In the world of international finance, a country’s foreign exchange reserves are of paramount importance. They serve as a cushion against external economic shocks and play a crucial role in maintaining the stability of the economy.

Image: www.strategicfront.org

India’s Forex Reserves: A Historical Perspective

India’s foreign exchange reserves have witnessed a remarkable journey over the years. They stood at a mere USD 5.8 billion on August 15, 1947, the day India gained independence. Through prudent economic policies and steady growth, the reserves have grown exponentially over the decades.

Significance of Foreign Exchange Reserves

Foreign exchange reserves provide several advantages to a country. They:

- Promote Economic Stability: By providing a buffer against external economic shocks, such as currency fluctuations or capital outflows, reserves help maintain economic stability.

- Facilitate International Trade: Adequate reserves enable India to meet its import obligations, ensuring a smooth flow of essential goods and services.

- Control Inflation: Central banks can use foreign exchange reserves to intervene in the currency market, controlling inflation by stabilizing the rupee’s value.

Components of Forex Reserves

India’s foreign exchange reserves primarily comprise four components:

- Gold: India holds a significant amount of gold in its reserves, which serves as a safe haven asset and provides stability during periods of economic uncertainty.

- Foreign Currency Assets: These include holdings of major currencies such as the US dollar, euro, and pound sterling, which are used to facilitate international transactions and meet foreign exchange obligations.

- Special Drawing Rights (SDRs): These are international reserve assets created by the International Monetary Fund (IMF) that supplement a country’s foreign exchange reserves.

- Reserve Tranche Position: This is India’s claim on IMF resources, which can be utilized in case of balance-of-payments crises.

Image: www.indiatimes.com

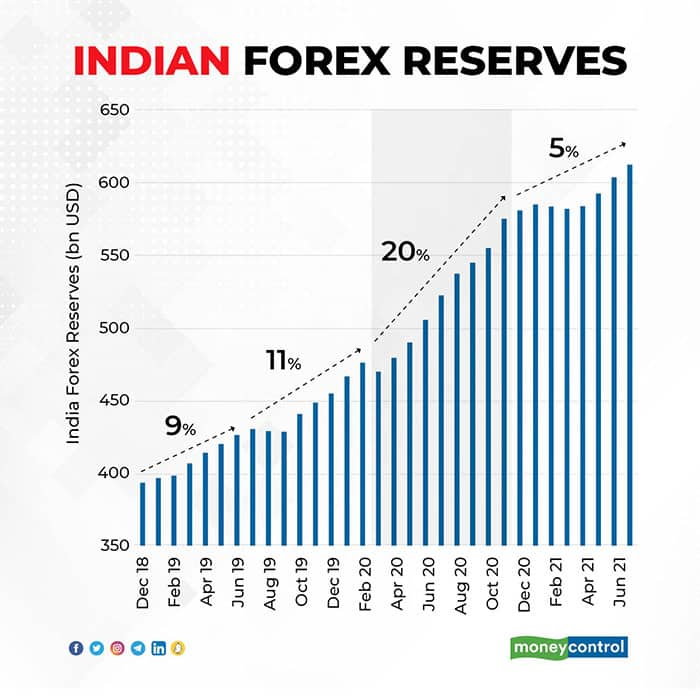

Latest Trends in Forex Reserves

As of January 1, 2016, India’s foreign exchange reserves had reached a record-high level of USD 355.46 billion. This growth was primarily due to:

- Strong inflows of foreign investment, particularly into the equity and debt markets.

- Improved balance of trade, with exports outpacing imports.

- Cautious approach by the central bank in terms of foreign exchange intervention.

Expert Tips and Advice

Managing foreign exchange reserves requires careful planning and prudent policies:

- Diversification: Spread investments across different asset classes and currencies to reduce risk.

- Transparency: Maintain clear communication on reserve management policies and investments.

- Targeted Intervention: Central banks can intervene in the currency market to prevent excessive volatility.

FAQs

- Q: What is the importance of foreign exchange reserves?

A: Foreign exchange reserves provide economic stability, facilitate international trade, and control inflation.

- Q: What are the components of India’s forex reserves?

A: Gold, foreign currency assets, special drawing rights (SDRs), and reserve tranche position.

- Q: How are foreign exchange reserves managed?

A: Governments and central banks manage reserves through diversification, transparency, and targeted intervention.

Indian Forex Reserves As On 01 Jan 2016

Conclusion

India’s foreign exchange reserves have emerged as a cornerstone of the country’s economic stability and growth. By maintaining healthy reserves and adopting prudent policies, India can weather external economic challenges and navigate the complexities of global finance. Are you now interested in tracking India’s foreign exchange reserves and understanding their impact on the economy?