As a fervent Forex trader, I’ve often found myself enthralled by the intricacies of leverage ratios. These financial multipliers amplify both the potential profits and risks associated with every trade. Embark on this comprehensive guide as we delve into the world of leverage ratios, empowering you with the knowledge to master this indispensable tool.

Image: fcsapi.com

Unveiling Leverage: A Double-Edged Sword

Comprehending Leverage

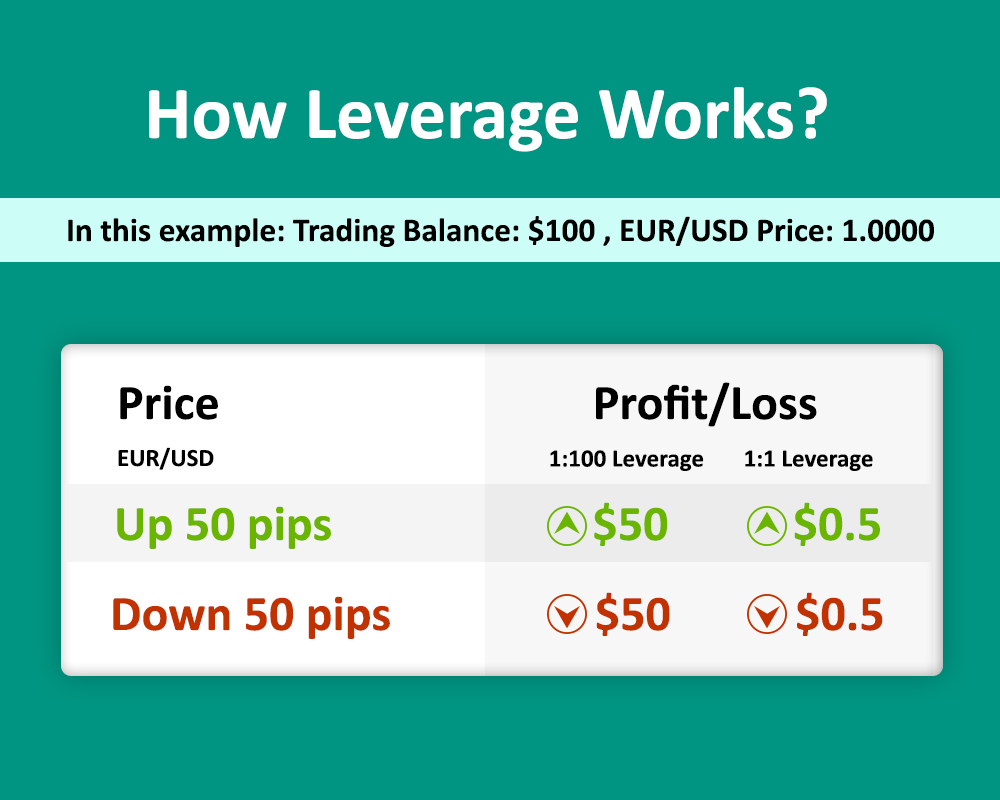

Leverage, in the realm of Forex trading, functions as a double-edged sword. It amplifies not only potential gains but also potential losses. By tapping into borrowed funds, traders can magnify their buying power and increase their exposure to the market. However, this amplified exposure demands a thorough understanding of risk management, as losses can be equally amplified.

Exploring Common Leverage Ratios

1:100 Leverage

1:100 leverage is a widely adopted ratio, indicating that for every $1 of equity, a trader can trade up to $100 worth of currency pairs. This magnifies both profit potential and risk exposure by a hundred times.

1:200 Leverage

1:200 leverage offers even greater amplification, allowing traders to control $200 worth of currency pairs for every $1 of equity. While it amplifies potential profits, the risk exposure is also magnified accordingly, requiring cautious risk management.

Image: app.jerawatcinta.com

1:500 Leverage

1:500 leverage is considered a high leverage option, permitting traders to trade $500 worth of currency pairs for every $1 of equity. This extreme amplification carries substantial risk, suitable only for experienced traders with robust risk management strategies.

Navigating Leverage Trends

Staying abreast of the latest trends in leverage usage is crucial for informed trading decisions. Recent studies indicate a shift towards lower leverage ratios as regulatory bodies globally impose tighter restrictions on the excessive use of leverage.

Harnessing Expert Insights

Tips for Effective Leverage Management

– Grasp the concept of leverage and its inherent risks before initiating any trades.

– Determine an appropriate leverage ratio that aligns with your risk tolerance and trading strategy.

– Practice prudent risk management techniques, such as setting stop-loss and take-profit orders, to mitigate potential losses.

Expert Advice for Leverage Optimization

– Only use leverage in conjunction with a robust trading plan that encompasses clear entry and exit strategies.

– Consider the market volatility and liquidity of the currency pairs you are trading when determining an appropriate leverage ratio.

Frequently Asked Questions: Unraveling Leverage in Forex

-

Q: What is leverage in Forex trading?

- A: Leverage is a tool that allows traders to trade with more capital than they have in their account, effectively amplifying both potential profits and risks.

-

Q: What are the different leverage ratios commonly used in Forex?

- A: Commonly used leverage ratios include 1:100, 1:200, and 1:500, indicating the amount of leverage provided for every unit of base currency.

-

Commonly Used Leverage Ratio In Forex

Q: How can I determine the appropriate leverage ratio for my trading strategy?

- A: The appropriate leverage ratio depends on your risk tolerance, trading experience, and market conditions. It is recommended to start with a lower leverage ratio and gradually adjust it as you gain experience and confidence.

Conclusion: Embracing Leverage with Wisdom

Leverage, when employed judiciously, can be a powerful ally in your Forex trading endeavors. It empowers you to magnify your returns while simultaneously exposing you to amplified risks. By comprehending the intricacies of leverage ratios, leveraging expert advice, and implementing sound risk management practices, you can harness the potential of leverage while mitigating its perils. As you continue your Forex trading journey, remember to trade responsibly and within your risk tolerance to maximize your chances of success.

Are you ready to master the art of leverage and unlock the full potential of Forex trading? Let us know your thoughts and experiences in the comments section below!