In the realm of Forex (Foreign Exchange) trading, where currency valuations fluctuate incessantly, the ability to interpret market movements and predict future price directions is paramount. Price action, the study of historical price data sans any indicators or technical oscillators, has emerged as a formidable strategy for discerning traders. By decoding the underlying patterns, trends, and reversals within price action, traders can gain a significant edge in the volatile Forex market.

Image: academy.shrimpy.io

Defining Price Action

Price action trading is the practice of analyzing raw price data without relying on complex indicators or technical tools. It involves examining candlestick patterns, trendlines, support and resistance levels, and volume to gauge market sentiment and identify profitable trading opportunities. Unlike indicator-based trading, which often lags behind price action, price action trading allows traders to anticipate market moves and react swiftly to prevailing market conditions.

Unveiling the Benefits of Price Action Trading

Proficient price action traders enjoy several distinct advantages in the cutthroat world of Forex trading:

-

Increased Precision: By directly studying price movements, traders can identify potential trading opportunities with greater accuracy, minimizing the risk of false signals.

-

Early Recognition: Price action analysis enables traders to spot market trends and reversals at an early stage, providing a crucial edge over traders who rely solely on lagging indicators.

-

Improved Discipline: Price action trading instills discipline and forces traders to rely on objective market data rather than potentially misleading technical indicators, reducing emotional decision-making.

Unveiling the Secrets of Price Action Trading

Mastering price action trading requires a deep understanding of key concepts and strategies:

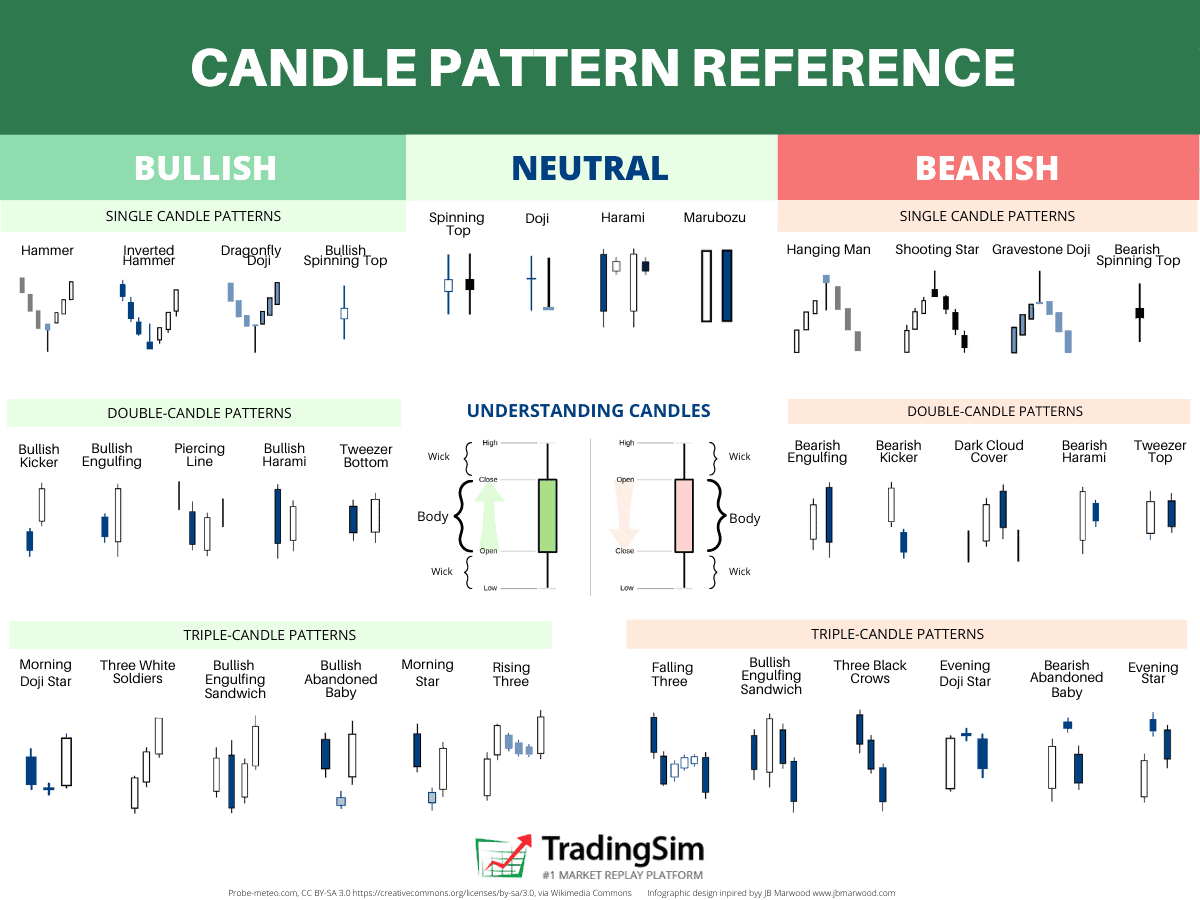

1. Candlestick Patterns: Candlesticks are graphical representations of price data over a specific timeframe. By recognizing and interpreting candlestick patterns, traders can decipher market sentiment and predict future price trajectories.

2. Trendlines: Trendlines are lines drawn connecting successive swing highs or lows, delineating the prevailing market trend. Identifying trendlines helps traders align their trades with the overall market momentum.

3. Support and Resistance Levels: Support and resistance levels are price points at which the market has repeatedly encountered difficulty breaking through. These levels can serve as potential reversal points or areas for placing stop-loss or take-profit orders.

4. Volume Analysis: Volume analysis measures the number of trades executed over a specific timeframe. High volume often accompanies significant market moves and can provide confirmation for trading decisions.

5. Risk Management: Risk management is pivotal in Forex trading. Price action analysis can help traders identify potential risk areas and implement appropriate risk management strategies, such as stop-loss orders and position sizing.

Embark on the Path to Price Action Mastery

Mastering price action trading is an ongoing journey that requires patience, dedication, and continuous learning. By combining theoretical knowledge with practical experience, traders can harness the power of price action to navigate the ever-changing Forex market and achieve consistent profits.

Image: suvagadapaw.web.fc2.com

In Forex Trading Best Price Action Stratergy