The allure of quick riches and financial freedom often blinds us to the dangers that lurk in the shadows of unregulated markets. The forex industry, a trillion-dollar behemoth, has become a breeding ground for unscrupulous actors seeking to exploit the hopes and dreams of unsuspecting investors. Manish Chawla, a self-styled forex guru and founder of MCX India, stands as a grim reminder of the devastation that can result from such fraudulent schemes.

In this comprehensive exposé, we delve deep into the Manish Chawla forex scam, unraveling the web of deception and deceit that brought down an entire empire. From the initial promises of unimaginable wealth to the shattered dreams and financial ruin of countless victims, we paint a vivid picture of the true nature of this audacious fraud.

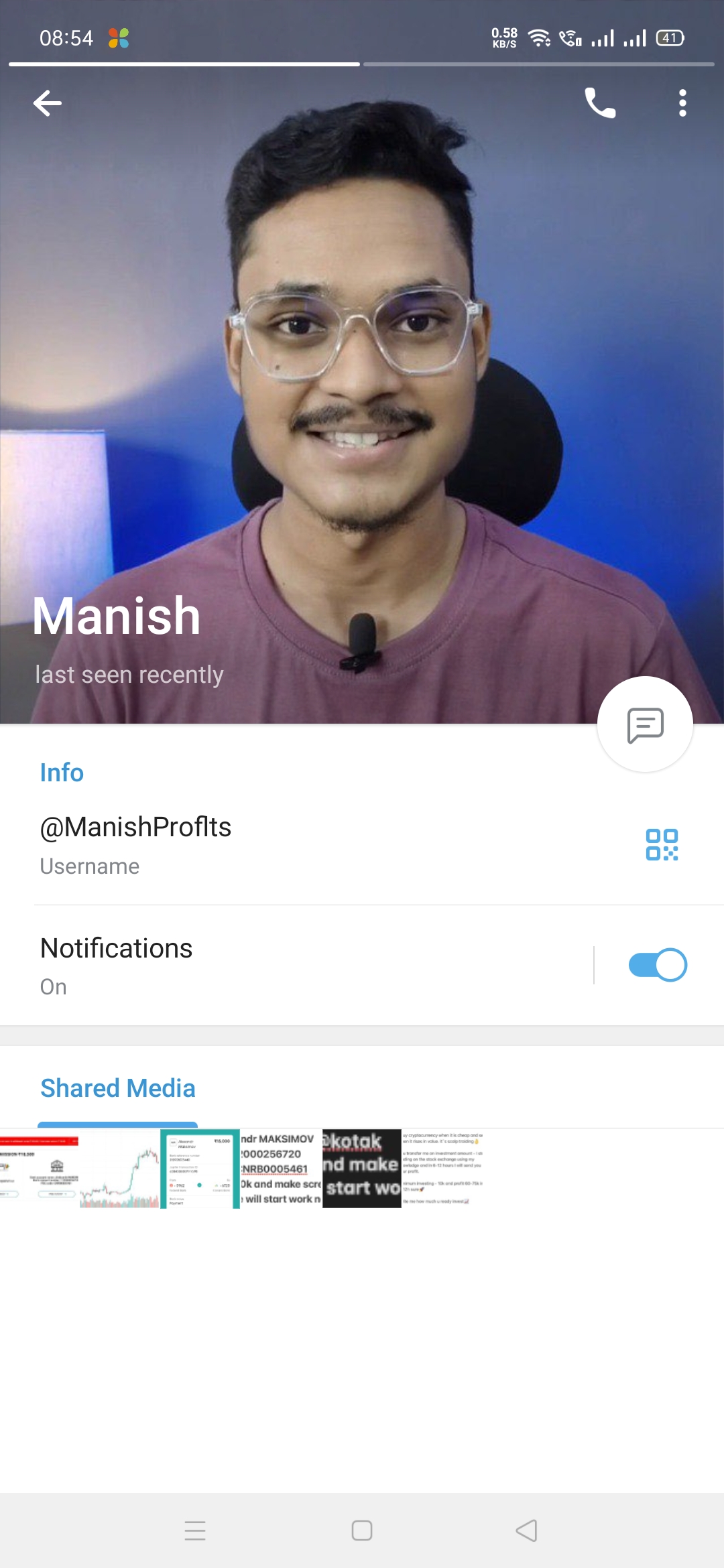

The Rise and Fall of Manish Chawla

Manish Chawla emerged from obscurity as a charismatic speaker and self-proclaimed forex trading expert. With promises of turning small investments into fortunes overnight, he lured thousands into his fraudulent schemes. MCX India, the company he founded, became a magnet for aspiring traders seeking a shortcut to financial success.

Image: consumercomplaintscourt.com

However, behind the façade of legitimacy lay a carefully orchestrated scam. Chawla employed a sophisticated network of offshore entities, shell companies, and unregulated brokers to create an illusion of credibility and siphon away investor funds.

The Unraveling Scam

As the scheme gained momentum, cracks began to appear in Chawla’s meticulously crafted veneer. Investors started to question the lack of transparency and accountability within MCX India. Alarmed by the mounting pressure, Chawla resorted to desperate measures.

He manipulated trading accounts, fabricated profits, and even forged documents to maintain the illusion of success. However, the truth was about to come crashing down.

Victims Left Devastated

The collapse of MCX India sent shockwaves through the forex community. Thousands of investors, many of whom had invested their life savings, found themselves stripped of their hard-earned money. The emotional and financial toll was immeasurable.

Victims shared harrowing tales of lost homes, broken relationships, and shattered dreams. The once-alluring promises of wealth had turned into a nightmare of financial ruin.

The Aftermath

In the wake of the scam, authorities launched investigations and apprehended Manish Chawla. He faces multiple charges, including fraud, money laundering, and racketeering. The legal battle is ongoing, and the full extent of the damage inflicted by Chawla’s scheme is yet to be determined.

Image: www.zeebiz.com

Lessons Learned

The Manish Chawla forex scam serves as a cautionary tale for investors seeking quick riches in unregulated markets. It underscores the importance of due diligence, transparency, and accountability in any financial endeavor.

Here are some crucial lessons to learn from this tragic event:

-

Beware of exaggerated promises: If it sounds too good to be true, it probably is. Be wary of individuals or organizations promising unrealistic returns with minimal risk.

-

Investigate before investing: Thoroughly research any investment opportunity, including the company, its management, and its track record.

-

Diversify your investments: Spread your investments across different asset classes and geographies to minimize risk.

-

Avoid unregulated markets: Stick to regulated markets and financial institutions that provide investor protections and oversight.

Seeking Justice

Victims of the Manish Chawla forex scam deserve justice and compensation for the losses they have suffered. Authorities must continue to pursue legal action against those responsible and ensure that they are held accountable for their crimes.

Furthermore, regulatory bodies need to strengthen oversight of the forex industry and implement stricter measures to prevent such scams in the future.

Manish Chawla Forex Scam Latest News

Conclusion

The Manish Chawla forex scam is a sobering reminder of the devastating consequences of fraud and greed. It serves as a wake-up call to investors, emphasizing the need for vigilance, skepticism, and a thorough understanding of financial markets. By learning from this tragic event, we can empower ourselves to protect our hard-earned money and hold unscrupulous actors accountable.