Have you ever wondered how much money you could potentially make or lose on a forex trade? It’s not always easy to predict, especially when you’re dealing with fluctuating currency values and the complexities of leverage. But there’s a magic tool that can help you navigate these uncertainties: the forex pip calculator. This handy tool is a must-have for any forex trader who wants to understand the true cost and potential rewards of their trades.

Image: www.babypips.com

Think of the pip calculator as your trusted financial advisor, whispering in your ear, “Hey, if you move this amount of money in this direction, here’s what you stand to gain or lose.” But unlike a human advisor, the pip calculator is always objective, and it never charges a fee. So, let’s delve deeper into the world of pips and explore how a pip calculator can transform your forex trading strategy.

What is a Pip?

Before we explore the intricacies of the pip calculator, we need to understand its basic building block: the pip. Pip stands for “point in percentage” and represents the smallest unit of change in an exchange rate. It’s the tiny, albeit powerful, fluctuation that can determine the success or failure of your trade.

Imagine you’re trading the EUR/USD pair. The exchange rate is currently 1.1000. A one-pip movement in the EUR/USD means the exchange rate has changed to 1.1001 or 1.0999. For most currency pairs, a pip is equal to 0.0001. However, for pairs involving the Japanese yen (JPY), a pip is usually 0.01.

Why Pips Matter

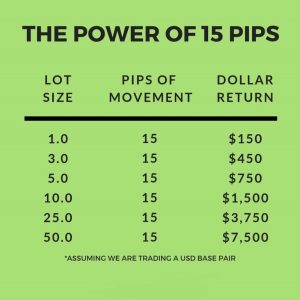

Pips are the currency of the forex market. They determine your profit or loss. The more pips you gain on a trade, the more money you make. Conversely, the more pips you lose, the greater your losses will be. This is where the pip calculator comes in – it helps you translate these tiny pip movements into real-world financial impact.

Understanding the Pip Calculator

At its core, a pip calculator is a simple tool that calculates the value of a pip based on the size of your trade and the current exchange rate. The formula is relatively straightforward:

Pip Value = (Pip Size / Exchange Rate) * Trade Size

Let’s break this down:

- Pip Size: As we discussed, for major currency pairs, the pip size is usually 0.0001.

- Exchange Rate: This is the current value of the currency pair you’re trading.

- Trade Size: The total amount of money you’re investing in the trade, usually expressed in the base currency.

Image: www.newtraderu.com

Example: The EUR/USD Trade

Imagine you’re trading the EUR/USD pair, and the current exchange rate is 1.1000. You’re trading 10,000 units of the base currency (EUR). Let’s calculate the pip value:

Pip Value = (0.0001 / 1.1000) * 10,000 = $0.91

This means that for every pip the EUR/USD moves in your favor, you’ll earn $0.91. Conversely, if the price moves against you, you’ll lose $0.91 per pip.

Benefits of Using a Pip Calculator

Here are some of the key advantages of using a pip calculator:

- Helps in Risk Management: The calculator allows you to understand the potential profit or loss of a trade, enabling you to set appropriate stop-loss orders and manage your risk effectively.

- Determines Trade Size: You can use the calculator to determine the optimal trade size based on your risk tolerance and account balance.

- Improves Trading Decisions: By understanding the value of each pip, you can make more informed decisions about which trades to enter and exit at the right time.

- Saves Time and Effort: Instead of manually calculating pip values, you can simply input your trade parameters into a pip calculator and instantly get the results.

Advanced Pip Calculator Features

While basic pip calculators offer essential functionalities, some advanced calculators offer additional features:

- Leverage Calculation: They allow you to factor in leverage, which can significantly magnify your profits or losses. Understanding leverage is crucial for managing risk.

- Profit/Loss Calculation: Some calculators can even calculate your potential profit or loss based on the number of pips you’re aiming for.

- Historical Data Analysis: Advanced calculators may provide historical data analysis tools to track pip movements and spot potential trends.

Finding the Right Pip Calculator

There are countless pip calculators available online, both free and paid. You can easily find them by searching for “forex pip calculator” on Google or through online forex trading platforms.

When choosing a calculator, consider the following factors:

- Ease of Use: It should be simple and straightforward to operate.

- Accuracy: Make sure it provides accurate calculations based on real-time market data.

- Additional Features: Explore the additional features offered by different calculators to determine if they meet your specific needs.

Beyond the Calculator: Understanding Pip Movements

While the pip calculator is a vital tool, remember that it’s just one part of the equation. To truly master the forex market, you need to understand the factors that influence pip movements:

- Economic News and Events: Major economic releases, such as interest rate announcements or GDP reports, can significantly impact currency values and influence pip movements.

- Political Events: Political instability, elections, or policy changes can also affect currency valuations and lead to unpredictable pip movements.

- Market Sentiment: Investor sentiment, driven by news and economic indicators, plays a crucial role in determining the direction of currency pairs and, consequently, pip movements.

- Technical Analysis: Technical indicators and chart patterns can help you identify potential trends and predict future pip movements.

Forex Pip Calc

Conclusion

The pip calculator is an indispensable tool for forex traders as it provides valuable insights into the potential profit or loss of a trade. By understanding the value of each pip, you can make more informed decisions, manage your risk effectively, and ultimately improve your trading performance.

However, it’s essential to remember that the pip calculator is just one piece of the puzzle. Developing a comprehensive understanding of forex trading involves mastering technical analysis, economic factors, and market sentiment. So, armed with your new understanding of pips and the pip calculator, go out there and explore the exciting world of forex trading!