Embarking on the path to becoming a funded forex trader can be an exhilarating journey, paving the way for financial freedom and independence. In this article, we’ll delve into the realm of funded forex trading, exploring its intricacies, benefits, and the steps involved in securing funding.

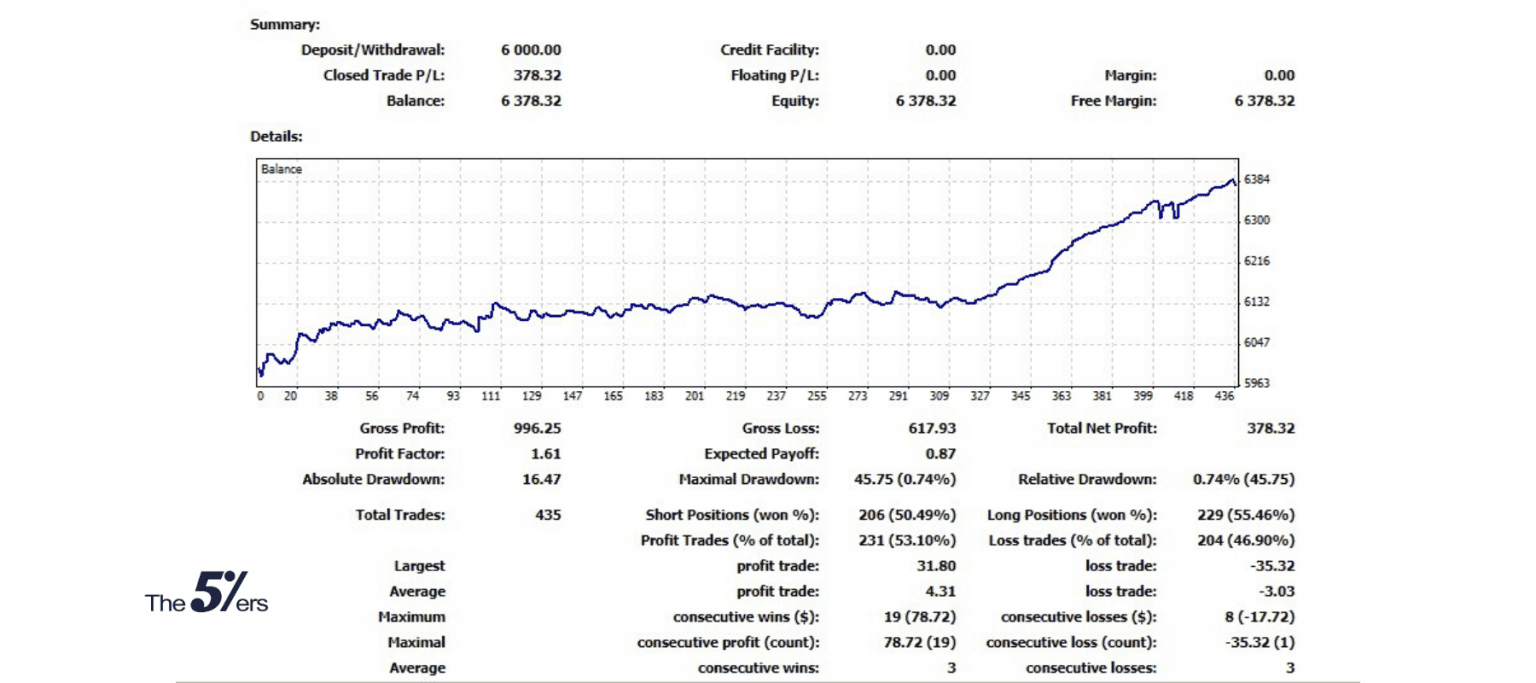

Image: the5ers.com

Introduction to Funded Forex Trading

Funded forex trading involves being provided with a sum of capital by a financial institution or brokerage firm, known as a prop firm, to trade forex (foreign exchange) markets. Traders who demonstrate consistent profitability and adhere to strict risk management guidelines have the potential to earn attractive returns. Unlike traditional retail forex trading, where traders use their own funds, funded traders operate with the firm’s capital, creating the possibility for higher leverage and greater earning potential.

Advantages of Becoming a Funded Forex Trader

The allure of funded forex trading lies in its numerous advantages:

- Elimination of Trading Capital Risk: As the prop firm provides the trading capital, funded traders do not risk their own funds in the event of losses.

- Increased Leverage: Funded forex traders often have access to higher levels of leverage compared to retail traders, amplifying potential profits while also amplifying risks.

- Opportunity for Career Advancement: Excelling as a funded forex trader can lead to exciting career opportunities within the financial industry.

- Earning Potential: Successful funded forex traders have the potential to earn substantial returns based on their trading performance.

The Key to Success: Passing the Evaluation Process

Securing a funded trading account typically involves passing a rigorous evaluation process set by the prop firm. These evaluations usually encompass a series of live trading assessments or demo account challenges, designed to assess traders’ skills, risk management, and adherence to the firm’s guidelines. Consistency in profitability and controlled risk-taking are pivotal to passing these evaluations.

Image: www.youtube.com

Types of Funded Forex Programs

To cater to diverse trader needs, prop firms offer a range of funded forex programs:

- Evaluation-Based Funded Accounts: These programs require passing a live trading evaluation, providing successful traders with access to a funded trading account.

- Profit-Sharing Arrangements: Under these programs, traders share a percentage of their profits with the prop firm, typically providing traders with higher capital in exchange for a portion of their earnings.

- Subscription-Based Funded Accounts: Traders pay a subscription fee to access a funded trading account, offering greater flexibility and reduced performance pressure compared to evaluation-based programs.

Choosing the Right Prop Firm

Navigating the myriad of prop firms available requires careful research and consideration:

- Reputation and Track Record: Opt for firms with a proven reputation for transparency, reliability, and trader support.

- Trading Platform and Market Access: Ensure the prop firm provides access to a reputable trading platform and desirable market conditions.

- Evaluation Process: Thoroughly review the evaluation process, including the evaluation period, trading requirements, and profit targets.

- Capital and Leverage Offered: Consider the amount of trading capital and leverage offered, ensuring alignment with your trading style and risk tolerance.

Become A Funded Forex Trader

Conclusion

Becoming a funded forex trader presents a compelling opportunity to capitalize on the lucrative world of financial markets. By understanding the mechanics, benefits, and evaluation process involved, aspiring traders can take the first step towards securing funding and unlocking the potential for financial success. Remember, the path to funded trading requires dedication, perseverance, and unwavering adherence to sound risk management principles.