Candlestick charts are a popular way to visualize price action in the foreign exchange (forex) market. Candlestick charts have a long history and have been used by traders for centuries.

Image: id.pinterest.com

Candlesticks provide a visual representation of four price points:

- Open

- Close

- High

- Low

Why use candlestick charts?

There are a number of reasons why candlestick charts are popular among forex traders.

Some of the benefits of candlestick charts include:

- Easy to read: Candlesticks are a graphical representation of price action, making them easy to understand and interpret.

- Versatile: Candlesticks can be used to identify trends, reversals, and support and resistance levels.

- Reliable: Candlesticks have been used by traders for centuries, and they have a proven track record of reliability.

How to interpret candlestick charts

The interpretation of candlestick charts is based on the color, size, and shape of the candlesticks.

Bullish candlesticks are green or white and have a higher close than open.

Bearish candlesticks are red or black and have a higher open than close.

The size of the candlestick indicates the amount of price movement that occurred during the period covered by the candlestick.

The shape of the candlestick provides information about the sentiment of the market.

For example, long green candlesticks indicate strong buying pressure, while short red candlesticks indicate strong selling pressure.

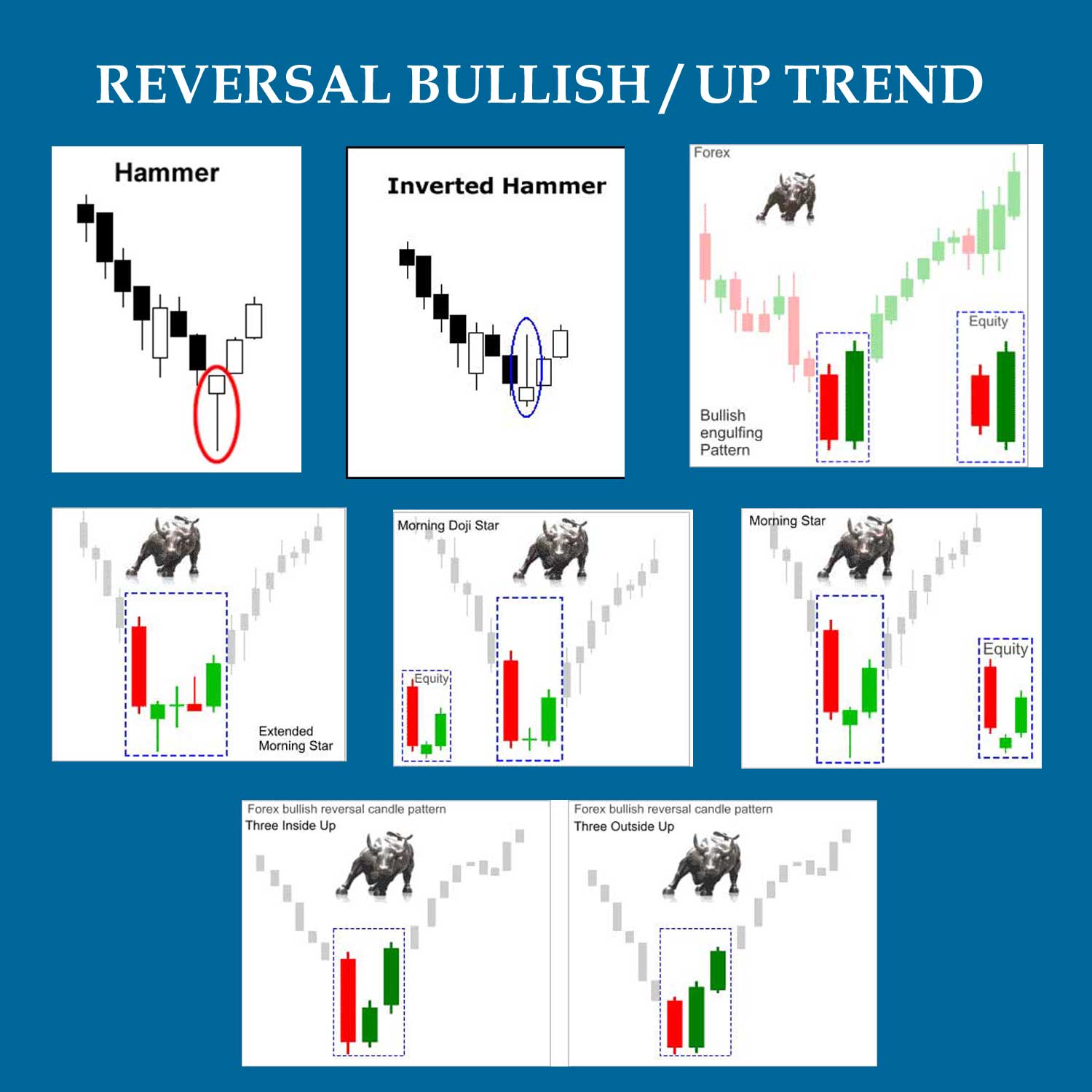

Most common candlestick patterns

There are a number of candlestick patterns that are commonly used by forex traders.

Some of the most popular candlestick patterns include:

- Bullish engulfing pattern

- Bearish engulfing pattern

- Hammer

- Hanging man

- Doji

Image: www.aiophotoz.com

Trading with candlestick charts

Candlestick charts can be used to develop a number of trading strategies.

One of the most popular strategies is to trade breakouts.

A breakout occurs when the price of an asset moves above a resistance level or below a support level.

Breakouts can be traded in either direction.

For example, a trader could buy an asset after it breaks above a resistance level or sell an asset after it breaks below a support level.

Tips for using candlestick charts

Here are a few tips for using candlestick charts in your forex trading:

- Use multiple time frames: Candlestick charts can be used on any time frame, from 1-minute charts to monthly charts.

- Combine candlestick charts with other technical indicators: Candlestick charts are a powerful tool, but they can be even more effective when used in conjunction with other technical indicators.

- Practice, practice, practice: The best way to learn how to use candlestick charts is to practice.

How To Read Candle Charts Forex

Conclusion

Candlestick charts are a powerful tool that can help forex traders make more informed trading decisions.

By understanding how to interpret candlestick charts, traders can identify trends, reversals, and support and resistance levels.

This information can be used to develop trading strategies that can help traders improve their profitability.

So, if you’re looking for a way to improve your forex trading, consider learning

Are you interested in learning how to read candle charts for forex trading?