Immerse yourself in the riveting world of forex trading, where market fluctuations can generate both exhilaration and trepidation. As you embark on this financial adventure, it’s imperative to equip yourself with the tools that empower informed decision-making. Enter the Leledc SSRC indicator – a beacon of guidance in the often-choppy waters of the forex market.

Image: forexvspower.com

What is the Leledc SSRC Indicator?

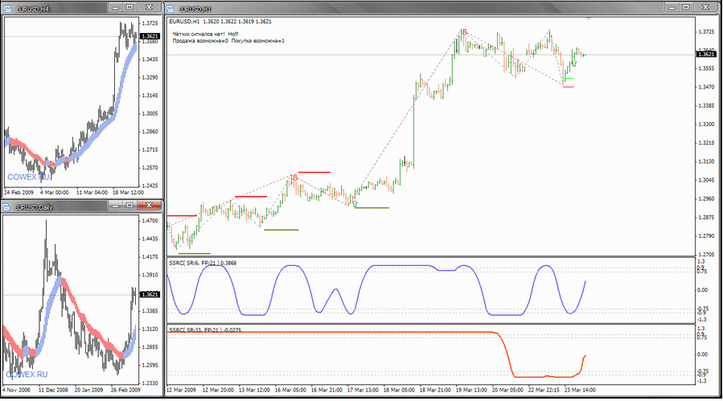

Conceived by the esteemed trader, Lefteris Ledakis, the Leledc SSRC (Seasonal Stochastic Relative Strength Currency) indicator is a technical analysis tool that harnesses the power of seasonal patterns and stochastic oscillators to provide invaluable insights into currency pair behavior. By deciphering these patterns, traders can discern potential market reversals and identify optimal entry and exit points.

How to Interpret the Leledc SSRC Indicator

The Leledc SSRC indicator oscillates between 0 and 100, with the midpoint at 50. When the indicator is above 50, it signifies that the base currency is strengthening against the quote currency, suggesting a potential uptrend. Conversely, values below 50 indicate that the base currency is weakening, implying a possible downtrend.

Beyond this basic interpretation, the indicator reveals additional nuances:

-

Overbought/Oversold Zones: Values close to 100 or 0 signal that the market is overbought or oversold, respectively, potentially heralding a reversal.

-

Crossovers: When the SSRC line crosses the 50 level, it often indicates a change in trend. A crossover from below to above suggests a bullish reversal, while a crossover from above to below suggests a bearish reversal.

How to Use the Leledc SSRC Indicator in Forex Trading

The Leledc SSRC indicator can be integrated into your trading strategy in several ways:

-

Trend Confirmation: Combine the SSRC with other trend-following indicators to confirm potential trends. If the indicators align, consider entering a trade in the indicated direction.

-

Trend Exhaustion: Identify overbought/oversold conditions using the SSRC. When the indicator reaches extreme levels, it may signal that the trend is losing momentum and a reversal could be imminent.

-

Trade Timing: Use the SSRC to identify potential trade entry or exit points. Enter trades when the indicator aligns with your trading bias, and exit trades when the indicator suggests a reversal.

Image: ufubipytas.web.fc2.com

How To Use Leledc Ssrc Forex Indicator

https://youtube.com/watch?v=6fbRZP3SSRc

Enhance Your Trading with the Leledc SSRC Indicator

Harness the power of the Leledc SSRC indicator to elevate your forex trading. Empowered with its insights, you can navigate the financial markets with greater confidence, make informed decisions, and unlock the potential for trading success. Join the ranks of traders who have embraced this invaluable tool and embark on a journey of financial empowerment.