Navigating the world of foreign exchange can be both exciting and daunting. Whether you’re a seasoned globetrotter or a first-time traveler, understanding the fees and charges associated with a forex card is crucial. In this in-depth guide, we’ll demystify the charges levied by IndusInd Bank, one of the leading financial institutions in India, so you can plan your financial roadmap with confidence.

Image: www.moneycontrol.com

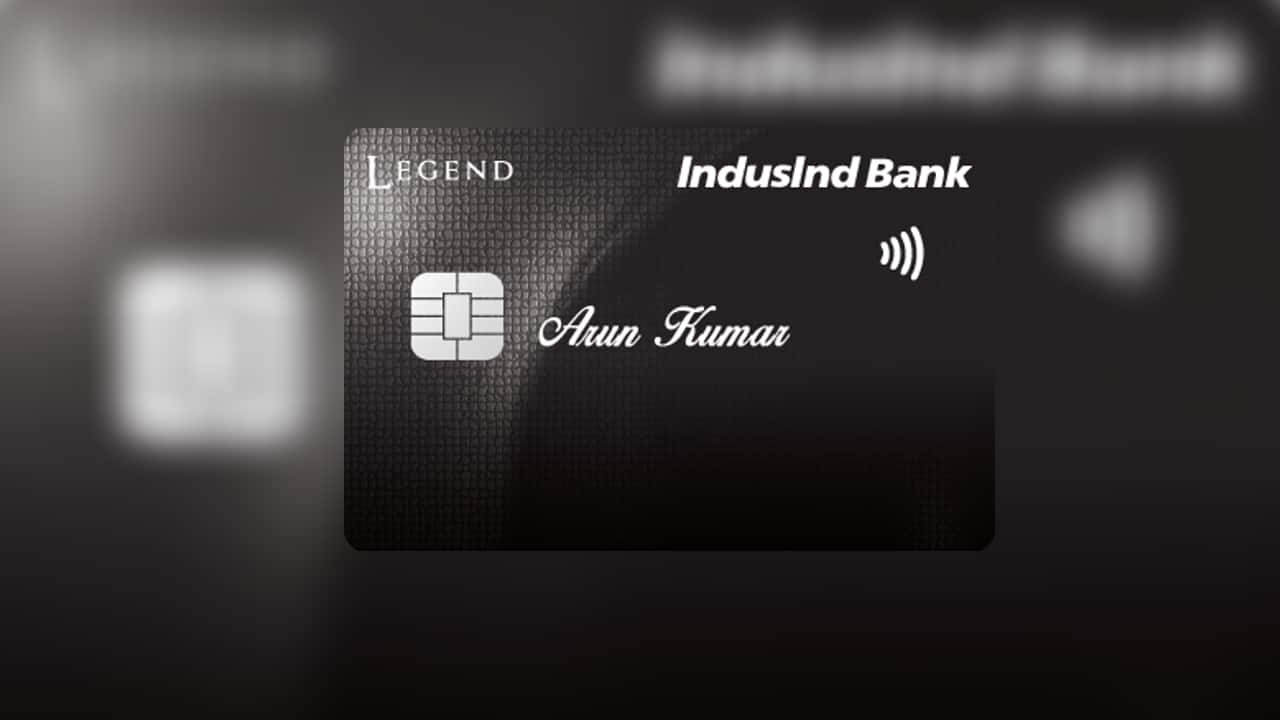

IndusInd Bank Forex Card: A Glimpse

An IndusInd Bank Forex Card is a preloaded card that allows you to make international payments in multiple currencies. It eliminates the need for converting cash or traveler’s checks, providing convenience and protection against currency fluctuations. However, it’s essential to be aware of the associated fees and charges to avoid unexpected expenses.

Detailed Breakdown of Charges

1. Issuance and Renewal Fees:

– Issuance Fee: A one-time fee charged when you apply for a new forex card.

– Renewal Fee: An annual fee levied to keep your card active after its expiration date.

2. Usage Fees:

– ATM Withdrawal Fee: A charge imposed every time you withdraw cash from an ATM abroad.

– POS Transaction Fee: A percentage-based fee applied to purchases made using the card at retail outlets.

3. Currency Conversion Fees:

– Currency Conversion Mark-up: An additional percentage charged on the currency exchange rate when you convert funds into another currency.

4. Other Fees:

– Inactivity Fee: An annual fee levied if you don’t use your card for a specific period.

– Balance Inquiry Fee: A charge incurred whenever you check your card balance through an ATM or customer service.

Tips for Minimizing Forex Card Costs

By following these expert tips, you can effectively reduce the charges associated with using an IndusInd Bank Forex Card:

– Compare the fees charged by different banks before selecting your forex card.

– Opt for a card that offers fee waivers or discounts on specific transactions.

– Use ATMs affiliated with IndusInd Bank to avoid additional fees.

– Make large purchases using your card to minimize the impact of percentage-based fees.

– Utilize online banking or mobile apps to monitor your card balance and avoid unnecessary balance inquiries.

Image: fiaks.com

FAQs on IndusInd Bank Forex Card Fees

1. Q: Are there any hidden fees or charges associated with IndusInd Bank Forex Card?

A: No, all fees and charges related to the card are clearly outlined in the bank’s official website.

2. Q: Can I use my IndusInd Bank Forex Card in any country?

A: Yes, the card is accepted worldwide wherever major credit or debit cards are accepted.

3. Q: Is it safe to use the card for online transactions?

A: Absolutely, IndusInd Bank employs advanced security measures to protect your financial information.

Indus Ind Bank Forex Card Fees Charges

Conclusion

By understanding the fees and charges associated with IndusInd Bank Forex Card, you can make informed decisions and plan your foreign financial transactions effectively. Whether you’re planning a backpacking adventure or a business trip abroad, a forex card can provide convenience and peace of mind. Are you ready to unlock the world with IndusInd Bank Forex Card?