In the realm of financial markets, forex trading stands out as a vibrant arena that offers ample opportunities for discerning investors. For those based in India, understanding the concept and utilizing the margin facility can be instrumental in maximizing trading potential.

Image: www.interactivebrokers.com

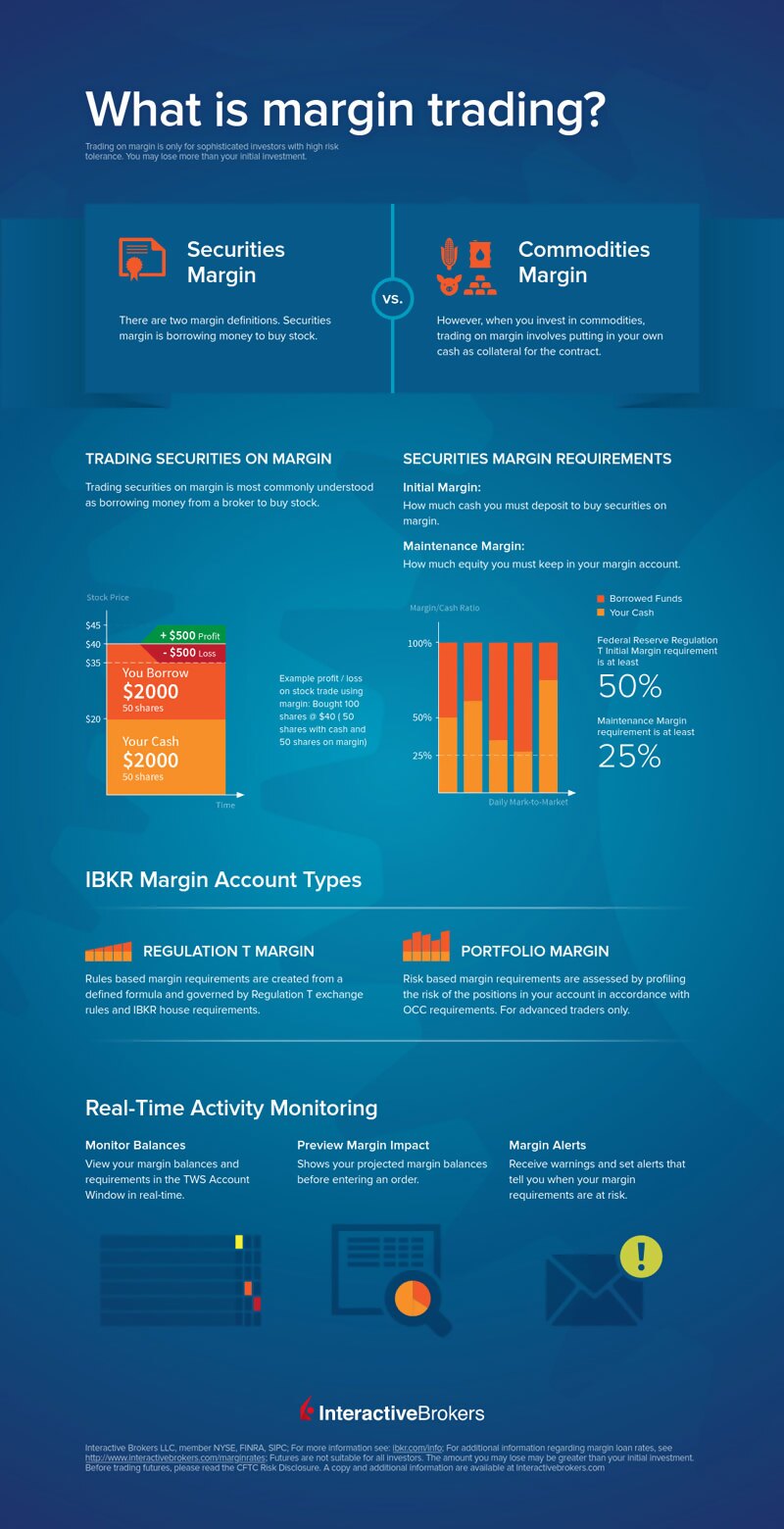

Margin trading in forex involves leveraging borrowed funds from a broker to increase the purchasing power of traders. This enables them to control a larger position than their initial capital would allow, potentially amplifying both profits and losses.

Benefits of Margin Trading

Harnessing the power of margin in forex trading can bestow several advantages upon savvy traders:

- Increased Trading Power: Margin allows traders to leverage funds, enabling them to control a larger position and amplify their potential returns.

- Enhanced Profitability: By multiplying the initial capital, margin trading enhances the profit potential on profitable trades.

- Flexibility and Versatility: Margin offers traders the flexibility to adapt to changing market conditions, seize opportunities, and execute complex trading strategies.

Understanding Margin Requirements in India

In India, the Reserve Bank of India (RBI) regulates forex trading and sets specific margin requirements. These requirements vary depending on the currency pair being traded:

- Major Currency Pairs: 5%

- Minor Currency Pairs: 10%

- Exotic Currency Pairs: 20%

For instance, if a trader desires to trade a major currency pair with a notional value of 100,000 USD, the margin requirement would be 5,000 USD. This amount serves as collateral and must be maintained to sustain the position.

Calculating Margin in Forex Trading

To effectively calculate the margin required for a particular trade, traders must multiply the notional value of the trade by the margin percentage set by their broker. The following formula can be used:

Margin = Notional Value x Margin Percentage

Image: eaglesinvestors.com

Managing Risk with Margin

While margin trading offers enhanced profit potential, it is imperative to exercise prudent risk management strategies to mitigate potential losses. Overleveraging or exceeding margin requirements can lead to substantial losses. Traders should adhere to the following principles:

- Maintain an Adequate Margin Level: Always ensure that the margin level remains above the minimum required by the broker, typically 100%.

- Monitor Market Volatility: Closely monitor market volatility, as it can significantly impact margin requirements and potential losses.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses by automatically exiting trades when predetermined levels are reached.

- Diversify Trading: Spread risk by trading multiple currency pairs or asset classes to avoid overexposure to any single market or instrument.

Margin Available For Lot Trading In Forex In India

Conclusion

Margin trading in forex presents a powerful tool for Indian investors seeking to expand their trading potential. By leveraging funds efficiently, understanding margin requirements, and employing sound risk management strategies, traders can harness the opportunities offered by the forex market while mitigating potential risks.

Remember, the key to successful margin trading lies in knowledge, discipline, and a measured approach.