Have you ever wondered what drives the seemingly chaotic dance of currency prices? Behind the rapid, even dizzying, fluctuations of exchange rates lies a world of complex algorithms and lightning-fast trades. This world is the domain of FX scalpers, and among them, FX Scalper X stands out as a powerful and controversial tool.

Image: www.fxscalperx.com

For those unfamiliar, FX scalping is a high-frequency trading strategy aimed at capturing small profits from minimal price movements. FX Scalper X is an automated tool designed to assist in this process by identifying and executing trades with the speed and precision that manual trading simply cannot achieve. But before diving into the mechanics and intricacies of FX Scalper X, let’s delve into the broader context of high-frequency trading and the world it inhabits.

The Rise of High-Frequency Trading

The concept of high-frequency (or HFT) trading isn’t new. It emerged in the late 1990s and early 2000s, fueled by the rapid advancement of computing power and technological innovation. HFT systems, using complex algorithms and sophisticated data analysis, can execute thousands or even millions of trades in a matter of seconds, capitalizing on minute price differences that would be impossible for humans to detect and exploit. The allure of HFT lies in its potential for generating enormous profits, particularly in volatile markets like forex.

Advantages of HFT:

- Speed and Precision: HFT systems can analyze vast amounts of data and execute trades faster than any human trader, giving them a significant edge in highly competitive markets.

- Reduced Latency: HFT systems utilize low-latency connections to minimize the time it takes to receive and execute trades, maximizing trading opportunities and minimizing the risk of missed opportunities.

- Market Making and Liquidity: HFT algorithms often provide liquidity to the market, making it easier for other participants to execute their trades. By contributing to market efficiency, HFT systems can stabilize prices and encourage more participants.

Criticisms of HFT:

Despite its potential benefits, HFT has also attracted significant criticism. Critics argue that:

- Market Manipulation: Some argue that HFT systems can manipulate market prices by creating artificial supply and demand, giving them an unfair advantage.

- Flash Crash Risk: HFT systems’ rapid execution can contribute to market volatility and even lead to sudden and dramatic price crashes like the infamous “flash crash” of 2010.

- Lack of Transparency: The complex nature of HFT algorithms and the fast pace of trading make it difficult for regulators and other market participants to understand how these strategies operate, raising concerns about potential abuse.

Image: investluck.com

FX Scalper X: The Machine That Trades

FX Scalper X embodies the complexities and controversies surrounding HFT. It’s a software solution that promises to empower individual traders with the tools and capabilities traditionally reserved for institutional investors. The software leverages advanced algorithms and technical analysis indicators to automatically detect, analyze, and execute profitable trading opportunities in the forex market, all in real time.

Key Features of FX Scalper X:

- Automated Trading: FX Scalper X removes the need for manual intervention, allowing users to set it up and let it execute trades autonomously based on pre-defined parameters and strategies.

- Advanced Algorithms: The software employs complex algorithms that continuously analyze market data, searching for profitable trading opportunities that might be missed by human traders.

- Technical Indicator Integration: FX Scalper X integrates various technical indicators commonly used in forex trading, enhancing its ability to identify trends and predict price movements.

- Backtesting and Optimization: The software allows users to backtest their trading strategies using historical data, helping them optimize their parameters for improved performance.

- Real-time Monitoring: FX Scalper X provides real-time trading dashboards, allowing users to monitor the software’s activity and track their trades.

Benefits of Using FX Scalper X:

Proponents of FX Scalper X tout its ability to:

- Improve Trading Efficiency: By automating trade execution, FX Scalper X frees up traders from constant market monitoring and analysis, allowing them to focus on other aspects of their trading strategy.

- Enhance Profitability: The software’s advanced algorithms and rapid execution speed can help traders capture profits from small price fluctuations that might be missed with manual trading.

- Minimize Emotional Trading: As an automated tool, FX Scalper X eliminates the influence of emotions like fear and greed, potentially leading to more disciplined trading decisions.

- Access to Institutional-Grade Technology: FX Scalper X provides individual traders with access to cutting-edge trading technology traditionally available only to financial institutions.

Risks and Challenges of FX Scalper X:

Despite its potential benefits, FX Scalper X is not without its risks and challenges. Some key concerns include:

- Market Volatility: FX Scalper X relies on pre-defined trading strategies that may not always be effective in volatile market conditions. Sudden market shifts can significantly impact the software’s performance.

- Overfitting and Drawdowns: The software’s algorithms can be susceptible to overfitting, where they become overly tuned to historical data and fail to adapt to changing market conditions, leading to significant trading losses.

- Software Errors and Glitches: As with any complex software system, FX Scalper X is not immune to errors and glitches, which can have a significant impact on trading performance.

- Lack of Personal Touch: While automation enhances efficiency, it also removes the human element from trading decisions. This can limit the trader’s ability to adapt to unforeseen market events or adjust their strategy based on personal intuition.

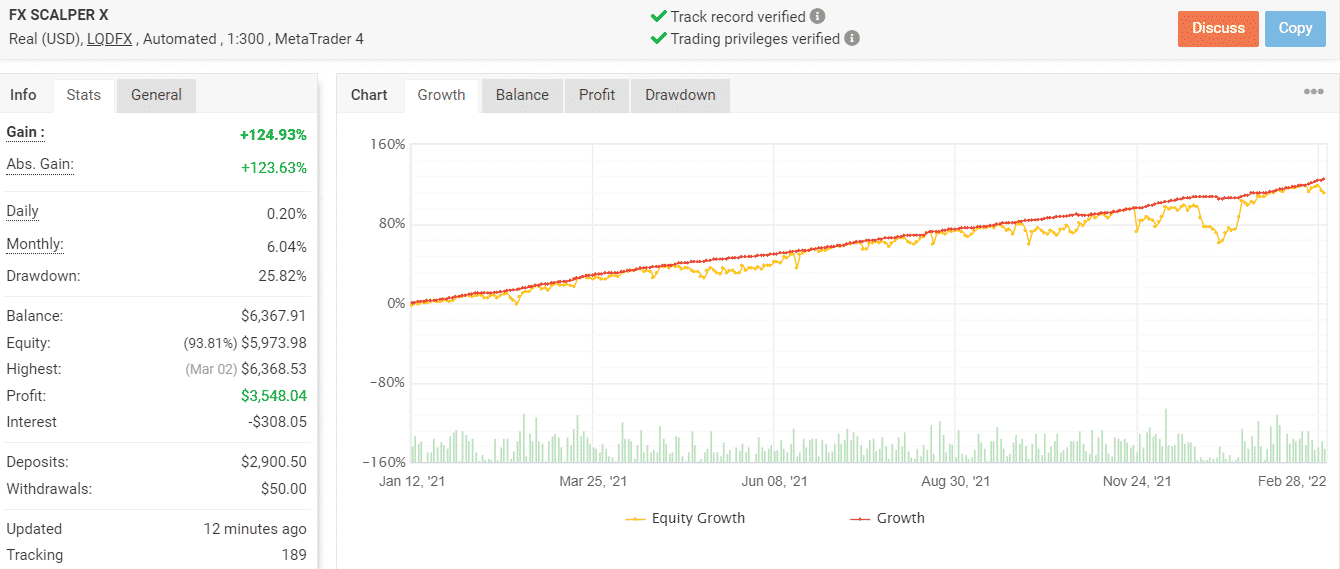

Fx Scalper X

Navigating the World of FX Scalper X: A Word of Caution

The world of FX Scalper X is a double-edged sword. It offers the tantalizing potential for high returns and trading efficiency, but it also presents significant risks and challenges. Before diving into the world of automated scalping, it’s crucial to:

- Thorough Research: Conduct a comprehensive analysis of FX Scalper X and its features, limitations, and associated risks. Look for reviews from independent sources and consider participating in demo accounts to test the software before investing real money.

- Risk Management: Implement robust risk management strategies, including stop-loss orders and position size management, to mitigate potential losses. Remember that even the most advanced software cannot guarantee profits.

- Continuous Learning: Keep up-to-date with market trends and developments in automated trading to ensure your strategies remain relevant and effective.

- Realistic Expectations: Understand that FX scalping is a high-risk strategy. Don’t expect to become overnight millionaires. Set realistic goals and be prepared for potential losses.

FX Scalper X represents a fascinating intersection of technology, finance, and human ambition. While it offers potential benefits for experienced traders, it also demands a thorough understanding of its complexities and associated risks. Approaching automated trading with a blend of caution, research, and realistic expectations is crucial to navigating this exciting but potentially treacherous landscape.