Introduction

Navigating the intricacies of foreign exchange rates can be a daunting task, especially when planning an international transaction. Understanding the exchange rate between the Indian Rupee (INR) and the Malaysian Ringgit (MYR) is crucial for individuals and businesses alike engaging in cross-border financial activities. This comprehensive guide will delve into Indian Bank’s forex rates for INR to MYR, providing an in-depth understanding of the factors influencing the exchange rate, decoding its implications, and offering practical tips for optimizing forex transactions.

Image: knnindia.co.in

Demystifying Forex Rates: INR to MYR

In the realm of international finance, the exchange rate represents the value of one currency in terms of another. In the context of INR to MYR, the exchange rate determines how many Indian Rupees are required to purchase one Malaysian Ringgit. Fluctuations in the exchange rate directly impact the cost of goods and services imported and exported between India and Malaysia. Several factors contribute to the dynamic nature of the INR to MYR exchange rate, including economic indicators, interest rates, inflation, and political stability in both countries.

Key Drivers of the INR to MYR Forex Rate

Understanding the key drivers that influence the INR to MYR forex rate is essential for making informed financial decisions. Here are some of the primary factors at play:

Economic Growth: Robust economic growth in either India or Malaysia can lead to increased demand for their respective currencies, resulting in an appreciation in the value of the currency against the other. Conversely, a slowdown in economic activity can depreciate the currency.

Interest Rates: Interest rate decisions by the Reserve Bank of India (RBI) and Bank Negara Malaysia (BNM) significantly impact the exchange rate. Higher interest rates in India relative to Malaysia attract foreign investment, increasing demand for the Indian Rupee and pushing up its value against the Malaysian Ringgit.

Inflation: Inflation rates in both countries play a crucial role. Higher inflation in India compared to Malaysia erodes the purchasing power of the Indian Rupee, leading to its depreciation against the Malaysian Ringgit.

Political Stability: Political stability influences investor confidence. Positive developments and reforms in India or Malaysia can boost investor sentiment, resulting in increased demand for their respective currencies and an appreciation in value. On the other hand, political instability can trigger capital flight and negatively impact the currency’s value.

Implications of INR to MYR Exchange Rate Fluctuations

The volatility of the INR to MYR exchange rate has significant implications for individuals, businesses, and the broader economy:

Trade and Investment: Exchange rate fluctuations directly impact the cost of imports and exports, affecting the profitability of businesses engaged in cross-border trade. Stable exchange rates promote trade and investment by reducing uncertainty.

Travel and Tourism: Tourists and business travelers are impacted by the exchange rate. When the Indian Rupee depreciates against the Malaysian Ringgit, Indian travelers to Malaysia will find their purchasing power reduced, while Malaysian travelers to India will experience the opposite.

Remittances: Indian expatriates in Malaysia and Malaysian expatriates in India closely monitor the exchange rate for remittances. A favorable exchange rate can increase the value of remittances sent back home.

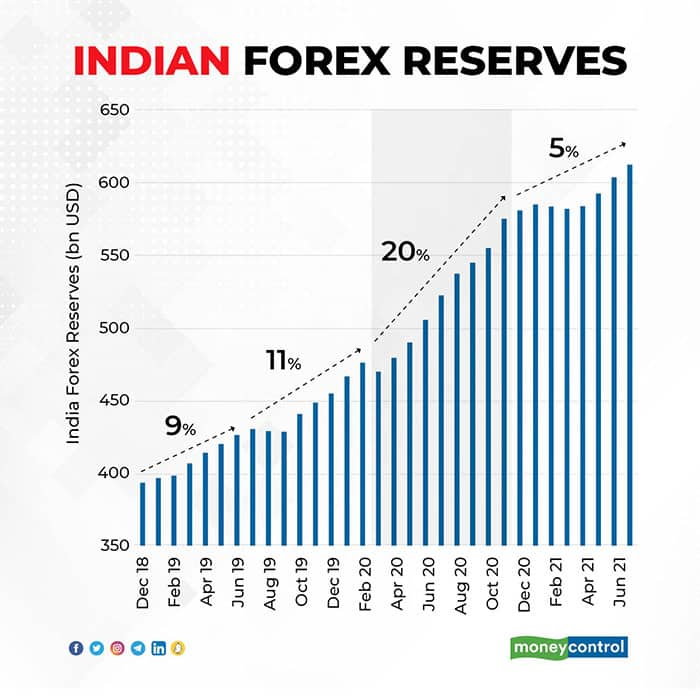

Image: www.moneycontrol.com

Optimizing Forex Transactions: A Smart Approach

Navigating currency exchange effectively requires a strategic approach to optimize the value of your transactions:

Monitor the Market: Stay informed about economic news and events that may impact the INR to MYR exchange rate. Tracking currency trends can help you identify favorable times to buy or sell.

Compare Rates: Don’t settle for the first exchange rate you come across. Compare rates offered by different banks and financial institutions to ensure you’re getting the best deal.

Utilize Online Platforms: Online currency exchange platforms often offer competitive rates and convenient transactions. Explore reputable platforms to compare rates and fees.

Consider Forward Contracts: Forward contracts allow you to lock in an exchange rate for a future date, mitigating the risk of unfavorable currency fluctuations.

Seek Expert Advice: If you’re dealing with large currency transactions, consulting a financial advisor or currency specialist is highly recommended. They can provide valuable insights and guide you through the process.

Indian Bank Forex Rates For Inr To Myr

https://youtube.com/watch?v=b430QbQFWA8

Conclusion

Understanding the Indian Bank forex rates for INR to MYR is crucial for engaging in international financial transactions. By staying informed about the factors influencing