The Unexpected Trap: A Personal Story

Imagine this: You meticulously analyze the forex market, spot a promising opportunity, and confidently place a huge order. To your dismay, your order is executed at a significantly different price than the one you intended. Confused and frustrated, you realize you’ve become a victim of order slippage. This all-too-common phenomenon can sabotage your forex trades, turning potential profits into bitter losses. But fear not! In this comprehensive guide, we’ll unravel the secrets of order slippage, empowering you to avoid these pitfalls and emerge as a victorious forex trader.

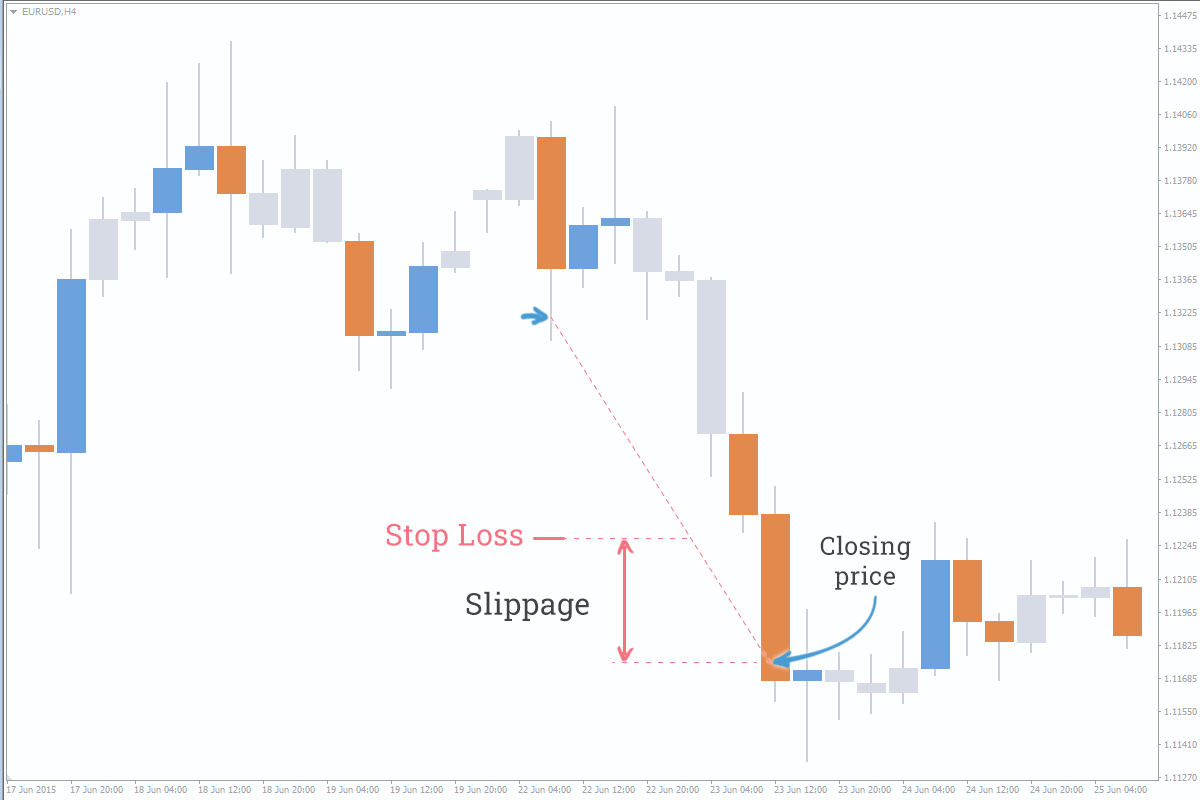

Image: fxssi.com

Understanding Order Slippage

Order slippage is the difference between the expected execution price of an order and the actual price at which it is executed. This discrepancy arises primarily due to market volatility, liquidity constraints, and technological limitations. When the market experiences rapid price fluctuations, there may be insufficient liquidity at your desired price level, resulting in your order being filled at a different price.

Causes of Order Slippage

- Market Volatility: Rapid price movements can make it challenging to execute orders at the intended price.

- Liquidity Constraints: Low liquidity in a particular currency pair can lead to order slippage as there may not be enough counterparties to fill your order at your desired price.

- Technological Delays: In fast-moving markets, there may be delays in the transmission of orders, causing you to receive an execution price that differs from your initial request.

Impact of Order Slippage

Order slippage can have a profound impact on your forex trades:

- Missed Opportunities: Execution at an unfavorable price can result in losing out on potential profits.

- Increased Losses: Slippage can amplify losses, especially in volatile markets.

- Risk Management Challenges: Slippage can make it difficult to adhere to your risk management strategy.

Image: www.warriortrading.com

Preventing Order Slippage Strategies

- Choose Liquid Currency Pairs: Trade in currency pairs with high liquidity to minimize the risk of order slippage.

- Optimize Order Size: Place smaller orders to avoid exacerbating slippage during periods of volatility.

- Set Wider Stop-Loss Orders: Allow sufficient room for price fluctuations by setting wider stop-loss orders.

- Consider Limit Orders: Limit orders specify the maximum or minimum price you are willing to accept for your order, reducing the likelihood of slippage.

- Use Brokers with Fast Execution: Choose brokers with reliable and high-performance execution servers to minimize delays.

Tips and Expert Advice

- Monitor Market Volatility: Stay informed about economic news and events that can trigger market volatility, increasing the likelihood of slippage.

- Test Order Execution Speed: Determine the responsiveness of your broker’s execution servers by placing small test orders during different market conditions.

- Consult with Experienced Traders: Seek advice from seasoned forex traders who can share their insights and strategies for mitigating order slippage.

FAQs on Order Slippage

Q: Can order slippage occur in all types of forex orders?

A: Yes, order slippage can affect market orders, limit orders, stop orders, and stop-limit orders.

Q: Is order slippage completely avoidable?

A: While it is not entirely possible to eliminate order slippage, employing the strategies discussed above can significantly reduce its occurrence.

Q: How can I minimize the impact of order slippage on my trades?

A: Implement risk management techniques such as setting wider stop-loss orders, choosing less volatile currency pairs, and using limit orders when appropriate.

Huge Order Slippage In Forex

Conclusion

Order slippage is a common but potentially detrimental aspect of forex trading. By understanding its causes, impact, and preventive measures, you can enhance your trading strategy to minimize slippage’s drawbacks and maximize your profits. Are you ready to conquer the challenges of order slippage and elevate your forex trading experience?