Introduction

In the tumultuous world of currency markets, the forex spot rate stands as a pivotal beacon, guiding traders and businesses alike. It represents the real-time exchange rate between two currencies, offering a snapshot of the currency market’s relentless dance. Understanding how to get the best forex spot rate is paramount for navigating this complex and rewarding landscape.

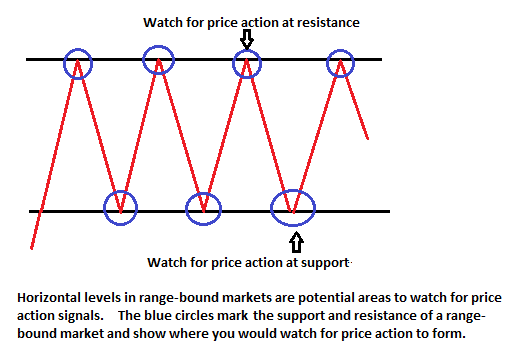

Image: s3.amazonaws.com

Understanding the Forex Spot Rate

The forex spot rate, often referred to as the spot rate or simply “spot,” is the exchange rate at which two currencies are traded for immediate delivery. Unlike forwards or futures contracts, which set the exchange rate for a future date, spot rates are for transactions that settle within two business days.

The spot rate is influenced by a multitude of factors, including economic indicators, political events, interest rate differentials, and supply and demand dynamics. Therefore, it fluctuates constantly, making it crucial for traders to stay abreast of market conditions and understand how to secure the most favorable rates.

Sources for Forex Spot Rates

There are several ways to obtain forex spot rates:

- Brokers: Forex brokers are intermediaries who provide access to the spot market. They offer competitive spot rates, often with low spreads (the difference between the bid and ask price).

- Banks: Traditionally, banks have been the primary providers of forex services. While they may not always offer the most competitive rates, banks provide a safe and regulated platform for forex transactions.

- Online Platforms: Numerous online platforms, such as Reuters and Bloomberg, provide real-time forex spot rates. These platforms offer various tools and analytics to help traders track market movements and make informed decisions.

Tips for Getting the Best Forex Spot Rate

- Shop Around: Don’t fall prey to the first spot rate you encounter. Compare quotes from multiple brokers or platforms to secure the most favorable rate.

- Consider Spreads: Pay attention to the spread offered by brokers. A narrow spread indicates a more competitive rate.

- Monitor Market Conditions: Keep an eagle eye on economic indicators and political events that might affect currency values. Timely responses to market changes can lead to substantial savings.

- Execute Large Trades Strategically: Breaking down large trades into smaller orders can help mitigate risk and secure better average rates.

- Use Market Orders Cautiously: Market orders are executed immediately at the prevailing spot rate. However, during periods of high volatility, market orders may not yield the intended rate. Consider limit orders, which allow you to set a specific price for execution.

Image: www.awesomefintech.com

How To Get Forex Spot Rate

Conclusion

Mastering the art of obtaining the best forex spot rate is a journey that requires a blend of knowledge, diligence, and strategic thinking. By exploring the different sources for spot rates, employing the tips outlined above, and staying vigilant about market conditions, you can elevate your forex trading or business dealings, maximizing the value of each transaction and steering your ventures towards greater success. Remember, the forex spot rate is a window into the ever-changing global economy, and harnessing its nuances can open doors to untapped opportunities and drive your financial aspirations forward.