In today’s interconnected global economy, international banking and foreign exchange (forex) management play pivotal roles in facilitating seamless cross-border transactions and promoting economic growth. Understanding the intricacies of these financial realms is crucial for navigating the international business landscape effectively.

Image: www.rcdwealth.com

International banking refers to the provision of financial services by banks across national borders. It encompasses a wide range of activities, including cross-border lending, trade finance, currency exchange, and investment advisory services. By enabling businesses to access capital and manage risk in foreign markets, international banking fosters trade and investment, contributing to global economic development.

Forex management, on the other hand, deals with the buying, selling, and exchanging of different national currencies. It plays a vital role in international trade, tourism, and investments. By facilitating currency conversion and risk mitigation, forex management ensures the smooth flow of goods and services across borders. It also provides opportunities for speculation and profit-making for investors who can capitalize on fluctuations in currency exchange rates.

The benefits of international banking and forex management are multifaceted. For businesses, they enable expansion into new markets by providing access to foreign capital and managing exchange rate risks. For individuals, they facilitate travel, online shopping, and remittances between different countries. Moreover, the international financial system promotes economic stability and growth by connecting economies and allowing for efficient allocation of capital.

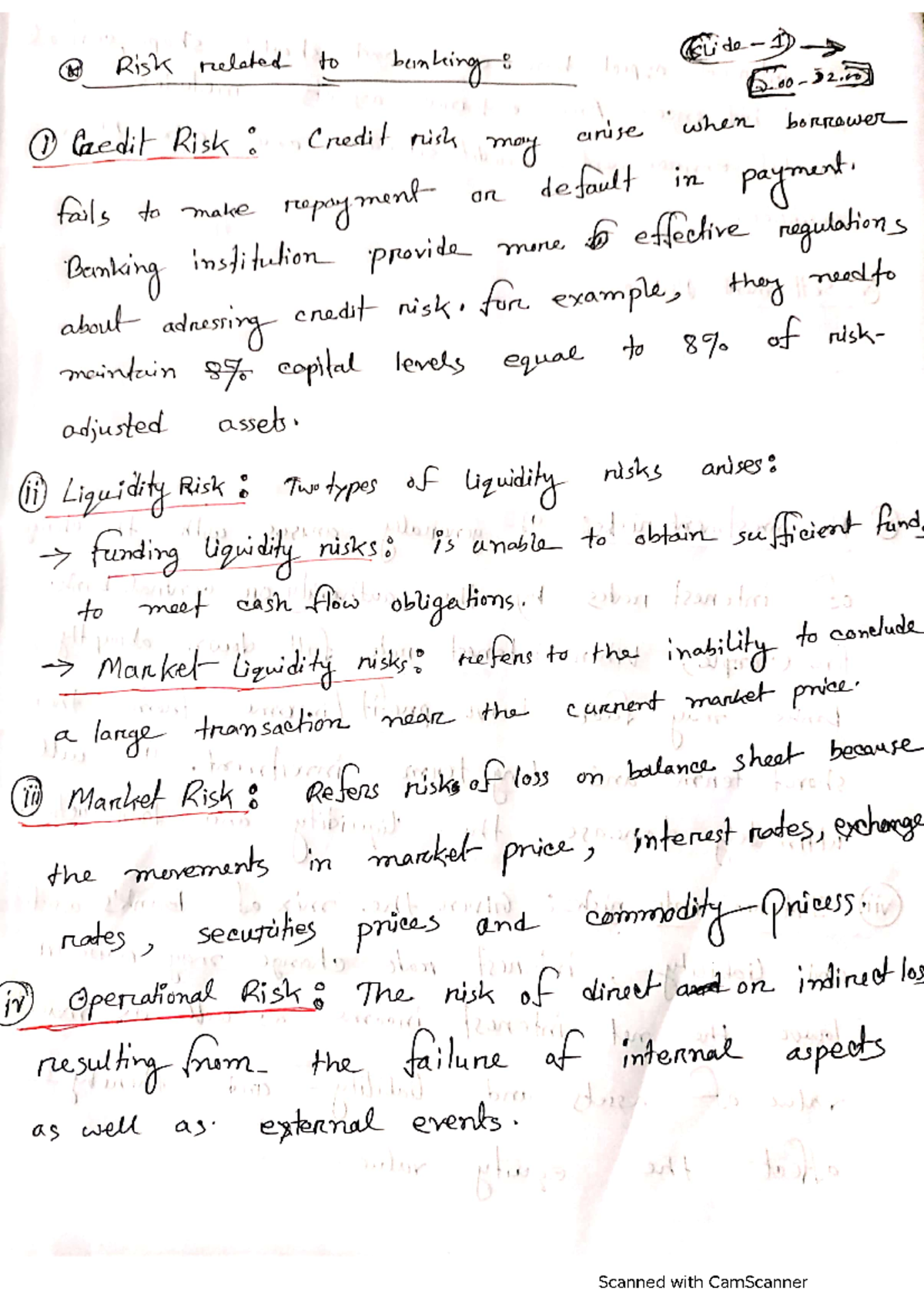

However, the complexities of international banking and forex management also present challenges that require careful navigation. Regulatory frameworks, exchange rate volatility, and geopolitical factors can impact cross-border transactions and investment decisions. Businesses and investors need to possess a deep understanding of these factors and consider appropriate risk management strategies to mitigate potential losses.

In summary, the international network of banking and forex management is an indispensable part of the global economy. By providing financial services across borders, these institutions facilitate trade, investments, and economic growth. Understanding the nuances of these interconnected realms empowers businesses, individuals, and governments to navigate the challenges and reap the benefits of a globalized financial landscape.

Image: www.studocu.com

Inrtnational Network Meaning Of International Banking And Forex Management