<!DOCTYPE html>

Image: www.livemint.com

In the tumultuous waters of international finance, foreign exchange (forex) reserves serve as a vital lifeline for nations. For India, its forex reserves have played a pivotal role in safeguarding its economic stability and weathering financial storms.

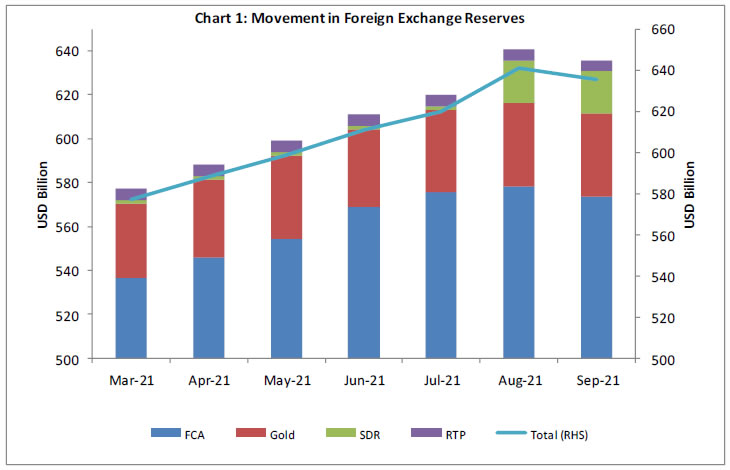

The term “forex reserves” refers to the assets held by a country’s central bank, typically in the form of currencies of other countries, gold, and Special Drawing Rights (SDRs). These reserves serve as a buffer against external shocks, allowing countries to meet their international payment obligations, stabilize their currencies, and defend their economies against speculative attacks.

India’s Forex Reserves: A Historical Perspective

India’s journey towards building substantial forex reserves began in the wake of the 1991 economic crisis. Faced with a severe balance of payments crisis, India undertook a series of economic reforms and sought IMF assistance. As part of these reforms, the government liberalized the foreign exchange market, paving the way for a gradual build-up of reserves.

Over the years, India’s forex reserves have grown steadily, reaching a record high of over $612 billion in April 2022. This growth has been driven by a combination of factors, including robust foreign direct investment, remittance inflows, and a relatively stable currency.

Uses of India’s Forex Reserves

India’s forex reserves are not merely a passive store of wealth but are actively utilized to manage the country’s financial stability and economic growth.

1. Stabilizing the Currency

Fluctuations in the global currency markets can pose a significant challenge for developing economies like India. Forex reserves provide a buffer against such fluctuations, allowing the Reserve Bank of India (RBI) to intervene in the market if necessary. By buying or selling foreign currencies, the RBI can help stabilize the rupee’s exchange rate and prevent excessive volatility.

Image: www.rbi.org.in

2. Meeting International Payment Obligations

India’s forex reserves are crucial for meeting the country’s international payment obligations, such as paying for imports of goods and services, servicing external debt, and making payments to foreign investors. By holding a sufficient level of reserves, India can ensure that it has the necessary resources to meet these obligations in a timely manner.

3. Defending Against Speculative Attacks

Speculative attacks on a country’s currency can lead to a rapid decline in its value, potentially triggering an economic crisis. Forex reserves provide a cushion against such attacks, allowing the RBI to intervene in the market and defend the rupee’s exchange rate.

4. Managing Exchange Rate Volatility

India’s forex reserves can be used to manage exchange rate volatility, which can arise due to global economic events or changes in domestic economic conditions. By releasing or absorbing foreign currencies into the market, the RBI can influence the supply and demand for the rupee, helping to curb excessive fluctuations.

Tips and Expert Advice for Managing Forex Reserves

Managing forex reserves effectively requires a combination of sound macroeconomic policies and prudent risk management strategies.

1. Diversify Reserve Assets

It is essential to diversify forex reserves across a range of assets, including currencies of different countries, gold, and SDRs. This diversification helps reduce the risk of losses in any single currency or asset class.

2. Maintain Adequate Reserve Levels

India’s forex reserve levels should be sufficient to cover at least 3-4 months of imports, ensuring that the country has enough resources to meet its international payment obligations and respond to external shocks.

3. Invest Reserves Prudently

Forex reserves should be invested prudently to maximize their returns while minimizing risk. Central banks often invest in low-risk, highly liquid assets, such as U.S. Treasury bonds.

FAQ on India’s Forex Reserves

Q: Why are forex reserves important?

Forex reserves are important for managing financial stability, meeting international payment obligations, defending against speculative attacks, and managing exchange rate volatility.

Q: How are forex reserves used?

Forex reserves are used to stabilize the currency, meet international payment obligations, defend against speculative attacks, and manage exchange rate volatility.

Q: How can we ensure efficient management of forex reserves?

Efficient management of forex reserves requires diversification of assets, maintaining adequate reserve levels, and investing reserves prudently.

India Forex Reserve Is Used When

Conclusion

India’s forex reserves play a pivotal role in ensuring the stability and growth of the Indian economy. By providing a buffer against external shocks and allowing the RBI to intervene in the foreign exchange market, forex reserves help stabilize the rupee, maintain economic stability, and boost investor confidence.

As India continues to navigate the dynamic global economic landscape, its forex reserves will continue to serve as a vital lifeline, safeguarding the country’s financial well-being and providing a foundation for sustainable economic growth.

Call to Action: Do you have any questions or thoughts on India’s forex reserves? Share your perspectives in the comments section below, and let’s engage in a discussion.