In the intricate world of modern finance, financial management is an indispensable pillar for corporate vitality and sustainability. It involves the judicious handling of financial resources to optimize performance, mitigate risks, and propel growth. Within this domain, the CS Professional Financial Treasury & Forex Management certification stands as a testament to a professional’s mastery in this dynamic discipline.

Image: www.lionkart.com

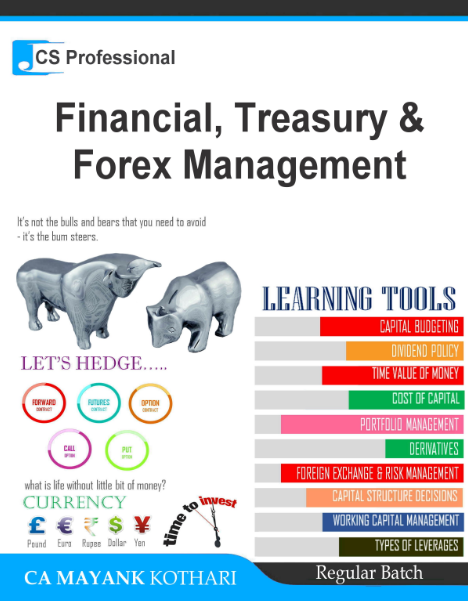

The CS Professional Financial Treasury & Forex Management certification empowers professionals with a comprehensive toolkit to navigate the complexities of corporate financial management and currency exchange operations. It is a distinguished qualification that bridges the gap between theoretical knowledge and practical expertise, arming individuals with the skills to make informed decisions that safeguard the financial health of their organizations.

Understanding Financial Treasury Management

Financial treasury management encompasses a wide array of responsibilities, including:

- Cash flow management: Ensuring the availability of funds to meet operating expenses, investments, and debt obligations.

- Investment management: Determining the optimal allocation of surplus funds to maximize returns while balancing risk.

- Risk management: Identifying and mitigating financial risks, such as interest rate fluctuations and currency volatility.

- Financial planning and analysis: Forecasting financial performance, budgeting, and developing strategies for long-term growth.

Exploring the Realm of Forex Management

Forex management, an integral aspect of financial treasury management, deals with foreign exchange (forex) transactions. It involves:

- Currency trading: Buying and selling currencies to facilitate international business transactions and manage currency risk.

- Hedging forex exposure: Using financial instruments, such as forward contracts and options, to protect against adverse currency fluctuations.

- Managing forex reserves: Managing the reserves of foreign currencies held by governments and central banks to influence exchange rates.

Enhancing Corporate Performance through Effective Financial Treasury & Forex Management

CS Professional Financial Treasury & Forex Management empowers professionals to enhance corporate performance through:

- Reduced financial risks: Mitigating risks associated with cash flow, investments, and forex transactions ensures financial stability.

- Optimized resource allocation: Efficient treasury and forex management frees up funds for strategic investments and growth initiatives.

- Increased operational efficiency: Automating treasury and forex operations streamlines processes and reduces operational costs.

- Improved decision-making: Informed financial and forex decisions supported by data analysis contribute to better outcomes.

- Competitive advantage: Mastery of financial treasury and forex management provides organizations with a competitive edge in global markets.

Image: www.bedicreative.com

The Value of the CS Professional Financial Treasury & Forex Management Certification

The CS Professional Financial Treasury & Forex Management certification is a highly sought-after qualification that:

- Demonstrates expertise: It serves as a credential that verifies a professional’s deep understanding of financial treasury and forex management.

- Enhances credibility: It boosts the credibility of professionals in the financial industry, earning them the respect of peers and clients.

- Provides a competitive edge: It distinguishes professionals in a competitive job market, enhancing their career prospects.

- Promotes continuous learning: The certification emphasizes the importance of ongoing education, ensuring professionals stay abreast of industry advancements.

- Supports professional growth: It opens doors to leadership and advisory roles, enabling professionals to make a significant impact on corporate financial health.

Cs Professional Financial Treasury & Forex Management

Conclusion: A Catalyst for Financial Success

The CS Professional Financial Treasury & Forex Management certification is an unparalleled resource for professionals seeking to elevate their skills in corporate financial management and forex operations. Its emphasis on practical knowledge and strategic thinking empowers professionals to drive performance, mitigate risks, and contribute to the sustainable growth of their organizations. By embracing the principles of sound financial treasury and forex management, professionals can secure a competitive advantage and unlock the potential for enduring financial success.