifying potential trading opportunities.

Leveraging Leading Indicators for Informed Trading Decisions

Mastering the art of utilizing leading indicators empowers forex traders to make informed decisions that are driven by proactive market intelligence. By anticipating future price movements, traders can pinpoint areas of market opportunity, minimize risk exposure, and effectively manage their trading portfolios.

What Are Leading Indicators In Forex

https://youtube.com/watch?v=Ke01_wmhpOU

Conclusion

Leading indicators serve as indispensable tools in the trader’s arsenal, providing a window into the future of forex market dynamics. By harnessing their predictive power and combining them with fundamental analysis, traders can navigate the complexities of currency markets with confidence and poise. Remember, knowledge is power, and when it comes to forex, leading indicators arm you with the foresight to make wealth-generating decisions.