Introduction

Image: medium.com

The foreign exchange market, commonly known as forex, presents boundless opportunities for savvy traders seeking financial success. However, navigating its complexities and identifying prime trading conditions can be a daunting task. This comprehensive guide will divulge the intricacies of the forex market and empower you with actionable insights to recognize when the conditions are ripe for profitable trading. Whether you’re a seasoned pro or a novice eager to delve into the world of forex, this article will equip you with the knowledge to make informed decisions and maximize your trading potential.

Unveiling the Forex Market: A Gateway to Global Currency Exchange

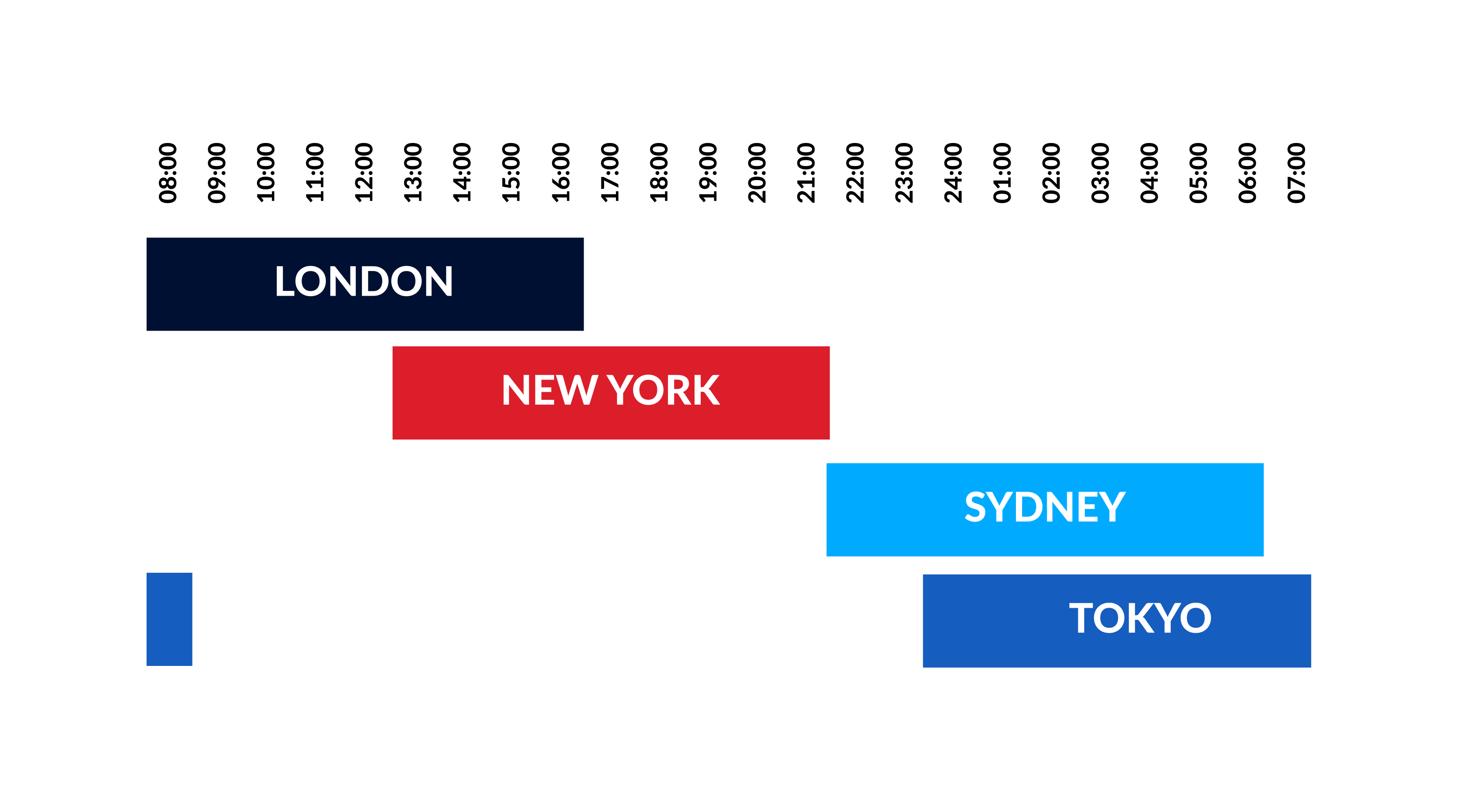

The forex market serves as a global hub where currencies are traded 24 hours a day, five days a week. Unlike traditional stock exchanges, forex trading is decentralized, conducted through an extensive network of banks, brokers, and other financial institutions. Its sheer size and liquidity make it an attractive market for traders seeking ample trading opportunities and favorable spreads.

Understanding the interplay of currency pairs is paramount in forex trading. Currency pairs represent the value of one currency relative to another. For instance, the EUR/USD pair indicates the number of US dollars required to purchase one euro. Traders capitalize on fluctuations in currency exchange rates, buying and selling currencies at strategic points to capture potential profits.

Identifying Favorable Market Conditions: Navigating the Forex Landscape

1. Economic Data and Market News:

The forex market is highly sensitive to economic data and market news. Traders pay close attention to economic indicators such as GDP growth, inflation rates, unemployment figures, and central bank interest rate decisions. These data releases can significantly impact currency valuations and create opportunities for profitable trades.

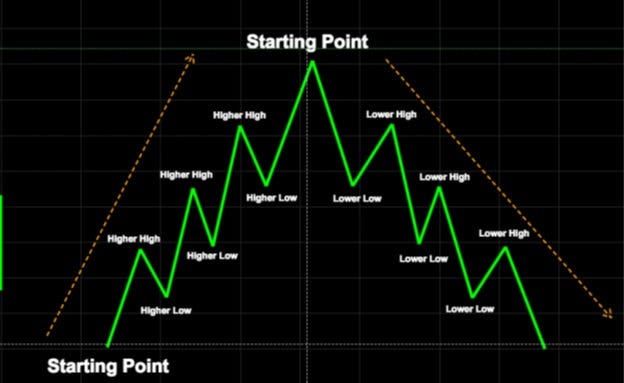

2. Technical Analysis: Charting the Market’s Movements

Technical analysis is a widely employed method of forecasting market trends by analyzing historical price data. Technical indicators, such as moving averages, support and resistance levels, and candlestick patterns, provide insights into potential price movements and help traders identify optimal entry and exit points.

3. Fundamental Analysis: Delving into the Market’s Underlying Factors

Fundamental analysis involves assessing the economic and political factors that influence currency values. Traders examine factors such as a country’s economic outlook, political stability, and trade policies to gauge the overall strength and stability of a particular currency. Fundamental analysis complements technical analysis, providing a holistic view of the market’s drivers.

4. Volatility and Volume:

Volatility measures the extent to which a currency’s exchange rate fluctuates. High volatility presents both opportunities and risks, as currency pairs with significant price swings can yield substantial profits but also expose traders to greater potential losses. Volume refers to the number of currency units traded over a specific period. High volume indicates increased market activity and liquidity, often associated with favorable trading conditions.

5. Seasonality:

Forex markets exhibit seasonal patterns that can impact trading conditions. Certain currencies tend to perform better during specific times of the year, influenced by factors such as tourism, holidays, and economic events. Seasonality analysis helps traders anticipate potential trend reversals and capitalize on predictable price movements.

Image: naga.com

How To Know When The Forex Market Is Good

Conclusion: Mastering the Forex Market’s Ebb and Flow

Deciphering the intricacies of the forex market is a key element of successful trading. By harnessing the insights provided in this guide, you can develop a comprehensive understanding of the market’s dynamics and identify when conditions are ideal for profitable trades. Economic data, market news, technical analysis, and fundamental analysis provide valuable tools for gauging market sentiment and uncovering trading opportunities. Remember, the forex market is a fluid and ever-changing environment; constant monitoring, adaptability, and a disciplined approach are essential for maximizing your chances of success. Embrace the challenge of the forex market, and embark on a rewarding journey towards financial empowerment.