In the world of online trading, Zerodha has become a formidable force, providing Indian investors with access to various financial markets. One such market that has piqued the curiosity of many is the foreign exchange market, popularly known as Forex. In this article, we will delve into the intricacies of Forex trading through Zerodha, exploring its feasibility, benefits, and limitations.

Image: www.makeupera.com

Zerodha and Forex Trading: A Symbiotic Alliance

Zerodha, being a broker primarily focused on the Indian equity markets, does not offer direct trading access to the global Forex markets. However, this gap is effectively bridged through its partnership with Sharekhan, a leading Forex broker in India. By leveraging this alliance, Zerodha clients can seamlessly access Forex trading platforms and benefit from the expertise of a specialized broker.

Understanding Forex: The Realm of Currencies

Forex, short for foreign exchange, is a decentralized global market where currencies are traded and exchanged. Unlike traditional stock markets, Forex trading operates 24 hours a day, five days a week, and involves buying and selling currency pairs with the motive of profiting from currency fluctuations.

In the Forex market, currency pairs are quoted in pips, where a pip represents the smallest price movement of a currency pair. Forex trading involves analyzing factors such as economic indicators, political events, and market sentiment to predict currency movements and capitalize on potential price differences.

Benefits of Forex Trading Through Zerodha

- Access to Global Market: Zerodha’s partnership with Sharekhan opens up the gateway to the vast global Forex market, expanding investment opportunities beyond traditional Indian markets.

- Professional Support: Sharekhan, as a dedicated Forex broker, provides exclusive support and guidance to Zerodha clients, assisting them with trading strategies, risk management techniques, and market analysis.

- Leveraged Trading: Forex trading through Zerodha allows traders to utilize leverage, magnifying their potential profits while also increasing their risk exposure. Leverage must be used cautiously to minimize losses.

Image: forexalertsystemreview.blogspot.com

Tips for Forex Trading Success

While Forex trading can be lucrative, it also carries inherent risks. Here are a few tips to enhance your chances of success:

- Educate Yourself: Gain a thorough understanding of Forex trading principles, risk management strategies, and market dynamics before venturing into live trading.

- Start with a Demo Account: Practice your trading strategies on a demo account using virtual funds to gain practical experience without risking real capital.

- Manage Your Risk: Establish clear risk management guidelines, including stop-loss orders and position sizing, to mitigate potential losses.

FAQs on Forex Trading Through Zerodha

Q: Is Forex trading legal in India?

A: Yes, Forex trading is legal in India as long as it is done through a regulated broker like Sharekhan.

Q: What is the minimum deposit required to start Forex trading through Zerodha?

A: The minimum deposit may vary depending on your account type and broker. Sharekhan offers a range of account types starting from a limited balance, making Forex trading accessible to a wide range of traders.

Q: Can I use technical analysis for Forex trading through Zerodha?

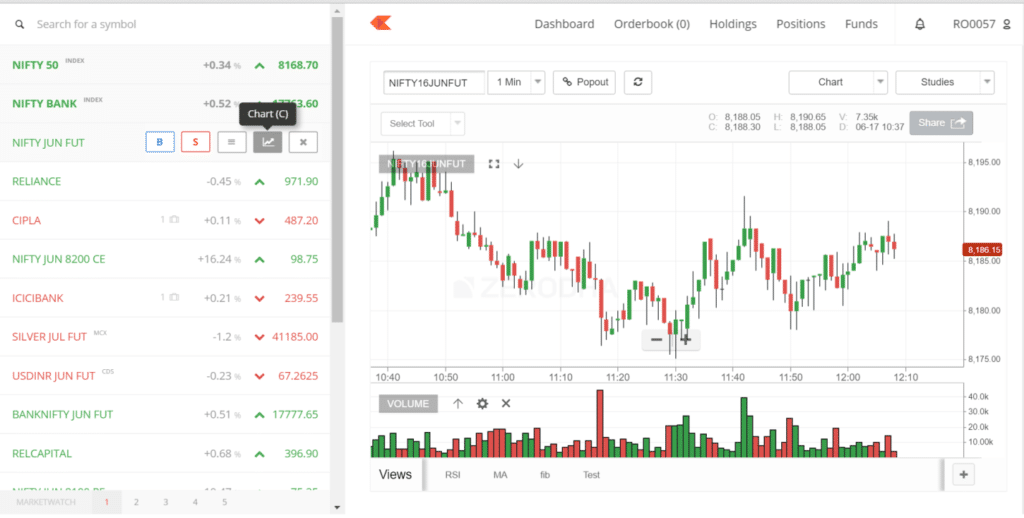

A: Yes, Zerodha’s Forex trading platform provides various technical analysis tools and indicators to help traders identify trading opportunities.

Can I Trade Forex Through Zerodha

Conclusion

Forex trading through Zerodha, made possible through its partnership with Sharekhan, presents a compelling opportunity for Indian investors to diversify their portfolios and explore the dynamic world of currency markets. By embracing our tips, seeking professional guidance, and practicing prudent risk management, you can increase your chances of success in this exciting and potentially lucrative realm. Are you ready to embark on the journey of Forex trading through Zerodha?