The Commodity Channel Index (CCI) is a popular technical indicator used by Forex traders to identify potential trading opportunities. It is a versatile indicator that can be used to measure price trends and identify overbought or oversold conditions. In this article, we will explore how to use the CCI to develop entry and exit conditions for an automated Forex trading EA using MQL coding.

Image: cc-ireland.ie

Understanding CCI Entry and Exit Conditions

The CCI is a momentum indicator that measures the difference between the current price and a moving average of prices over a specified period. A positive CCI value indicates that prices are above the moving average, while a negative value indicates that prices are below the moving average.

Traders typically use the CCI to identify overbought and oversold conditions in the market. When the CCI rises above a threshold value (e.g., +100), it suggests that the market is overbought and may be due for a correction. Conversely, when the CCI falls below a threshold value (e.g., -100), it suggests that the market is oversold and may be due for a rally.

Developing a CCI-Based Trading EA

To develop a CCI-based trading EA in MQL, you will need to follow these steps:

- Define the Entry Conditions: The first step is to define the conditions under which the EA will enter a trade. For example, you could set a rule that the CCI must be above +100 for a buy signal or below -100 for a sell signal.

- Define the Exit Conditions: The next step is to define the conditions under which the EA will exit a trade. For example, you could set a rule that the CCI must fall below +50 for a buy trade or rise above -50 for a sell trade.

- Code the EA: Once you have defined the entry and exit conditions, you can code the EA in MQL. The code will need to specify the CCI settings, the entry and exit conditions, and the trading logic.

- Test the EA: Before deploying the EA in a live trading environment, it is important to test it thoroughly on historical data. This will help you to identify any potential flaws in the design and to optimize the performance of the EA.

Benefits of Using CCI Entry and Exit Conditions

There are several benefits to using the CCI to develop entry and exit conditions for a Forex trading EA.

- Simplicity: The CCI is a relatively simple indicator to understand and interpret. This makes it easy to develop trading rules based on the CCI.

- Versatility: The CCI can be used to measure price trends in a variety of markets and time frames. This makes it a versatile indicator that can be used to develop trading strategies for different trading styles.

- Objectivity: The CCI is an objective indicator that is not based on the trader’s subjective opinion. This helps to reduce the risk of making emotional trading decisions.

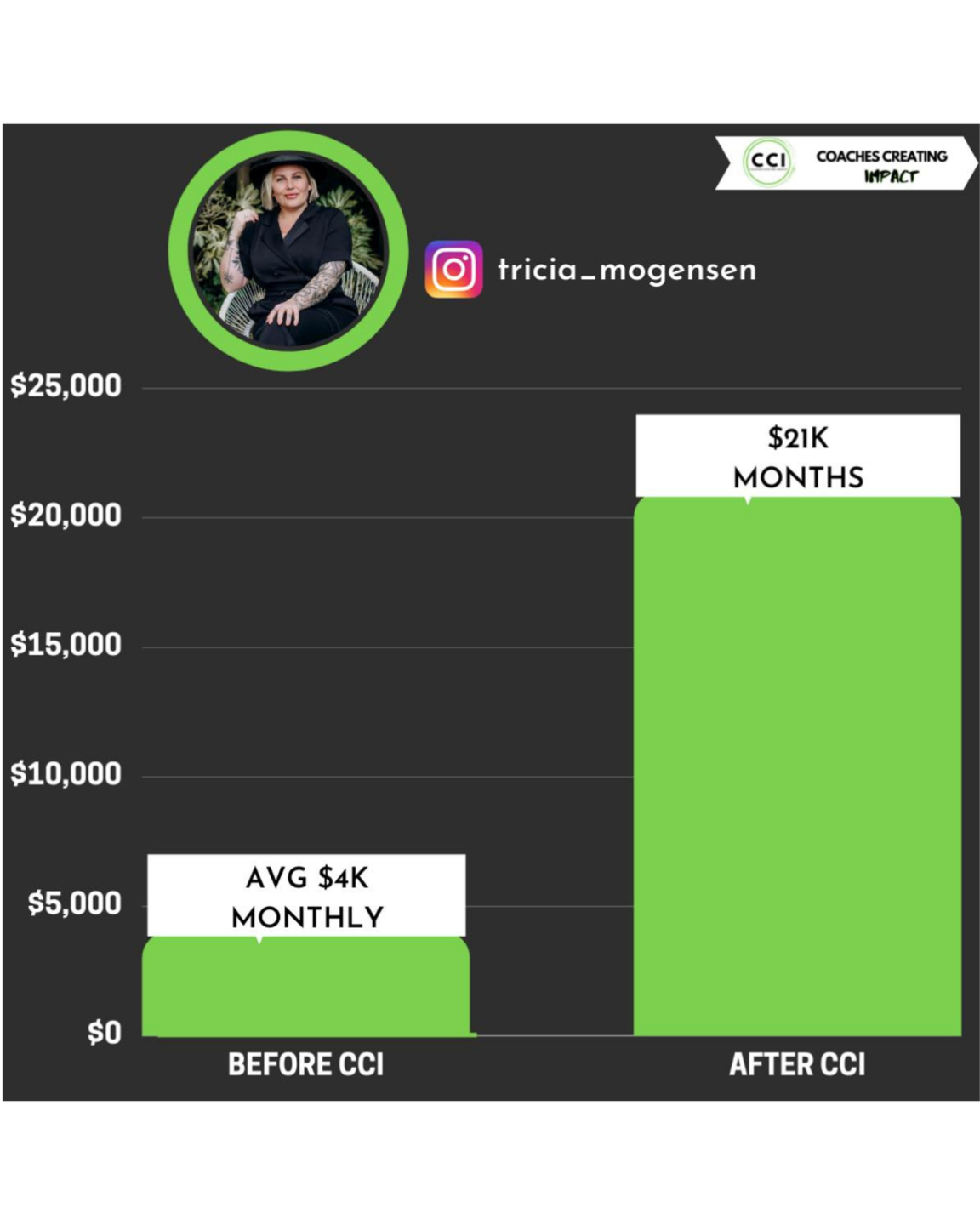

Image: www.coachescreatingimpact.com

Cci Entry & Exit Conditions Forex Ea Mql Coding

Conclusion

The CCI is a powerful technical indicator that can be used to develop effective trading strategies. By understanding the CCI and how to use it to identify entry and exit conditions, you can improve the performance of your Forex trading.