Introduction

In the dynamic world of forex trading, cross rates play a pivotal role in determining the exchange rates between two currencies not directly paired with each other. Understanding cross rates empowers traders with the knowledge to navigate the complex forex market adeptly, identify profitable opportunities, and maximize their returns. This comprehensive guide delves into the intricacies of cross rates, shedding light on their significance, calculation, and practical applications in forex trading.

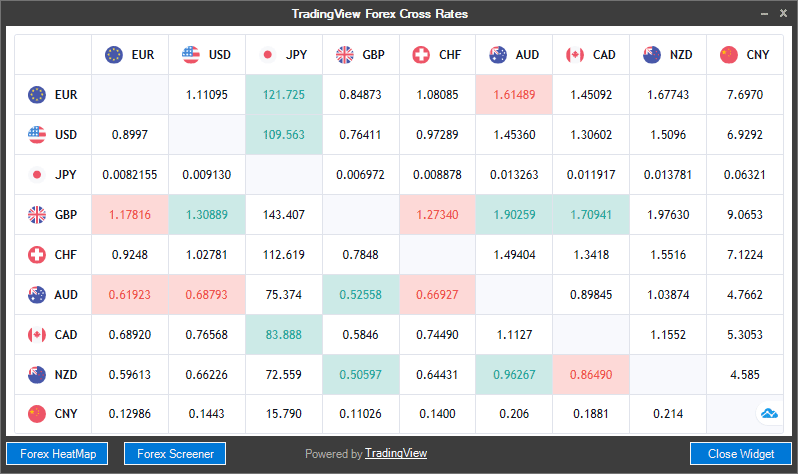

Image: clickalgo.com

Cross Rates: A Conceptual Overview

A cross rate is an exchange rate that compares the value of two currencies not directly paired with each other. Unlike direct exchange rates that pit two currencies against each other (e.g., EUR/USD), cross rates involve a third currency as an intermediary. For instance, to determine the EUR/JPY cross rate, traders would first need to convert EUR to USD (EUR/USD) and then USD to JPY (USD/JPY) and multiply the two exchange rates.

Importance of Cross Rates in Forex Trading

Cross rates are highly valuable in forex trading for several reasons. First, they allow traders to expand their trading horizons by enabling them to trade currency pairs that may not have a direct exchange rate available. Secondly, cross rates can provide a competitive advantage by identifying arbitrage opportunities, where traders can capitalize on price discrepancies between different currency pairs. Additionally, understanding cross rates assists traders in managing risk effectively, as correlated currency pairs can impact the profitability of trades involving cross rates.

Calculating Cross Rates

Calculating cross rates is a straightforward process that utilizes the formula:

Cross Rate = (Direct Exchange Rate A / Direct Exchange Rate B)

For example, let’s assume the following exchange rates:

-

EUR/USD = 1.1725

-

USD/JPY = 109.15

To calculate the EUR/JPY cross rate, we apply the formula:

EUR/JPY Cross Rate = (1.1725 / 109.15) = 0.01075

Therefore, the EUR/JPY cross rate is 0.01075, implying that 1 Euro is equivalent to 107.50 Japanese Yen.

Image: app.e-jmsb.id

Practical Applications in Forex Trading

Cross rates find practical applications in various aspects of forex trading. They enable traders to:

-

Trade currency pairs with limited direct quotes, thereby diversifying their portfolios.

-

Identify arbitrage opportunities by comparing cross rates with direct exchange rates.

-

Manage risk effectively by considering currency correlations across cross rates.

-

Make informed decisions about cross currency trades, considering the impact of underlying economic factors and market sentiment.

Historical Context and Trends

Cross rates have evolved alongside the development of the forex market. Over the years, technological advancements have facilitated the swift calculation and dissemination of cross rates, empowering traders with real-time data and analytics. Cross rates have also witnessed fluctuations in their values due to global economic events, central bank decisions, and geopolitical factors, impacting the profitability of cross currency trades. Staying abreast of these factors is crucial for successful cross rate trading.

Cross Rate In Forex Exchange

Conclusion

Mastering cross rates is an essential skill for forex traders seeking to maximize their profits and navigate the complexities of the currency market. By understanding the calculation and significance of cross rates, traders can expand their trading options, identify profitable opportunities, and manage risk effectively. In an ever-evolving forex market, embracing the intricacies of cross rates provides traders with a competitive edge and unlocks the potential for enhanced returns.