Introduction

Venturing abroad for educational pursuits or enriching experiences can be exhilarating, but it’s crucial to plan your finances carefully. Among the indispensable tools for international students, a forex card stands tall. IndusInd Bank offers a comprehensive Student Forex Card designed to cater to the unique financial needs of students studying overseas. Understanding the associated charges and benefits of this card is paramount for informed decision-making, ensuring a smooth financial journey during your academic sojourn.

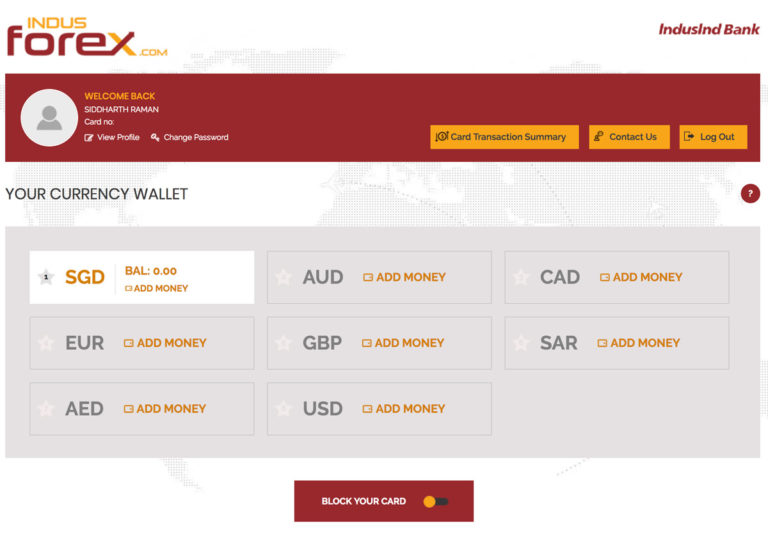

Image: www.schemaninja.com

IndusInd’s Student Forex Card acts as a prepaid card, denominated in multiple foreign currencies. It allows students to carry and spend foreign currency conveniently, eliminating the hassles of exchanging cash or using credit cards that might incur hefty charges. However, it’s important to be aware of the fees and other charges associated with using this card to make the most of its benefits.

Charges Levied on IndusInd Student Forex Card

To maintain transparency, IndusInd Bank levies certain charges for various transactions performed using their Student Forex Card. These charges are intended to cover administrative and operational costs, ensuring the smooth functioning of the card’s services:

- Issuance Fee: A one-time fee is charged at the time of card issuance, typically ranging from INR 500 to INR 1,000.

- Reloading Fee: Every time you reload your card with additional funds, a reloading fee is applicable. The percentage of the fee may vary based on the amount reloaded and the method used.

- Transaction Fee: When withdrawing cash from ATMs or making purchases using your card, a transaction fee is charged. The fee is typically a percentage of the transaction amount, varying depending on the location and type of transaction.

- Currency Conversion Fee: When you use your card to make transactions in a currency other than the one your card is denominated in, a currency conversion fee is applied. The fee is usually a percentage of the converted amount.

- Inactivity Fee: If your card remains inactive for an extended period, an inactivity fee may be levied to maintain the account.

Benefits of Using IndusInd Student Forex Card

Despite the associated charges, the IndusInd Student Forex Card offers a multitude of benefits, making it a valuable tool for students studying abroad:

- Convenience: Carrying and managing foreign currency in cash can be cumbersome and risky. The forex card offers a safe and convenient alternative, allowing students to access funds in various currencies with ease.

- Competitive Exchange Rates: IndusInd Bank offers competitive currency conversion rates, ensuring students get the most out of their money when exchanging currencies.

- Emergency Assistance: In case of card loss or theft, the bank provides emergency assistance to help students access their funds and obtain a replacement card promptly.

- Online Account Management: Students can conveniently track their card transactions and manage their account online through the IndusInd Bank’s net banking portal or mobile app.

- Additional Benefits: Some IndusInd Student Forex Cards offer additional benefits, such as discounts on international travel, travel insurance, and exclusive offers from partner merchants.

<

Image: www.cardexpert.in

Indusind Student Forex Card Charges

Conclusion

The IndusInd Student Forex Card is a comprehensive financial solution tailored to meet the specific needs of students pursuing education abroad. While it’s essential to be aware of the associated charges, the card’s benefits, such as convenience, competitive exchange rates, and emergency assistance, make it a valuable tool for managing finances.

By understanding the charges and leveraging the benefits, students can make informed decisions regarding their financial planning while studying overseas. Remember to compare different forex card options, read the terms and conditions thoroughly, and choose the card that best suits your individual needs. With the IndusInd Student Forex Card, students can confidently navigate their financial journey abroad, focusing on their academic pursuits and enriching experiences.