Introduction

Carrying large amounts of cash while traveling abroad can be risky and inconvenient. As a result, many travelers opt to use forex cards, which offer a safe and convenient way to make withdrawals and payments overseas. However, it’s important to be aware of the withdrawal charges that may apply when using a forex card in Thailand. In this article, we’ll explore these charges in detail, providing valuable information for travelers considering using a forex card for their Thailand trip.

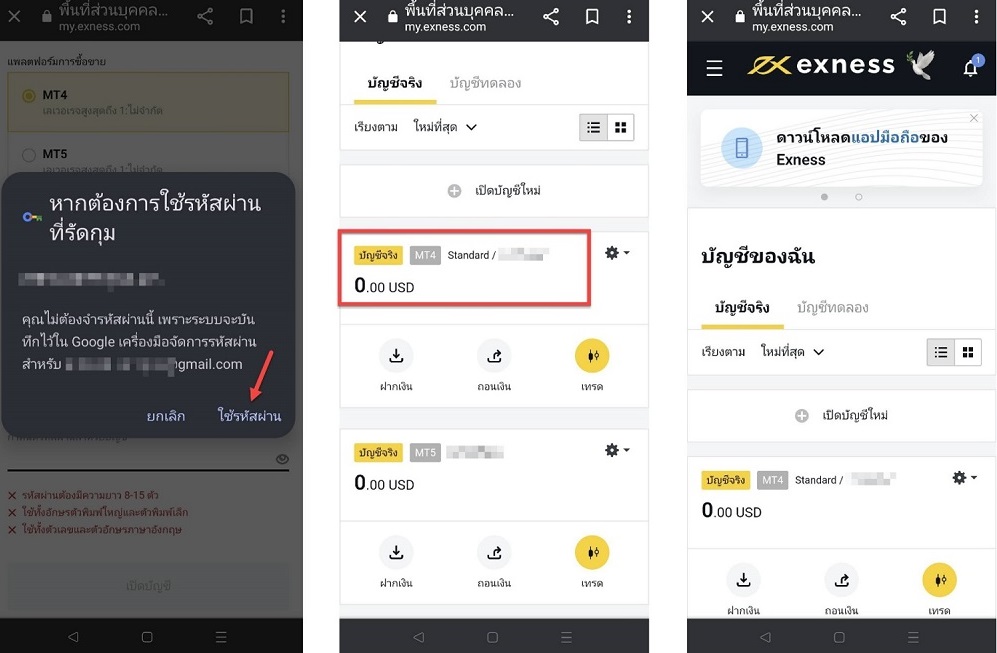

Image: unickefxtrading.blogspot.com

Understanding Forex Card Withdrawal Charges

Forex cards, also known as multi-currency cards, are prepaid cards that allow users to hold and convert multiple currencies in a single account. This eliminates the need to exchange physical currency, which can save time and often result in more favorable exchange rates. However, forex card providers typically charge fees for certain transactions, such as withdrawals and currency conversion.

Withdrawal Charges in Thailand

When using a forex card to withdraw funds from an ATM in Thailand, two main fees may apply:

- ATM Withdrawal Fee: This is typically a flat fee charged by the ATM operator. The fee can vary depending on the ATM’s location, type, and network.

- Forex Card Issuer Fee: This is an additional fee charged by the forex card provider for the currency conversion and withdrawal transaction. The fee is typically a percentage of the transaction amount.

Factors Affecting Withdrawal Charges

The withdrawal charges for using a forex card in Thailand can be influenced by several factors, including:

- Card Type: Different forex card providers offer different cards with varying fee structures. Some cards may have lower withdrawal fees than others.

- Bank: The bank that operates the ATM you use can also affect the withdrawal charges. Some banks have higher ATM fees than others.

- Location: ATM fees may vary depending on the location of the ATM. ATMs in remote or tourist areas tend to have higher fees.

- Amount Withdrawn: Some forex card providers charge a flat fee per withdrawal, while others charge a percentage of the amount withdrawn. Withdrawing larger amounts may result in higher fees.

Image: thaibrokerforex.com

Minimizing Withdrawal Charges

To minimize withdrawal charges when using a forex card in Thailand, consider the following tips:

- Choose a Forex Card with Low Fees: Compare different forex cards and choose one that offers low ATM withdrawal fees.

- Use ATMs Operated by Your Card Provider: If possible, use ATMs operated by the bank that issued your forex card. This may eliminate or reduce the ATM withdrawal fee.

- Withdraw Larger Amounts Less Frequently: Withdrawing less frequently, but larger amounts, can help reduce the overall fees compared to multiple small withdrawals.

- Consider Using a Currency Exchange Instead: If you anticipate making several withdrawals, it may be more cost-effective to exchange your currency at a currency exchange before traveling.

Forex Card Withdrawal Charges In Thailand

Conclusion

Forex cards can be a convenient and secure way to manage your finances while traveling in Thailand. However, it’s essential to be aware of the potential withdrawal charges to avoid unpleasant surprises. By understanding how these charges work and implementing cost-saving strategies, travelers can minimize their expenses and enjoy a hassle-free vacation in the Land of Smiles.