The foreign exchange (forex) market, the world’s largest and most liquid financial market, has experienced countless fluctuations over its long history. Amid these market gyrations, certain periods have stood out due to exceptionally wide price gaps, leaving an indelible mark on the annals of forex trading.

Image: www.defensahonorarios.cl

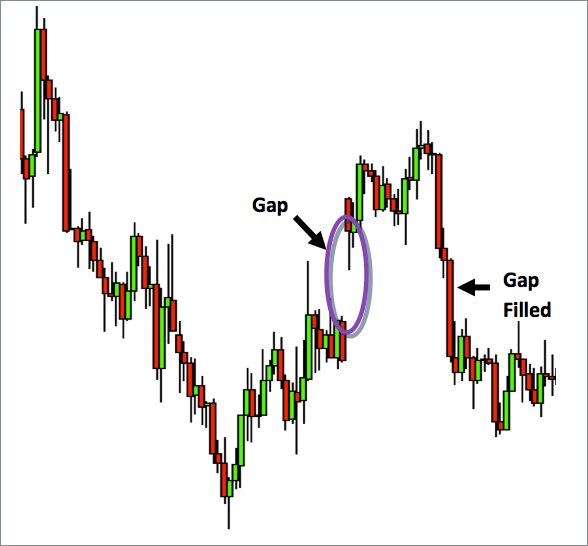

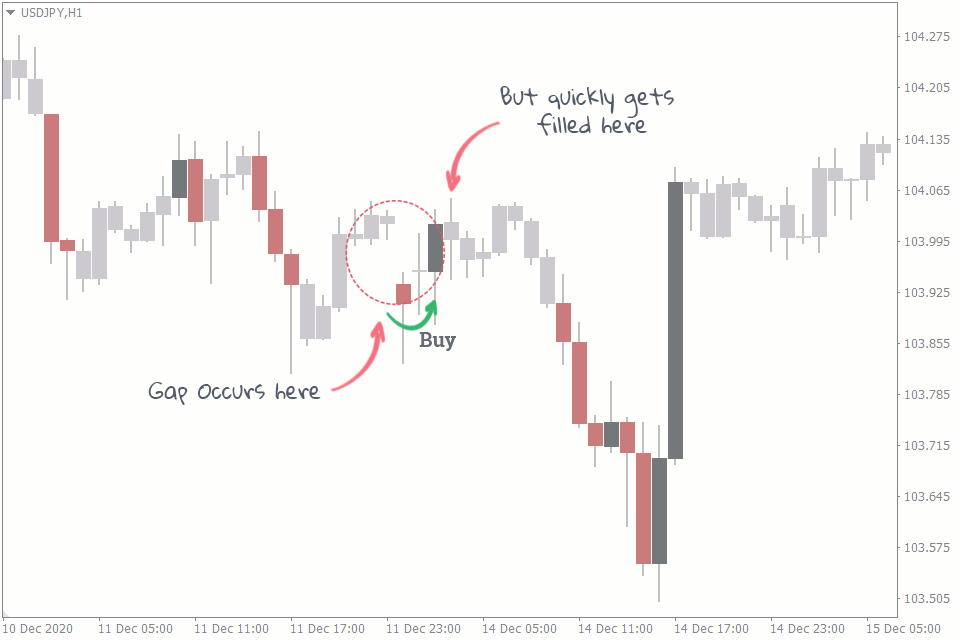

One such event etched into the memory of currency traders is the “max gap” in forex history – a period characterized by an unprecedented spread between the closing price of one trading day and the opening price of the next. This article delves into the circumstances surrounding this extraordinary phenomenon, exploring its causes, consequences, and the invaluable lessons it imparted on the market.

Understanding the Max Gap: A Crucial Concept

Defining the Max Gap

The max gap in forex refers to the widest difference between the closing price of a currency pair on a given trading day and its opening price on the subsequent trading day. This disparity can stem from geopolitical events, economic crises, or other market-moving news that triggers a surge in market sentiment, leading to a rapid shift in currency values.

Historical Perspective

Throughout history, the forex market has witnessed several notable max gaps. Prominent examples include the 1992 “Black Wednesday” event, when the British pound plunged dramatically against the German mark due to the United Kingdom’s withdrawal from the European Exchange Rate Mechanism. Another significant instance occurred following the 2016 U.S. presidential election, when the Mexican peso experienced a steep decline against the U.S. dollar amid concerns over potential trade policies.

Image: fxssi.com

Exploring the Factors Contributing to Max Gaps

Understanding the causes behind max gaps is essential to navigating the forex market. Several factors can contribute to these extreme price swings, including:

- Geopolitical Events: Sudden shifts in international relations, such as wars, political crises, or diplomatic disputes, can trigger market-moving news with immediate impact on currency values.

- Economic Crises: Economic downturns, interest rate changes, or fiscal policy decisions may have a substantial impact on national currencies, leading to max gaps in response to market volatility.

- Central Bank Actions: Unexpected interest rate changes or monetary policy announcements by central banks can result in large price gaps in the forex market due to their impact on currency demand and supply.

- Market Sentiment: Extreme shifts in market sentiment driven by fear, greed, optimism, or pessimism can exacerbate price movements, contributing to the formation of max gaps.

The Impact of Max Gaps on Forex Trading

Max gaps can have significant implications for forex traders, as they disrupt standard trading strategies and can lead to substantial losses or gains depending on the direction of the price movement. These gaps create unique opportunities as well as risks that traders need to be aware of to optimize their trading decisions.

Tips for Navigating Max Gaps in Forex

While max gaps are unpredictable, traders can implement specific strategies to manage the risks and capitalize on the potential opportunities they present. Here are a few tips to consider:

- Stay Informed: Keeping up-to-date with geopolitical events, economic news, and market sentiment can help you anticipate potential max gap-causing factors.

- Use Stop-Loss Orders: Employing stop-loss orders below or above critical support or resistance levels will limit potential losses and protect account balances during sudden price gaps.

- Trade with Caution: Exercising increased caution during periods of high market volatility is crucial to minimize the impact of max gaps. Consider smaller trade sizes or avoid opening new positions if substantial news or events are anticipated.

FAQ on Max Gaps in Forex

To enhance your understanding of max gaps in forex, here are some commonly asked questions and their answers:

- Q: What is the average size of a max gap in forex?

A: The size of a max gap varies depending on the underlying factors and market conditions. It can range from a few pips to hundreds of pips.

- Q: How can I identify potential max gaps?

A: Monitoring geopolitical, economic, and market sentiment developments can help you identify news or events that may trigger significant price fluctuations.

Max Gap In Forex History

https://youtube.com/watch?v=vNWxzDkOWa0

Conclusion: Embracing Volatility with Skill

The max gap in forex history serves as a testament to the inherent volatility of the currency market. Understanding the factors that contribute to these extreme price swings and adopting prudent strategies can empower traders to navigate market challenges and seize trading opportunities effectively.

As you dive deeper into forex trading, continue to seek knowledge and market insights to enhance your decision-making abilities. Remember, the forex market rewards those who embrace volatility and adapt to its ever-changing dynamics. Are max gaps in forex a phenomenon that intrigues you? Share your thoughts and experiences in the comments below.