Introduction:

Image: news.cgtn.com

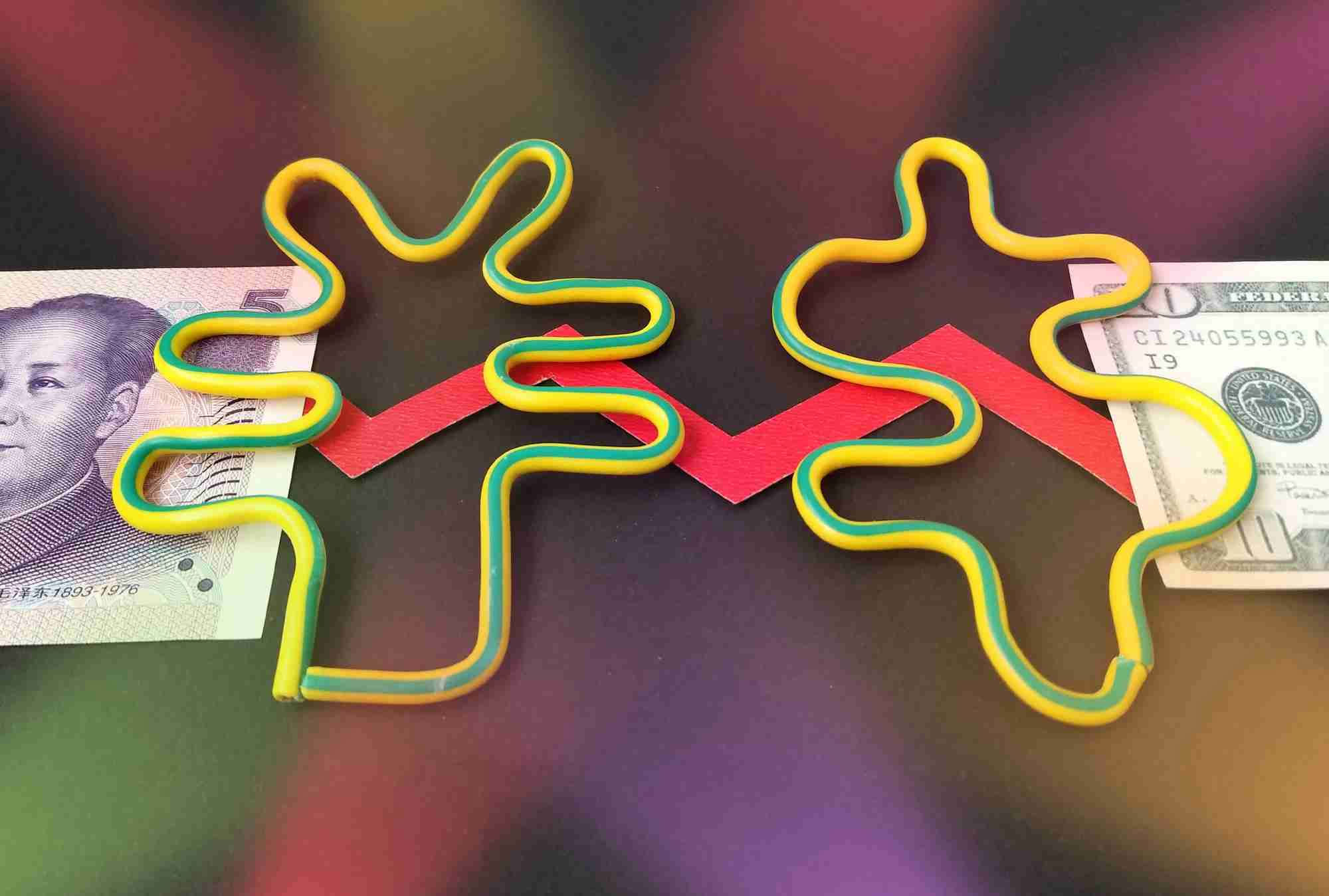

China’s economy has been the world’s engine of growth for decades, but its stability is threatened by increasing capital outflows. As Chinese investors seek higher returns overseas and uncertainties cloud the domestic economy, the country’s foreign exchange reserves, once a symbol of strength, are dwindling. This article explores the causes and consequences of China’s capital outflows, examining their impact on the country’s economy and the global financial system.

Capital Outflows: Causes and Manifestations:

Capital outflows from China have surged in recent years, driven by a complex interplay of economic and political factors. The liberalization of China’s financial markets and the emergence of a wealthy elite eager to diversify their investments abroad have played a significant role. Additionally, concerns about the stability of China’s currency, the renminbi, and economic growth prospects have further accelerated outflows.

These outflows manifest in various forms, including direct investment in foreign assets, purchases of foreign securities, and flight capital transfers. As Chinese investors seek refuge in safe-haven assets, the demand for foreign currencies, such as the U.S. dollar and the euro, has increased, putting downward pressure on the renminbi’s value.

Consequences for China’s Economy:

The depletion of China’s foreign exchange reserves poses several challenges for the country’s economy. First, it reduces the central bank’s ability to intervene in the foreign exchange market to stabilize the renminbi’s value, which could trigger further depreciation and financial instability. Second, capital outflows tighten domestic liquidity, making it more difficult for businesses to borrow money and potentially constraining economic growth.

Moreover, as China’s foreign exchange reserves decline, the country’s ability to repay its external debts may be compromised, raising concerns about sovereign credit risk and increasing the cost of borrowing.

Implications for the Global Financial System:

China’s capital outflows also have implications for the global financial system. A sustained outflow of capital from China could potentially reduce global liquidity and increase the risk of market volatility, especially in emerging markets. Additionally, if the renminbi depreciates significantly, it could trigger a sell-off in Chinese assets and exacerbate the ongoing global economic slowdown.

Government Response and Policy Implications:

Recognizing the urgency of addressing capital outflows, the Chinese government has implemented various measures to curb their outflow. These include tightening capital controls, restricting foreign exchange transactions, and enforcing penalties for illegal capital transfers. While these measures have slowed down outflows to some extent, they have also raised concerns about the country’s commitment to financial liberalization.

The effectiveness of these policies remains to be seen. China faces a delicate balancing act in its efforts to manage capital outflows without stifling economic growth and alienating foreign investors. Finding the appropriate balance will be crucial to maintaining the stability of China’s economy and the global financial system.

Conclusion:

China’s capital outflows pose significant challenges to the country’s economy and the global financial system. Understanding the causes and consequences of these outflows is essential for policymakers to develop effective responses. Striking a balance between managing capital outflows and promoting economic growth will be critical to preserving China’s economic stability and ensuring the stability of the global financial system.

Image: www.ibtimes.com

China Capital Outflows Forex Reserves