Amidst the ever-evolving landscape of the foreign exchange (forex) market, the direct remittance payment method has emerged as a cornerstone of streamlined and secure international transactions. This innovative approach offers significant benefits and unparalleled convenience to businesses and individuals alike, making it an indispensable tool in today’s interconnected financial ecosystem.

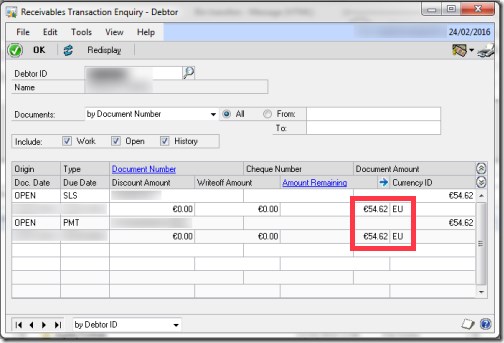

Image: timwappat.info

Unveiling the Essence of Direct Remittance Payments

Direct remittance payments represent a highly effective and efficient mechanism for transferring funds across borders. In essence, this method involves the direct transfer of funds from a sender’s account to a recipient’s account, circumventing the traditional intermediary processes associated with wire transfers or check payments. This streamlined approach not only expedites the delivery of funds but also eliminates the potential for delays, errors, and hefty fees often encountered in other remittance methods.

Benefits Galore: Unlocking the Advantages of Direct Remittance Payments

The direct remittance payment method holds a plethora of advantages, propelling it to the forefront of preferred payment channels in the forex market.

1. Lightning-Fast Speed: Unlike traditional methods, direct remittances are lightning-fast, enabling funds to be transferred in real-time or within a matter of hours. This instantaneous execution eliminates the anguish of waiting periods, providing both senders and recipients immediate access to funds.

2. Enhanced Security: Direct remittance payments are architected on secure rails, ensuring the utmost protection of financial information and transaction details. Several layers of encryption safeguard sensitive data, minimizing the risk of fraud and unauthorized access.

3. Reduced Costs: By bypassing intermediaries and their associated fees, direct remittances offer a cost-effective alternative to conventional money transfer methods. The absence of intermediary charges significantly lowers the overall cost of transactions, benefiting both senders and recipients.

4. Global Reach: The direct remittance payment method transcends geographical boundaries, facilitating seamless transfers to virtually any corner of the globe. This global connectivity empowers businesses to expand their reach and individuals to remit funds to loved ones abroad with ease.

5. Real-Time Tracking: Direct remittance payments provide real-time tracking capabilities, offering peace of mind to both parties involved. Senders can monitor the progress of their transfers, while recipients are notified as soon as funds are credited to their accounts.

Navigating the Nuances: Understanding the Process of Direct Remittance Payments

Initiating a direct remittance payment is a straightforward process, typically involving a few simple steps:

1. Enrollment: To initiate direct remittances, both senders and recipients must enroll with a participating financial institution or licensed remittance service provider.

2. Registration: After enrollment, the sender registers the recipient’s account details, including their name, account number, and destination bank.

3. Initiation: The sender initiates a transfer request, specifying the amount and currency to be transferred.

4. Verification: The sender’s financial institution verifies the transfer details and executes the transaction.

5. Delivery: Funds are transferred directly to the recipient’s account, as per the specified delivery timeframe.

Image: affairscloud.com

Direct Remittance Payment Method In Forex Transaction

Conclusion: A Path to Seamless Forex Transactions

In the digital age, the direct remittance payment method has emerged as an indispensable component of the forex market. Its lightning-fast execution, enhanced security, reduced costs, global reach, and real-time tracking capabilities have revolutionized the way businesses and individuals conduct international financial transactions. As technology continues to advance, the direct remittance payment method will undoubtedly continue to evolve, offering even greater convenience and efficiency in the years to come.