Navigating the forex market can be challenging, but one key factor that determines success is liquidity. This article provides a comprehensive liquidity provider list for forex brokers, empowering you to make informed decisions and enhance your trading experience.

Image: b2broker.com

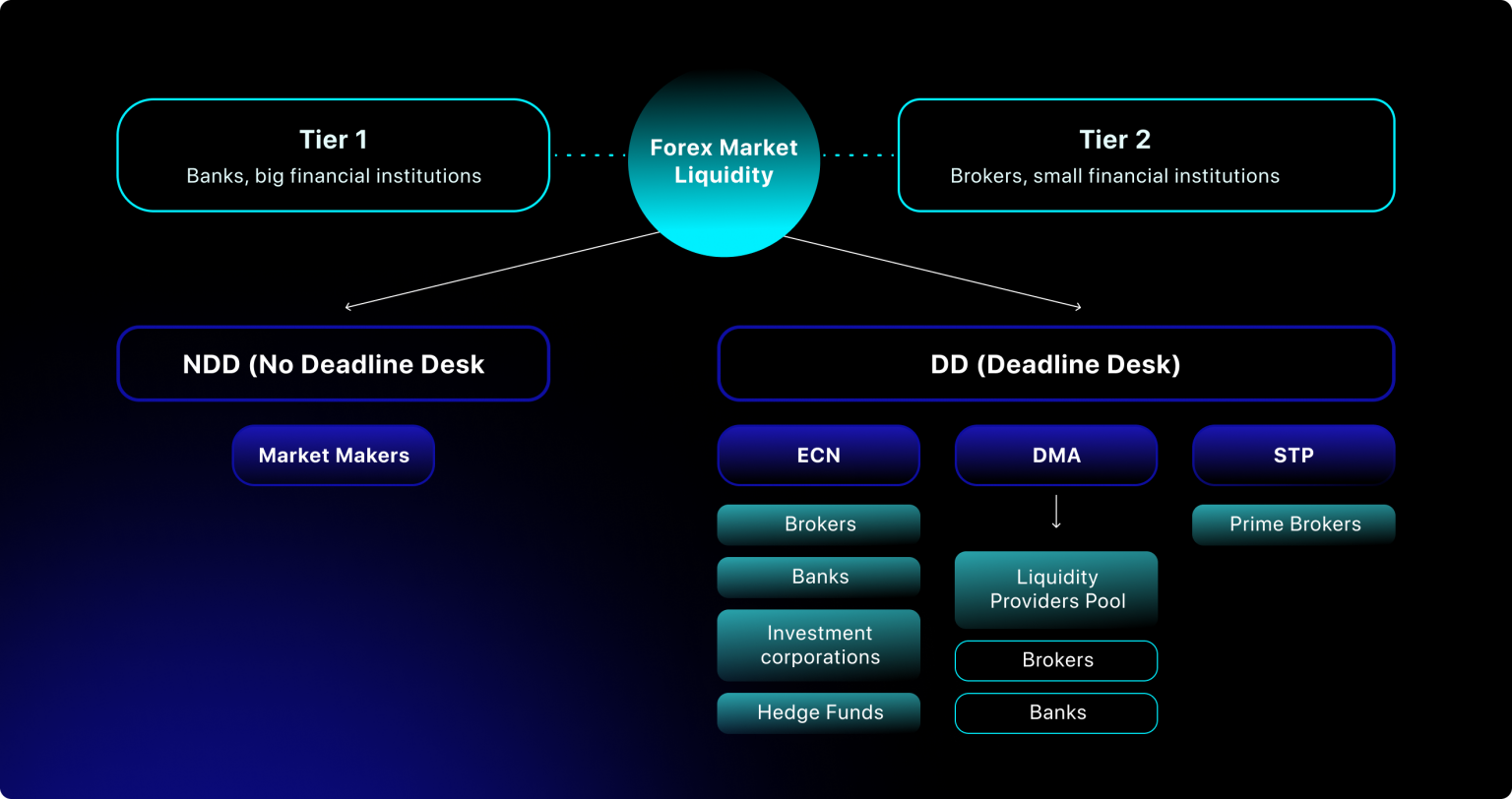

Forex liquidity, simply put, refers to the ease with which currency pairs can be bought and sold in the market. When liquidity is high, traders can execute orders quickly and efficiently, with minimal slippage or price deviations. Partnering with the right liquidity provider is crucial to ensure sufficient liquidity and optimal trading conditions.

Choosing the Right Liquidity Provider

Selecting a liquidity provider involves careful consideration of several factors, including:

- Spreads and commissions: Competitive spreads and low commissions directly impact profitability.

- Execution quality: Quick order execution, minimal slippage, and reliable price feeds are essential for successful trading.

- Technology: Advanced trading platforms and API integration ensure seamless connectivity and automation capabilities.

li>**Reputation and track record:** Trustworthy and established providers with a proven track record offer peace of mind.

Liquidity Provider List for Forex Brokers

Below is a comprehensive list of top liquidity providers for forex brokers:

| Liquidity Provider | Spreads | Execution | Technology |

|---|---|---|---|

| Currenex | Tight spreads | STP (straight-through processing) execution | Currenex Bridge API |

| Thomson Reuters (FXall) | Low interbank spreads | ECN (electronic communication network) execution | FXall Trading Platform |

| Goldman Sachs | Primary liquidity provider | DMA (direct market access) and ECN execution | GS Prime API |

| Citibank | Low commission rates | Proprietary trading platform and API | Citi Velocity API |

| Morgan Stanley | Global liquidity pool | AlgoQuant Insight Platform | MS Liquidity Connect API |

Tips for Selecting a Liquidity Provider

- Research and compare: Evaluate multiple providers based on their offerings and compare their spreads, execution, technology, and reputation.

- Consider your trading style: Different liquidity providers cater to specific trading styles. Choose a provider that aligns with your needs, whether it’s high-frequency trading or longer-term investments.

- Open a demo account: Experience firsthand the performance and reliability of a liquidity provider before committing to a live account.

Image: b2broker.com

Liquidity Provider List For Forex Broker

Conclusion

Selecting the right liquidity provider is paramount for forex brokers to achieve optimal trading conditions. By leveraging the liquidity provider list provided and considering the tips and expert advice, you can enhance your liquidity, improve your execution quality, and ultimately maximize your profitability.

Are you ready to elevate your forex trading experience with the right liquidity provider?